How Long Will This Last ?

Looking at the charts below, the amount capital being thrown at the last man standing, NEM, is stunning.

A real sustainable precious metals (and stocks) bull market typically starts with the weakest sectors.

They are the ones in the worst financial shape. They are the ones to benefit the most from an increase in metals prices.

That’s not happening.

Instead, we have what looks to be a market thinning out, on a massive scale.

Everything being poured into the leader … Newmont.

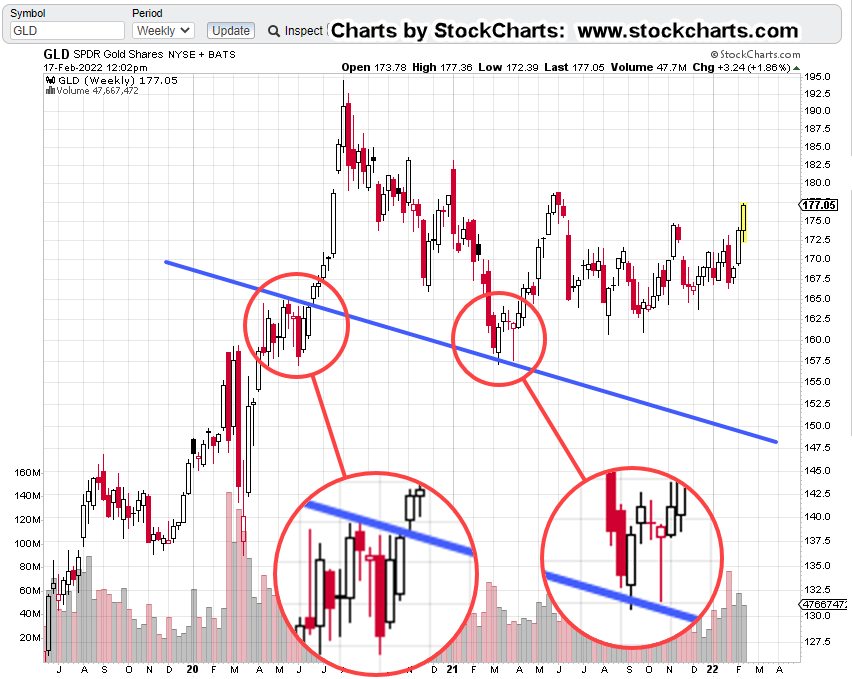

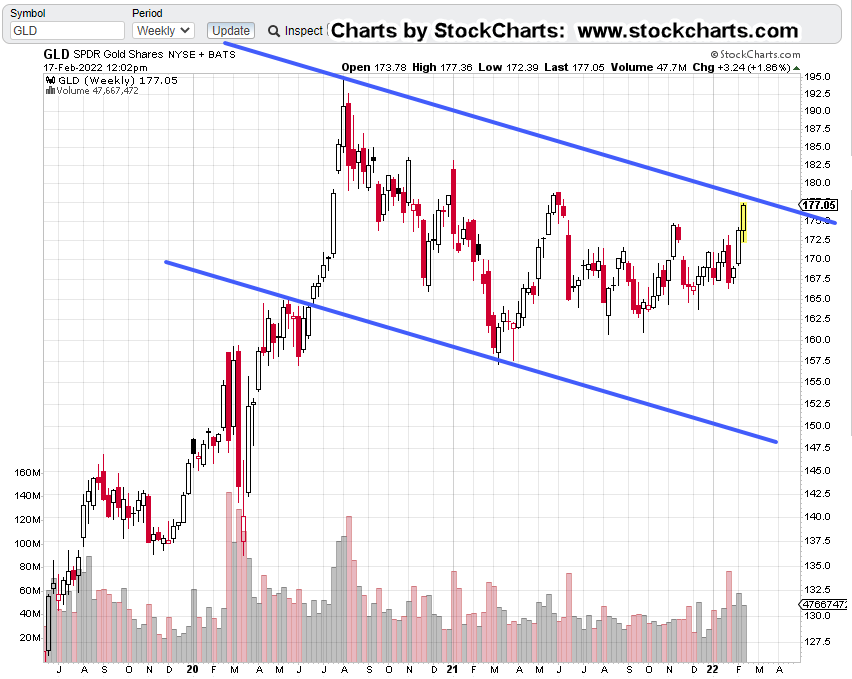

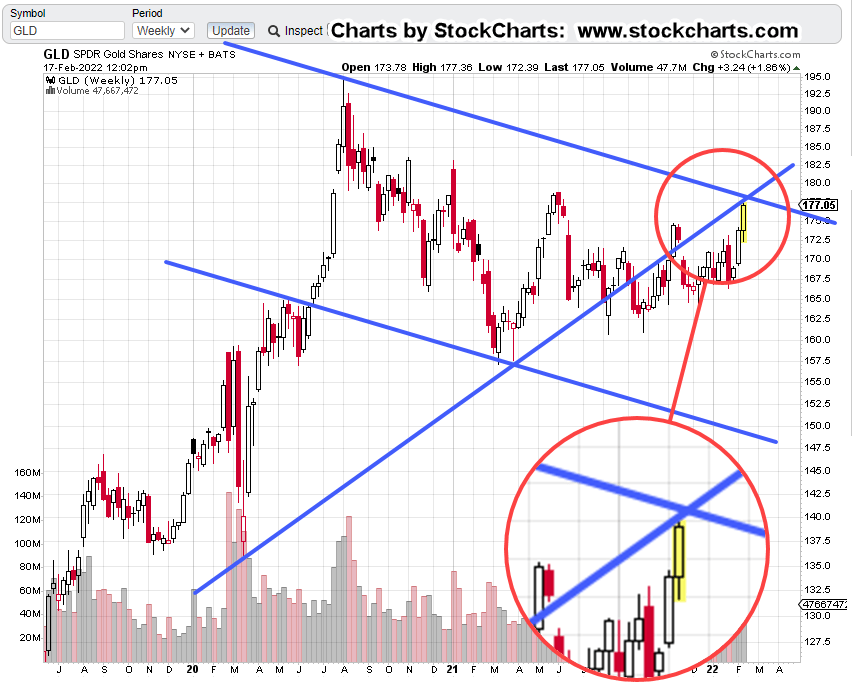

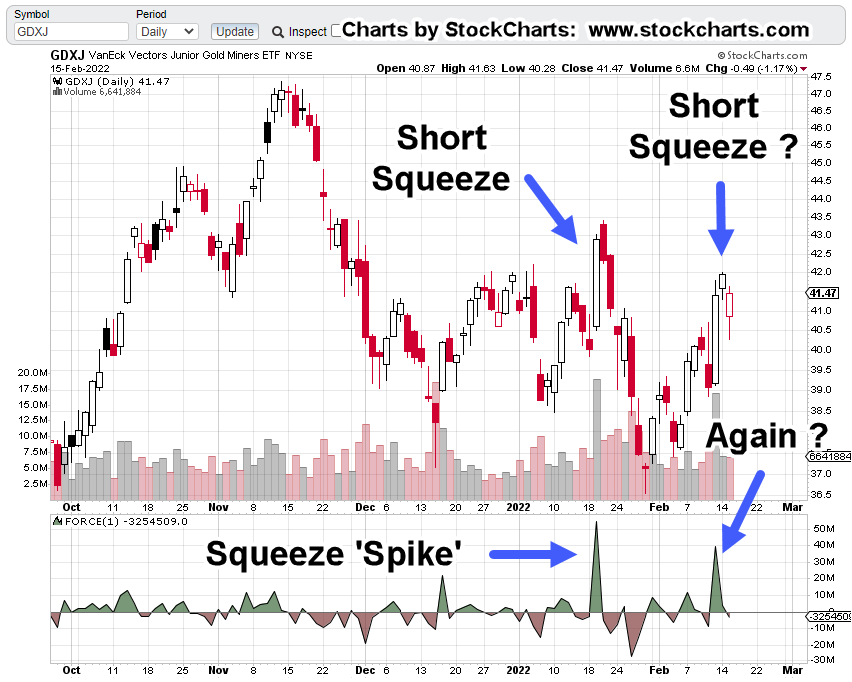

The charts below are from Monday’s close. Scroll up and down to get a ‘feel’ for what’s really happening.

It’s a bull market, non-confirmation on a huge scale.

Basically, the rest of the market, the rest of the Senior Miners and Juniors, don’t believe current conditions are sustainable.

How could they be?

Let’s get real and pose even the most basic questions.

How are these operations going to get spare parts or new equipment for their operations? How are they going to feed their employees?

Lastly, what about the ones that have forced their workforce to be injected?

Newmont (NEM), Weekly Close

Senior Miners, GDX, Weekly Close

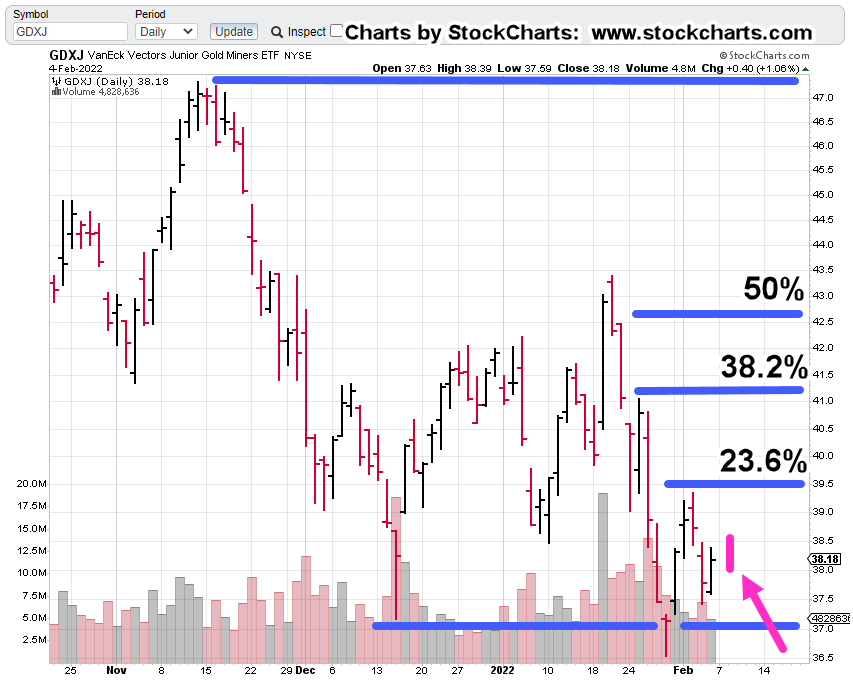

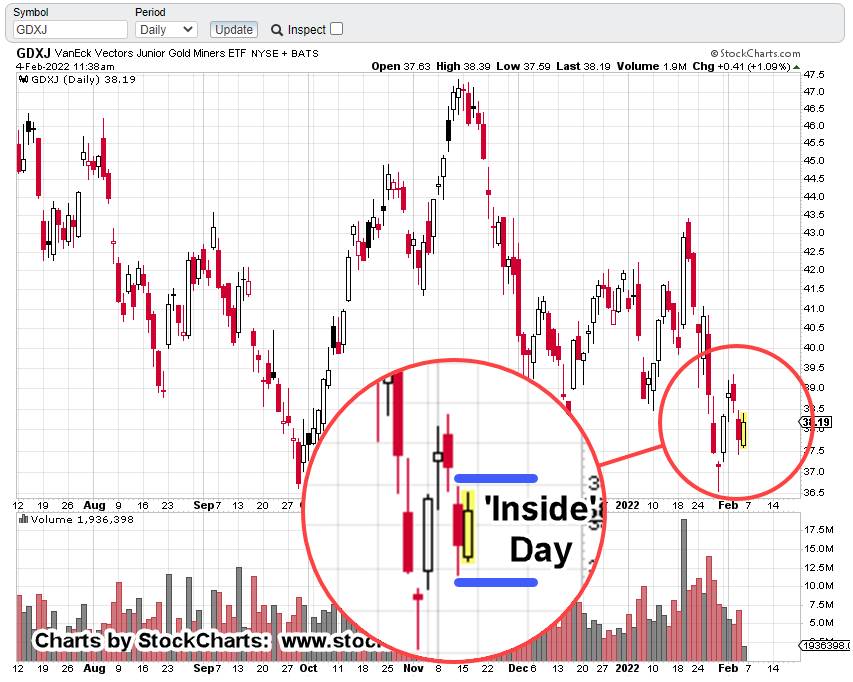

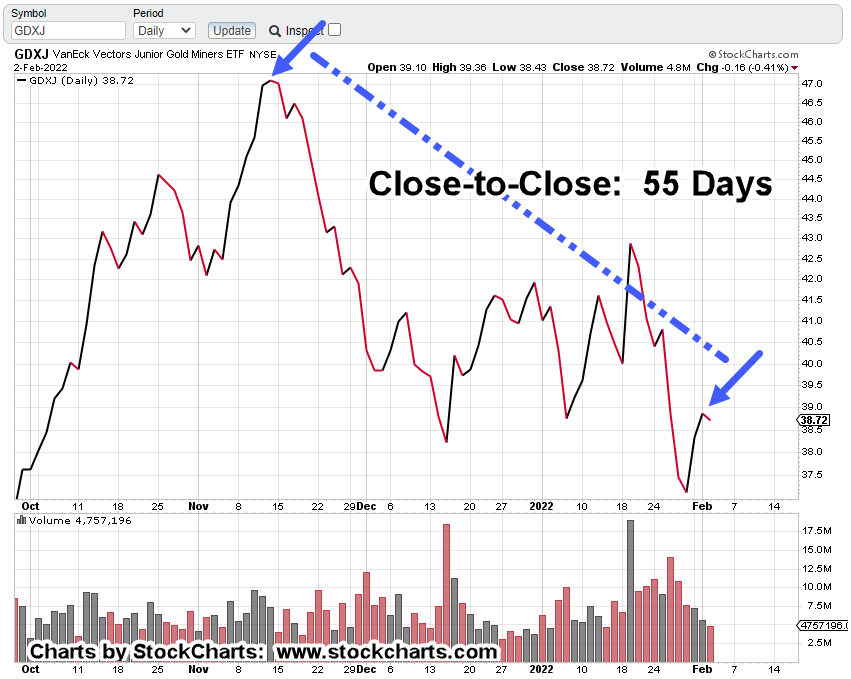

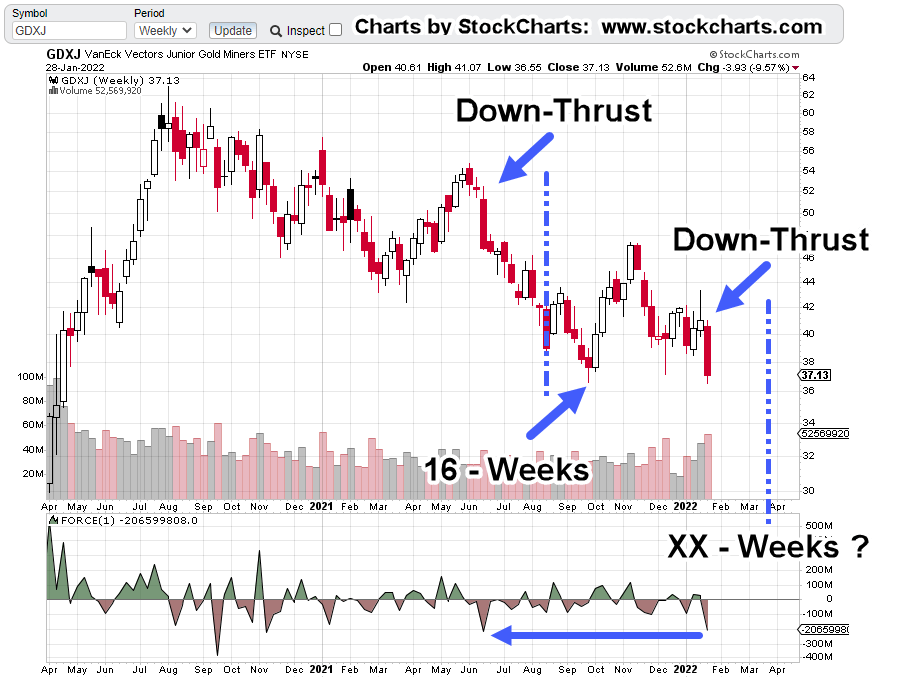

Junior Miners GDXJ, Weekly Close

The price action alone, tells us capital is flowing out of all sectors and into Newmont (NEM).

Just to make sure the herd continues to herd; that no-one else, is presenting this information, here’s a brief list of recent ‘analysis’.

Me-Too: Gold To The Moon

Will Gold give a Massive Breakout From it’s Sideways Trend ? Lyn Alden Prediction

Gold & Silver Breakout | On Track to Go Higher

GOLD Prices Will Not Stop RISING!! BUY GOLD Before This Happens.. – Chris Vermeulen | Prediction

Gold Breakout: Breakaway Gaps Confirmed

Silver Will Hit $1200/OZ as Russia Invades Ukraine – Lynette Zang | Silver Price Prediction

Gold price rally will power to $2,700, then $7,400 as ‘perfect storm’ brews – Chris Vermeulen

__________________________________________________

A Different View

Momentum indicators are pointing higher for both gold and the miners … that does not mean it’s a buy (not advice, not a recommendation).

For both GDX, and GDXJ, they’re entering up-thrust (potential reversal) territory as discussed in a previous post.

It’s time to monitor the sector for potential exhaustion and change of momentum.

That momentum could take a while to bleed-off … being patient is just one requirement for successful speculation.

Summary

From the panic, you would think no one’s ever seen a down market. On top of that, we’re potentially just getting underway.

This is the exact environment where Wycoff analysis comes to the fore: ‘What’s the market saying about itself?’

That analysis says, gold and the miners could still push a bit higher but there are huge disconnects under the surface; not the least of which, silver’s also not confirming the move.

More on that, later.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279