Time To Round Up, The Loonies?

If there’s one market attracting huge numbers of grifters, carpetbaggers, peddlers, and all-around crazies, it’s precious metals.

I’ve been hearing from this crowd, ‘the government’s going to collapse, the dollar’s going to collapse’, since the early 1980s.

As said many times before, I like precious metals as much as the next guy.

However, from a strategy standpoint, with each passing day, we see it’s the food supply (here, and here) that comes first (not advice, not a recommendation).

What’s currently taking place is so much more complicated (in my opinion) than just ‘stacking’.

Let’s not forget the flood of ‘fake’ or ‘diluted‘ precious metals and other chicanery; like having your coin-shop bank account closed for no apparent reason.

Well, we have to keep the loonies on the path which brings us to our case in point, Newmont Mining, NEM.

Newmont, Good News is Bad News

Gold price has moved higher over the past four to five months and expectedly, that’s been noted in Newmont’s latest Quarterly release, link here.

NEM, stock price at ‘nine-month highs’, what’s not to like?

It’s when we look at the chart, we see a different story.

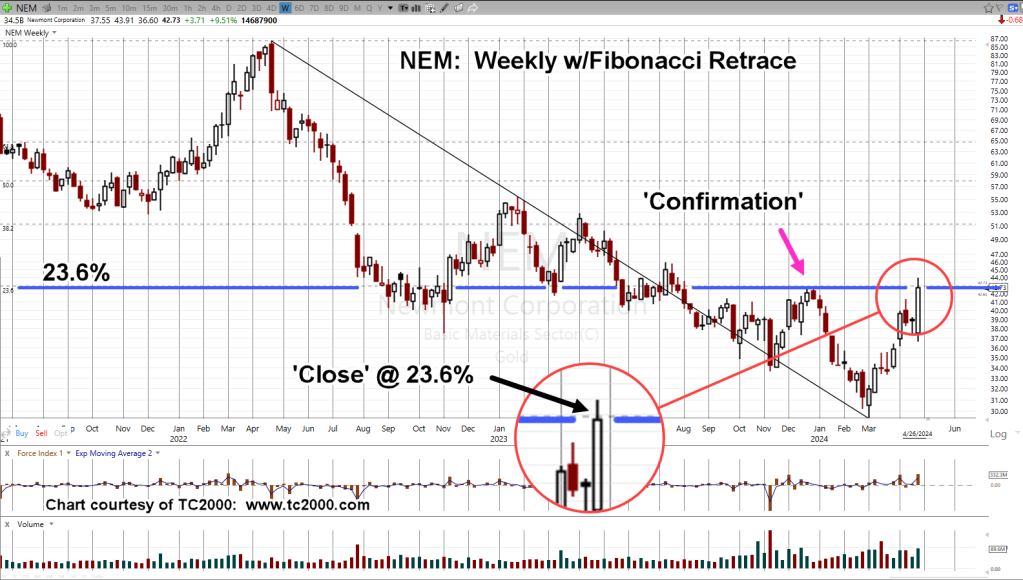

Newmont Mining, NEM, Weekly

After all the ‘good news’, NEM has only retraced an anemic 23.6%, of its overall downside move.

Note the close on Friday was right at the 23.6% level, giving it even more significance.

This level has also become an ‘axis line’ as exhibited by price action going back to August of 2022.

By The Numbers

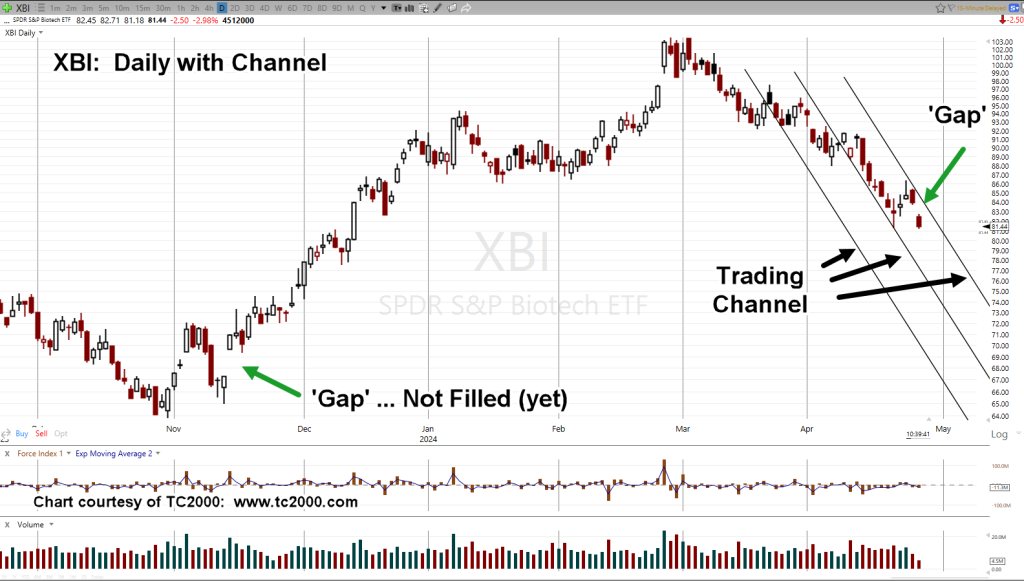

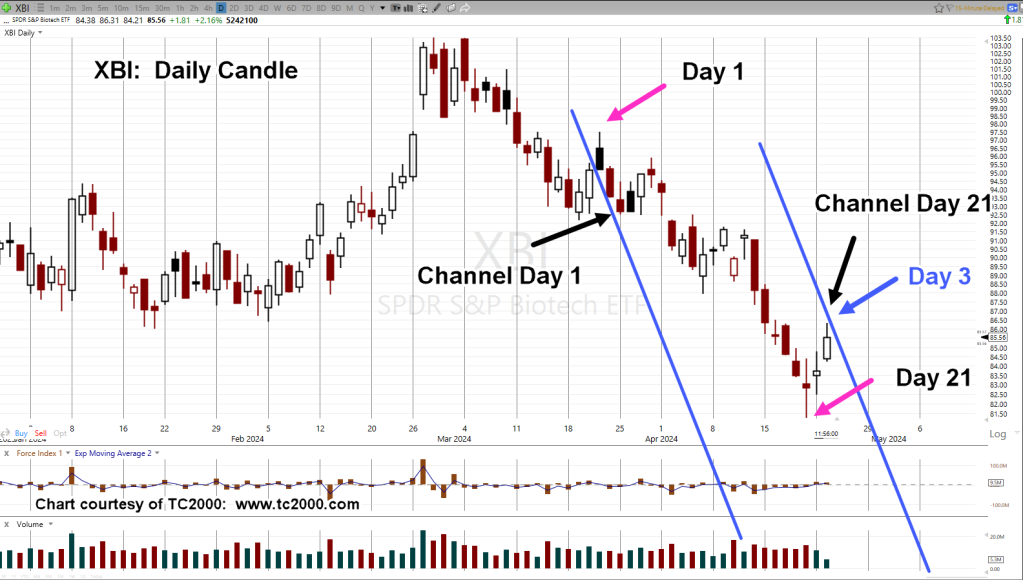

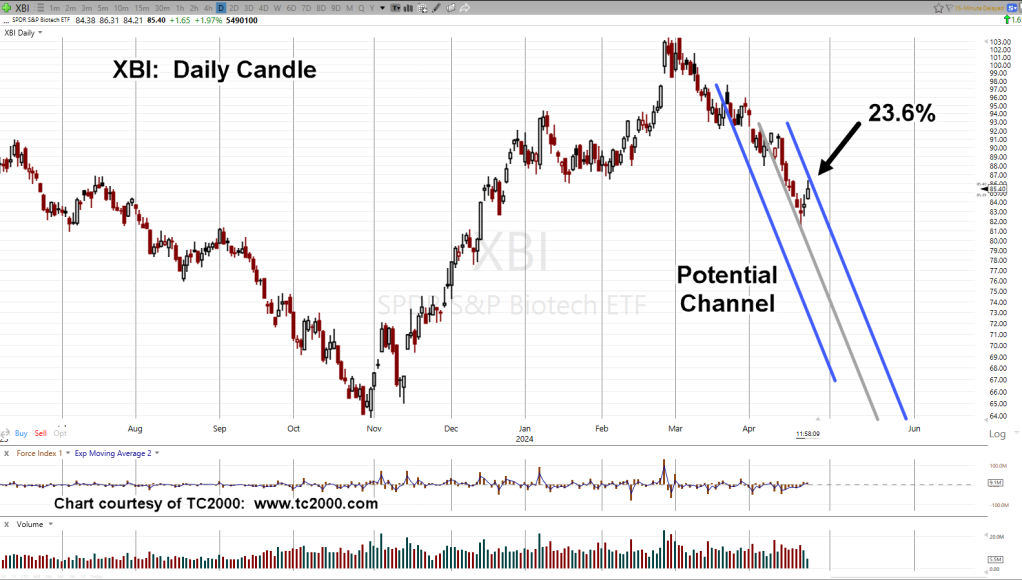

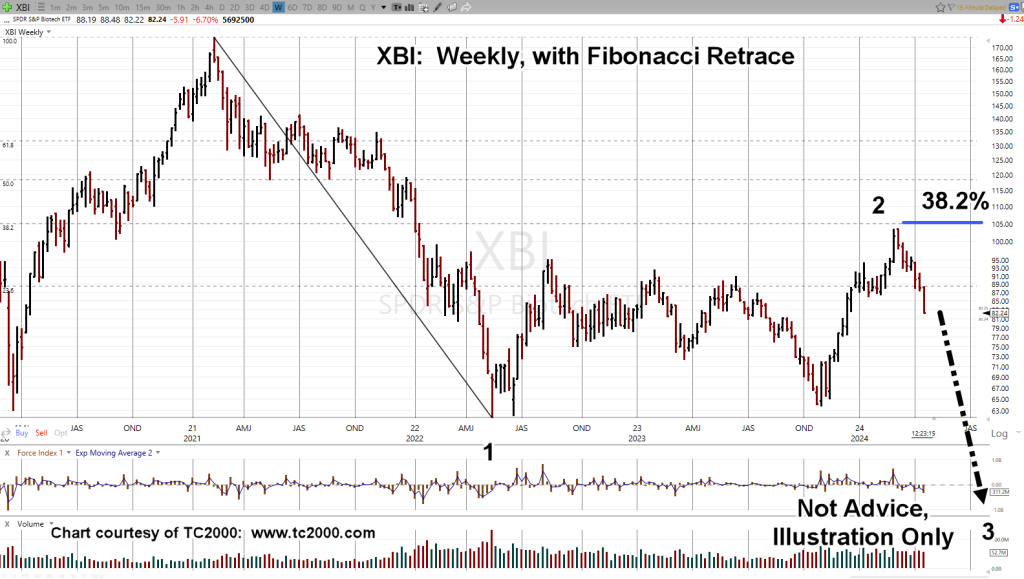

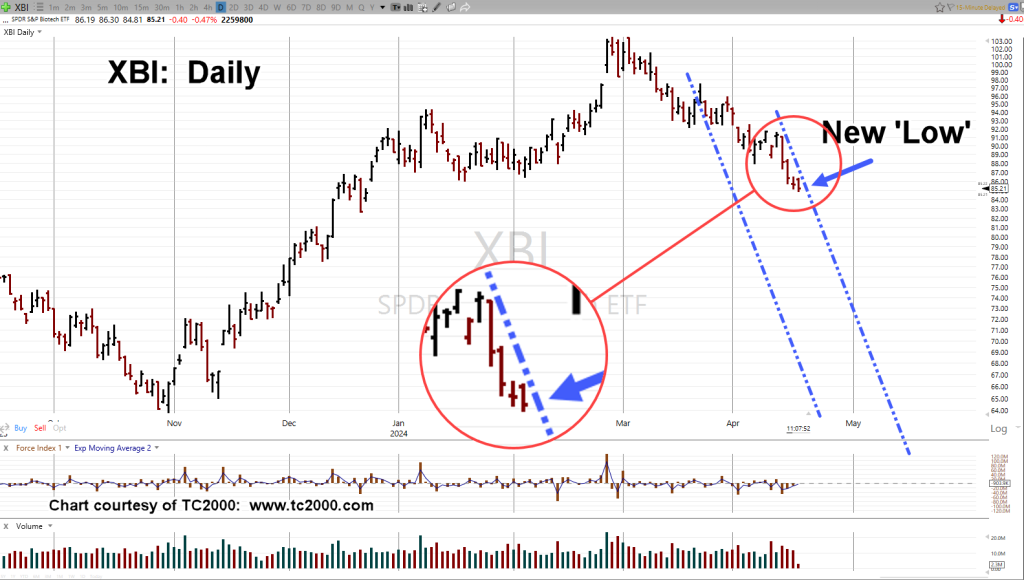

When looking through the major sectors, retrace (and reversal) from 23.6%, is becoming more frequent.

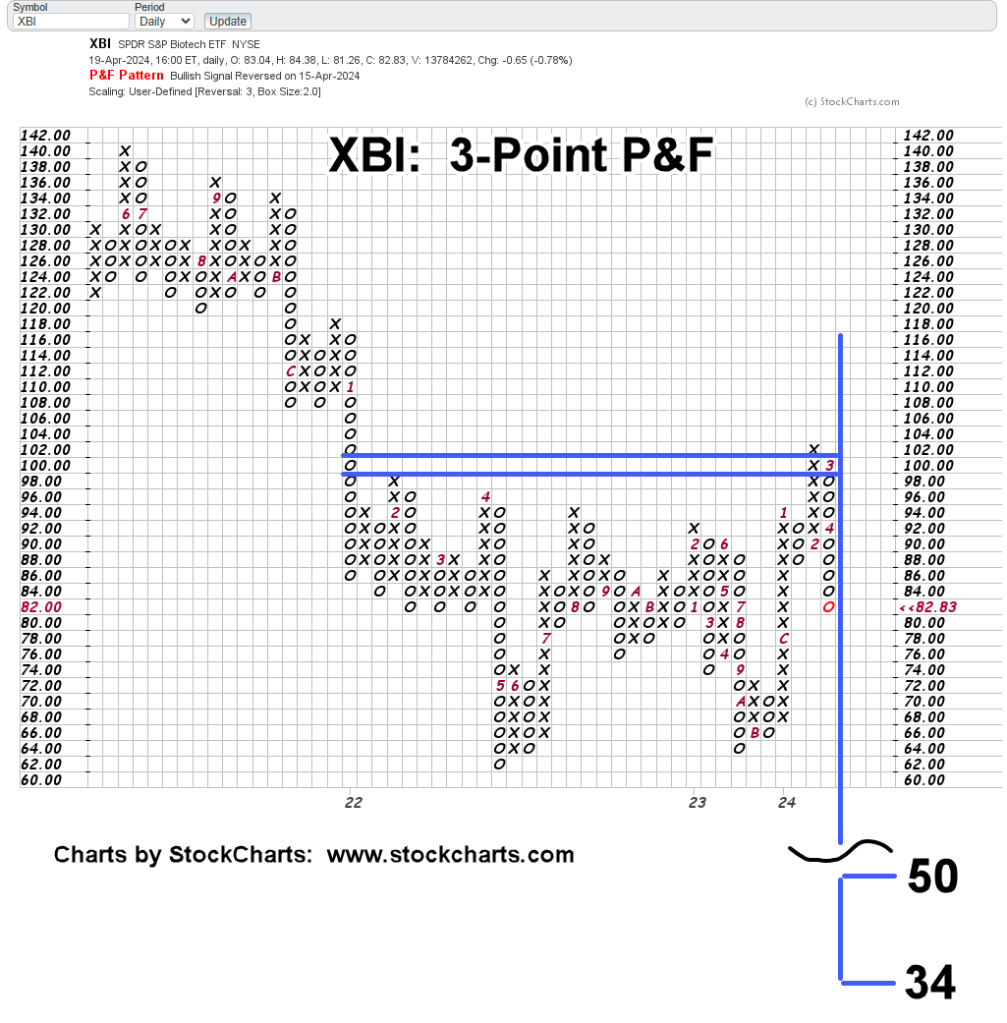

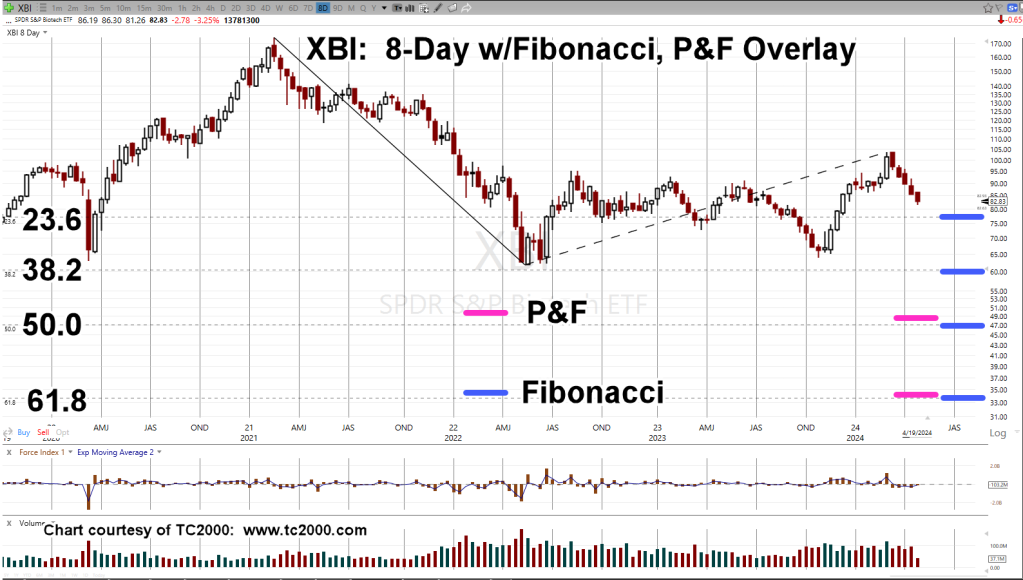

Two other indices posting and reversing from that level (measured from recent highs), are biotech XBI, and real estate, IYR.

NEM, What’s Next?

Thursday, 4/25, was a wide bar with heavy volume.

We’ve stopped at the retrace, which is also resistance, confirmed by price action in late December. ’23.

A reasonable expectation is NEM, retraces, testing the wide bar and volume before continuing to the downside or moving back higher to a breakout (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279