But, How Far ?

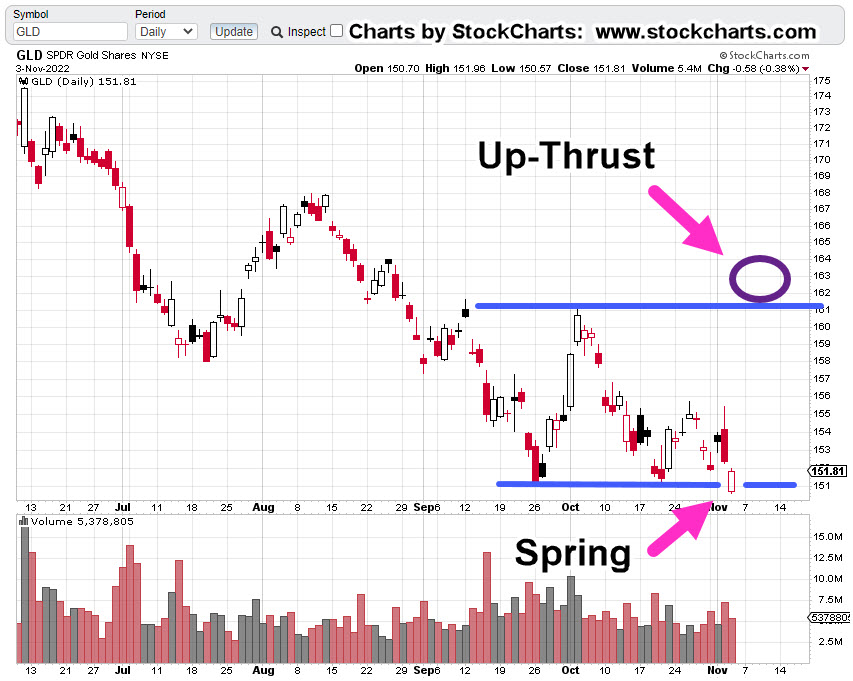

The last update on gold (GLD), posted four trading days ago, (link here), said the following:

“If there’s going to be a break to the upside, this would be the place; otherwise, watch for continued GLD downside.”

From that update, GLD continued slightly lower, posted a new monthly low (yesterday) and got itself into Wyckoff ‘spring’ position.

Now, in the pre-market (as of 8:41 a.m., EST), we see GLD, trading up approximately 2.1-points, or + 1.40%.

Let’s see where price action’s likely to go.

Gold (GLD), Daily

Spring set-ups have a tendency to go straight into an up-thrust as a repeating pattern.

The most likely point for an up-thrust, if GLD rallies from here, is shown below.

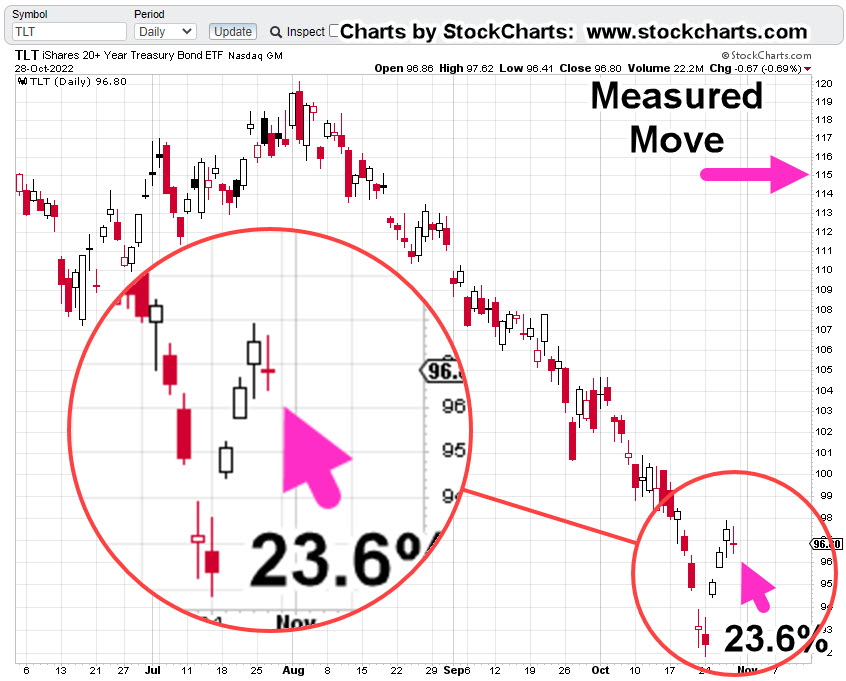

The up-thrust target is also a Fibonacci 23.6%, retrace level from the ‘Changing of Hands‘ high, set March 8th, this year.

If there is a rally, it’s potentially a temporary (but tradeable) upside event in an overall down market (not advice, not a recommendation).

Positions, Market Stance (courtesy only, not advice).

Over the past few trading days, changes have been made as shown (not advice, not a recommendation)

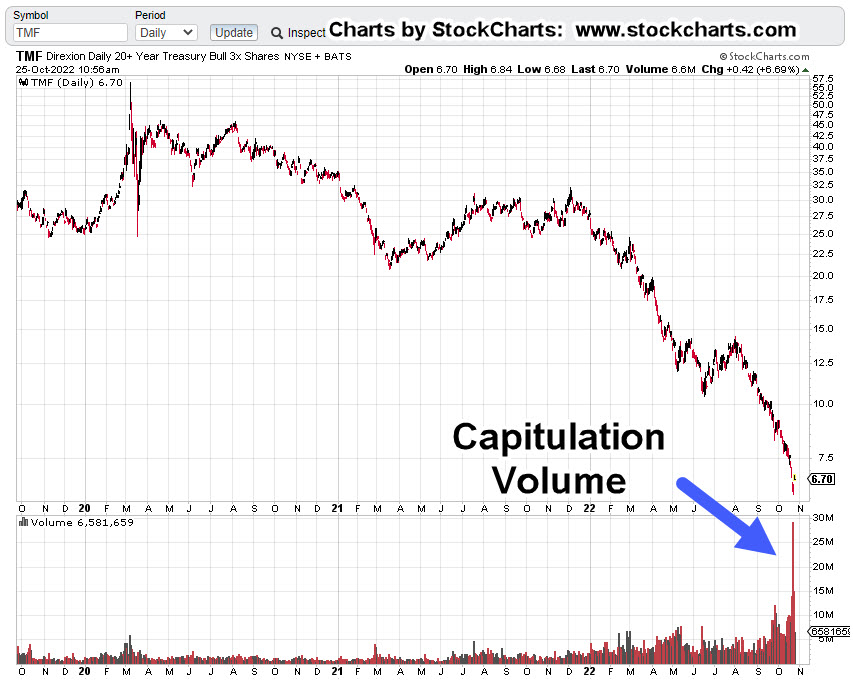

TMF-22-01:

Discretionary exit @ 6.85***

Trade Closed

Gain on TMF-22-01: + 4.67%

LABD-22-09:

Entry @ 19.88, 19.71, 21.23*** Stop @ 18.69

Note: Positions may be increased, decreased, entered, or exited at any time.

***, Indicates change

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279