Dollar’s Absent From The Show

To get the gold bulls in a hypnotic trance, thinking $3,000/oz. is just around the corner, the appropriate press releases need to be created.

As if on cue, reported by Jerimiah Babe, big names are coming out to say ‘hyperinflation’s’ a sure thing.

If it’s not happening now (as we speak) it’s bound to happen very soon.

In fact, just look at the prices (time stamp 1:30). Those price increases are proof.

Never mind the hundred or so ships off CA, or even the containers just happening to ‘slide off’ into the sea.

But wait, what about the fire?

No manufactured (um, sorry ‘supply chain’) crisis would be complete without a fire.

However, there’s a problem with all this hypnotizing the masses to hyperinflation.

That problem is … the dollar’s not playing along.

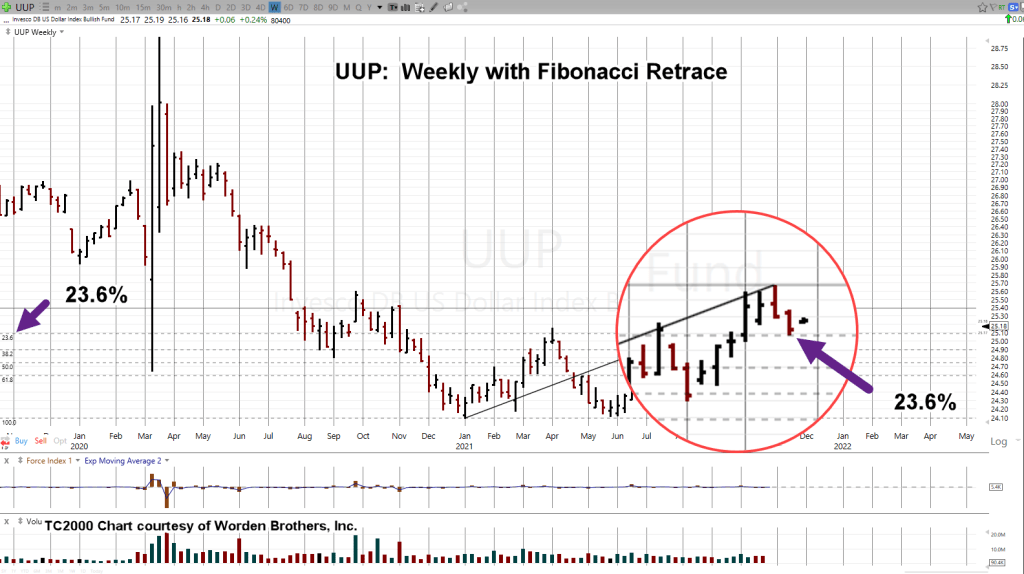

Dollar, UUP Analysis:

In fact, the dollar is showing significant strength.

It’s right at Fibonacci 23.6%, retrace (very shallow) and appears ready to move higher.

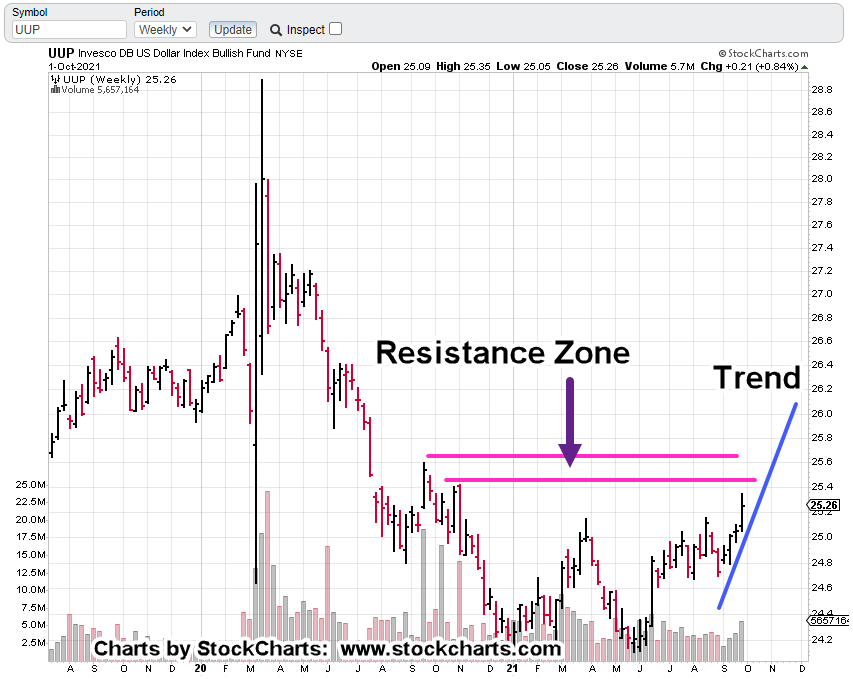

The weekly chart of UUP, is below and includes the Fibonacci levels.

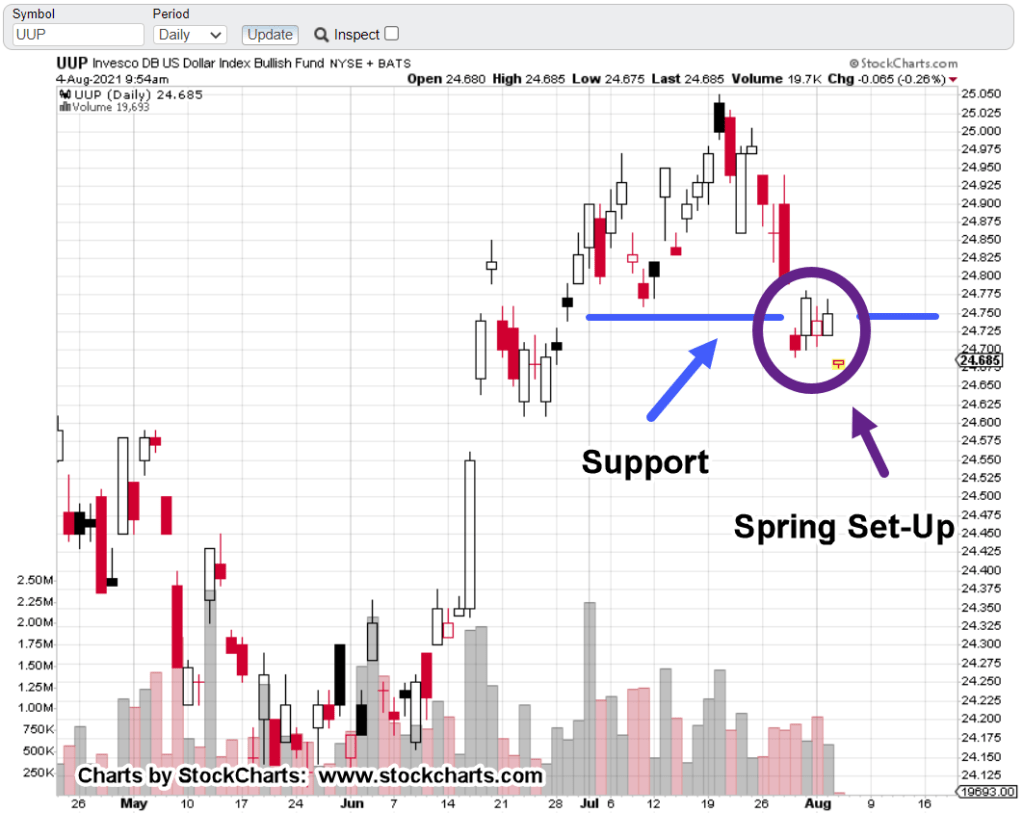

The next chart expands the last few weeks to show contact with the 23.6%, line and what looks like a nascent move up:

If UUP manages to make a new weekly high above last week’s 25.24, level, we have confirmation it’s attempting to continue the reversal and up-trend.

That reversal started way back at the beginning of this year.

This is what was said back then when the dollar looked poised for imminent collapse.

If gold and the dollar are still inversely correlated, the dollar appears ready for an upside breakout; obviously, a breakout higher would then put down pressure on gold.

Gold (GLD) Reversal:

Five weeks ago, the potential for a significant gold (GLD) reversal was discussed at this link.

That idea was updated last Friday at this link.

Then, over the weekend we’ve discovered one other analyst coming up with their own version.

At this juncture, GLD continues to ratchet higher to the 171 – 175 target area.

That move’s happening along with the requisite press generated hysteria … helping lead the bulls to a potential last stand.

Stay Tuned

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279