Not Waiting Around For The Fed

It’s been an abusive relationship for the gold bulls.

Following the corporate media (always a mistake) and YouTuber’s alike (sometimes a mistake), only to find out it’s all been a lie.

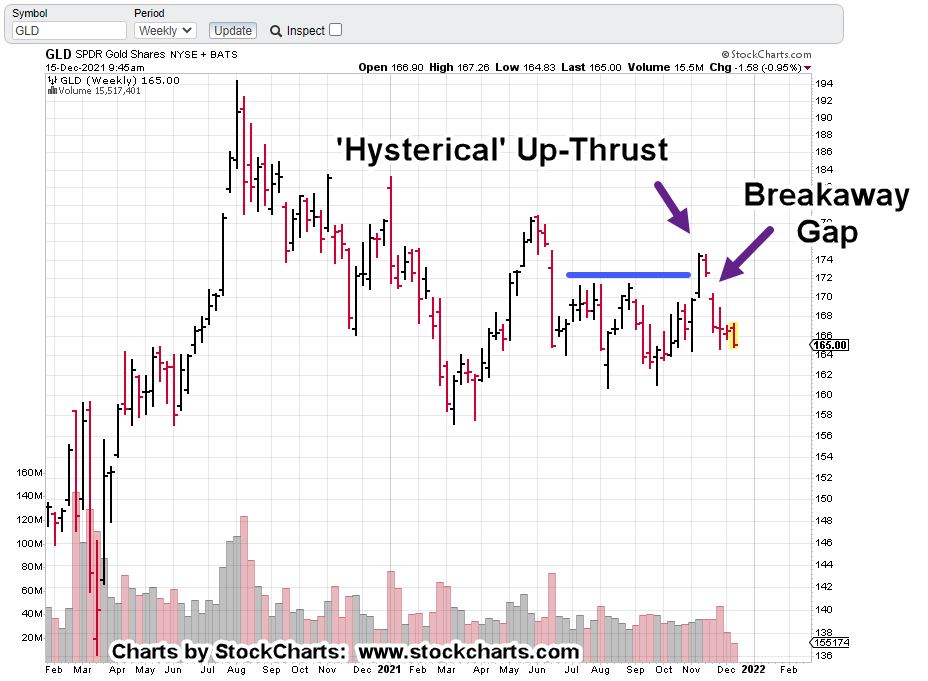

Gold (GLD), looks like it’s solidifying its breakaway gap (chart below) and simultaneously confirming a potential trading channel.

In what may be related news, ZeroHedge reports some of the internet is down … again.

Note the websites having problems involve food, payroll services and of course, entertainment.

Separately, the dollar (UUP) just made a new weekly high as its rally continues. In Steven Van Metre’s Sunday Night update (time stamp: 18:01), if the dollar breaks higher above UUP 26 or 27, then “… all the wheels come off ….”

Which brings us to the gold market.

Gold (GLD), Weekly Chart

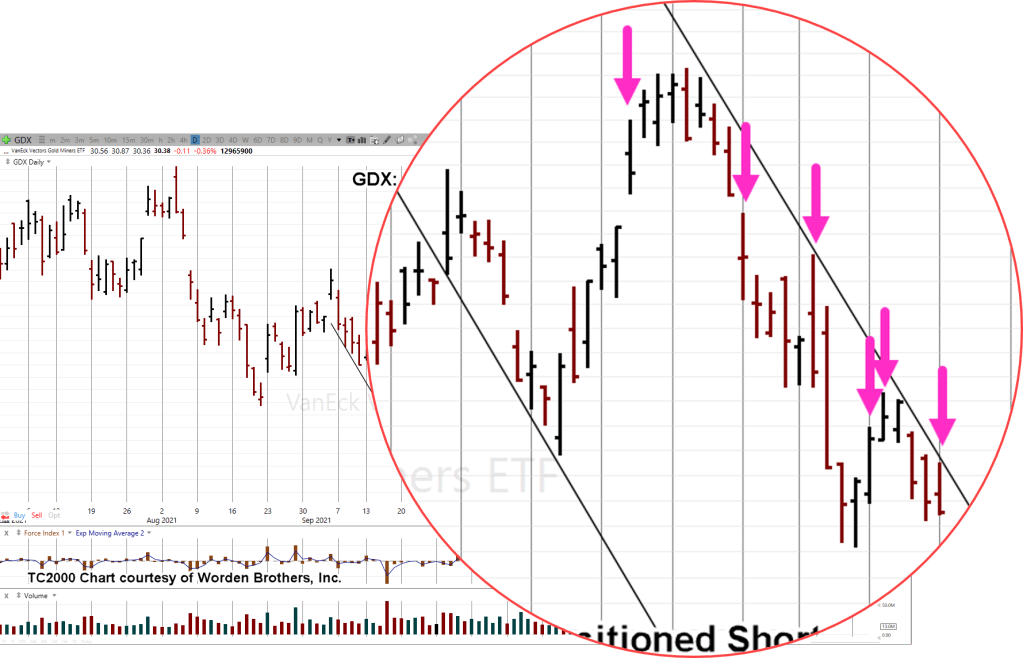

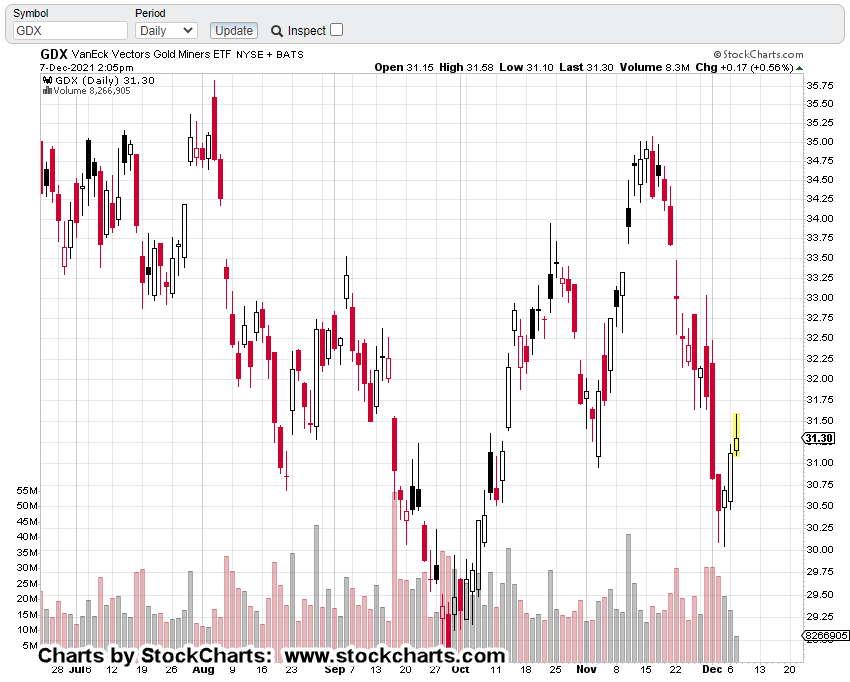

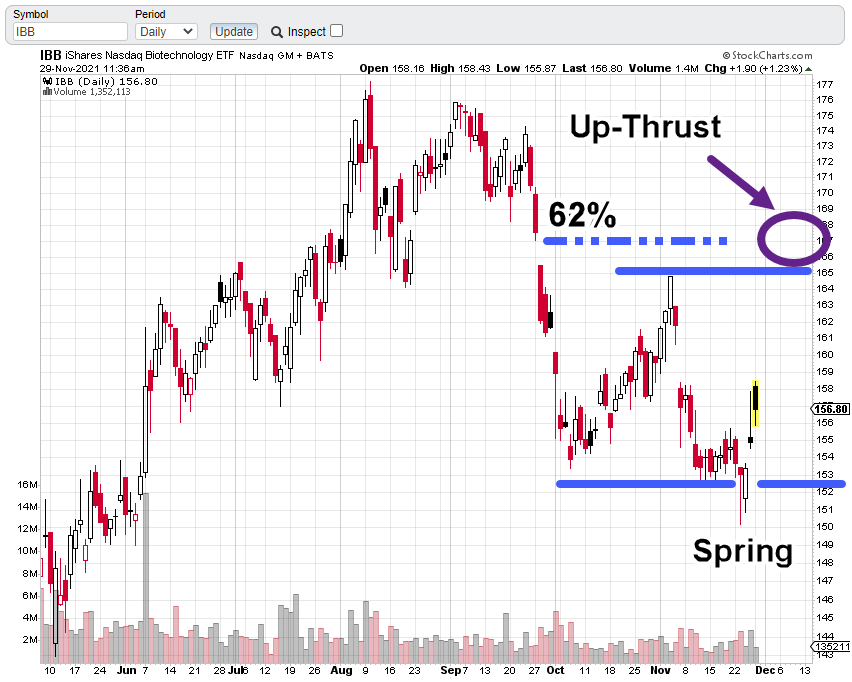

The chart reviews the recent up-thrust (reversal) that was accompanied by hysterical … bordering on unhinged insane press coverage of an imminent break higher.

Obviously, that didn’t happen.

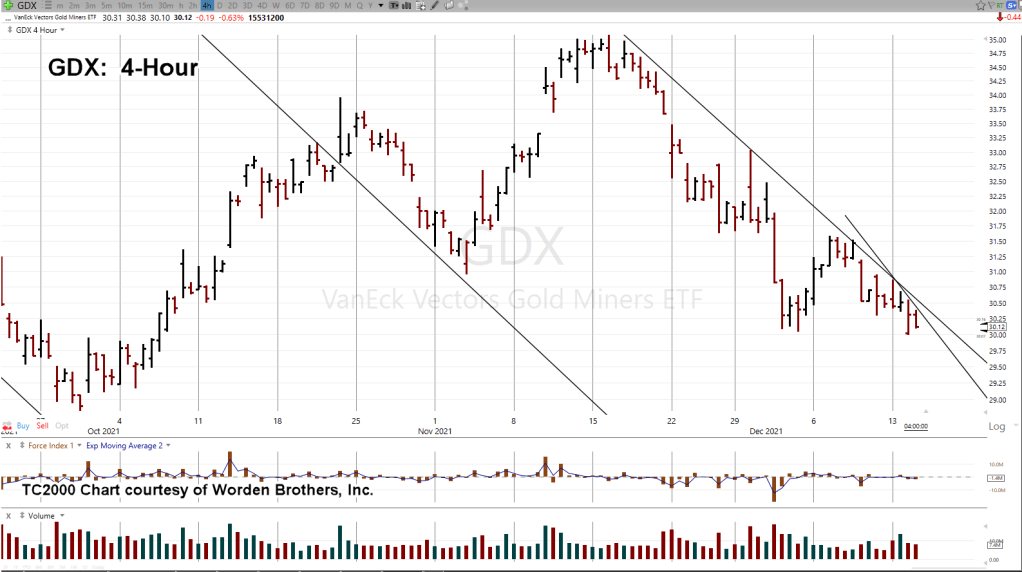

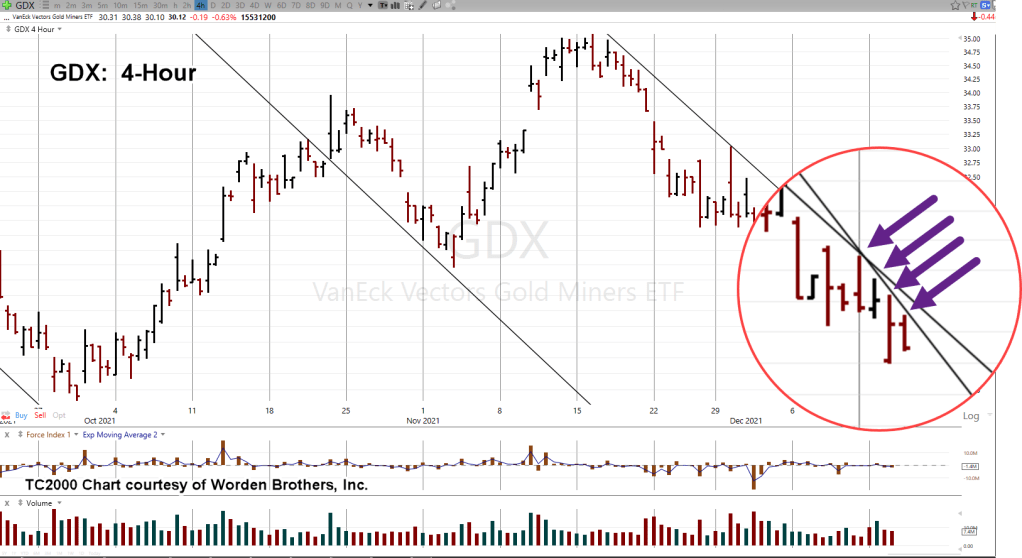

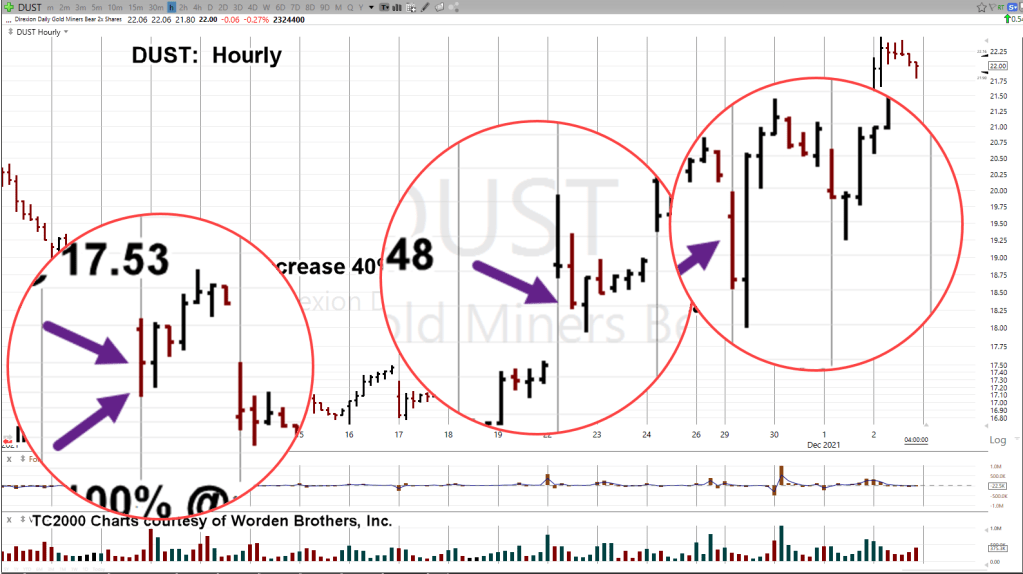

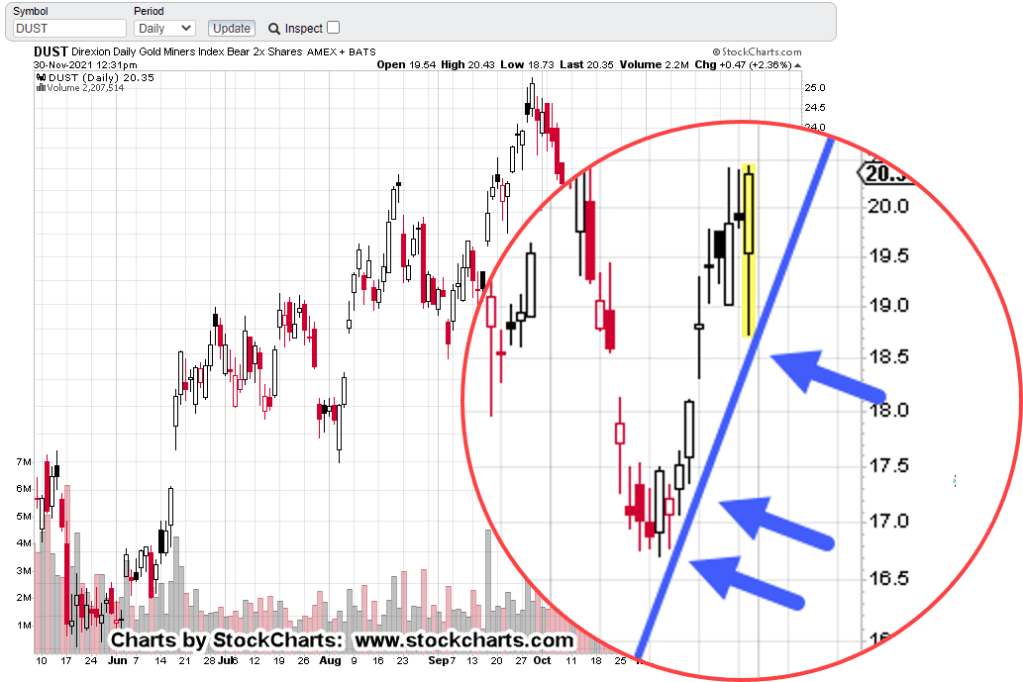

Zoom version

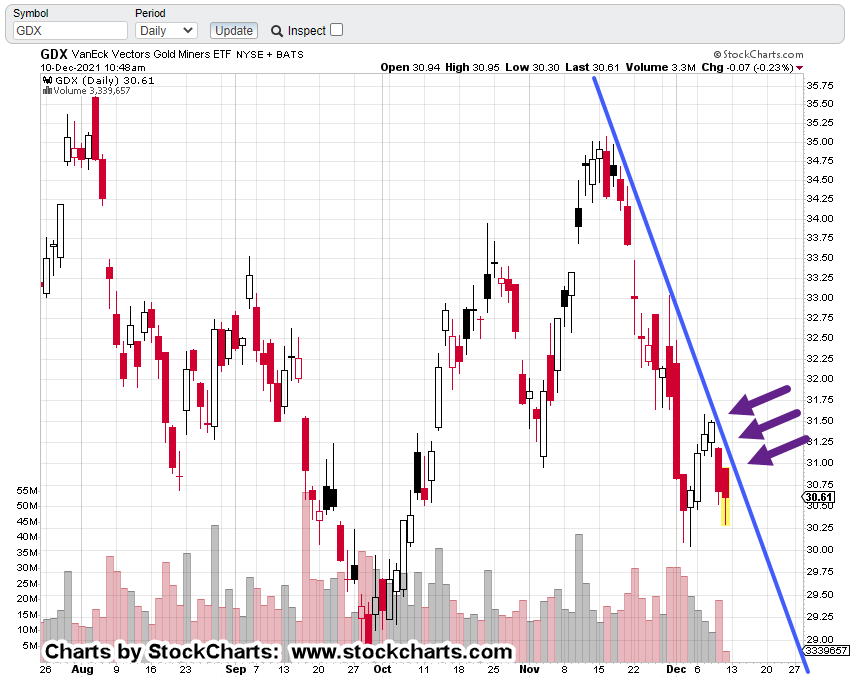

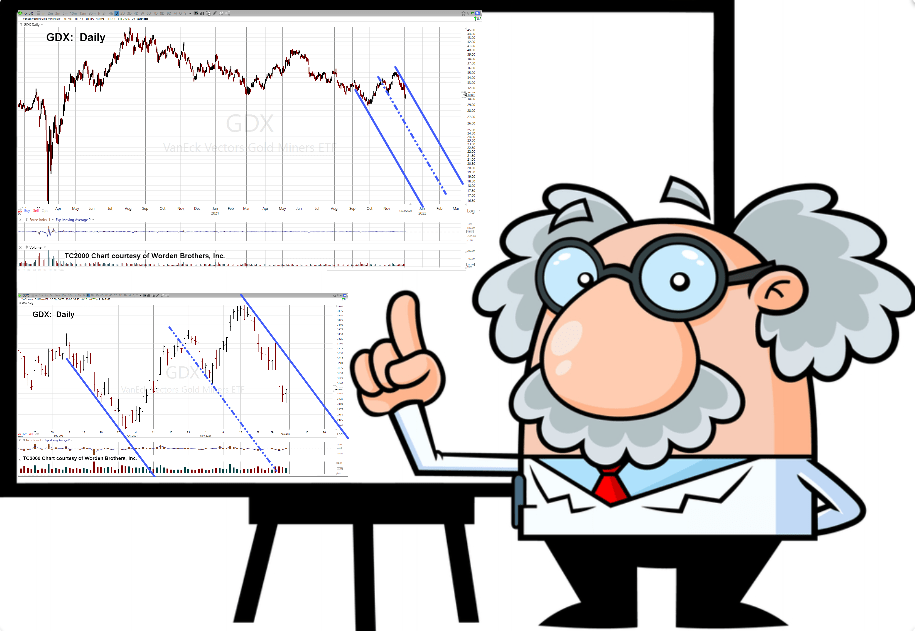

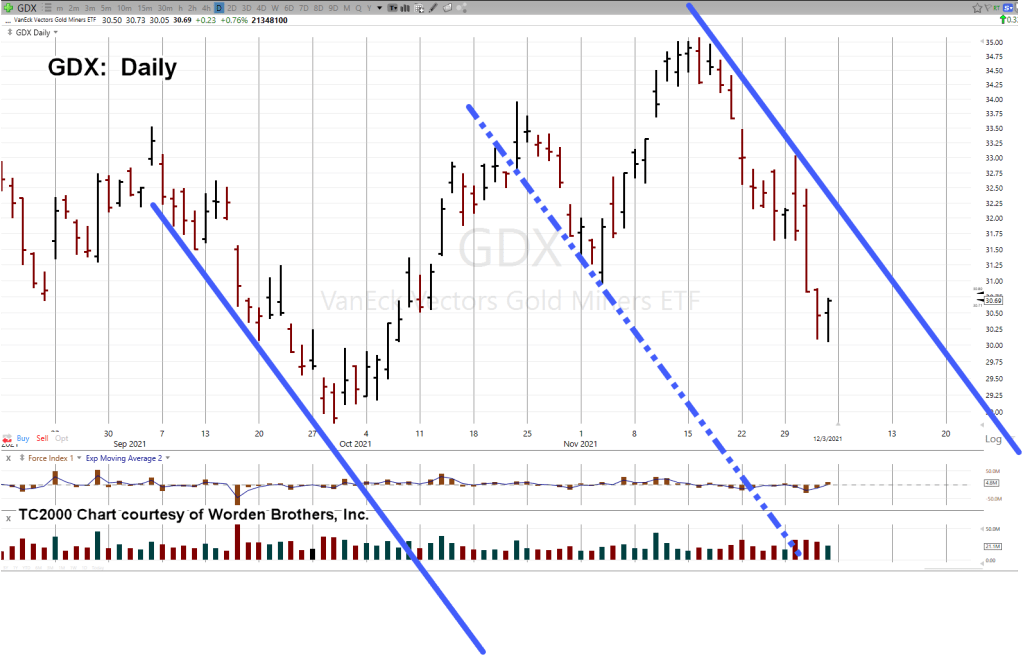

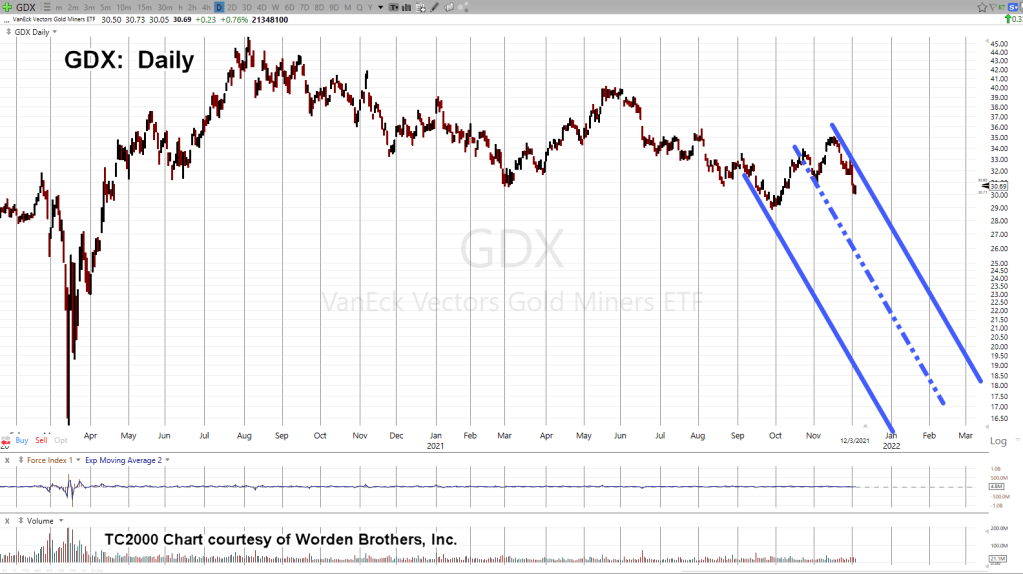

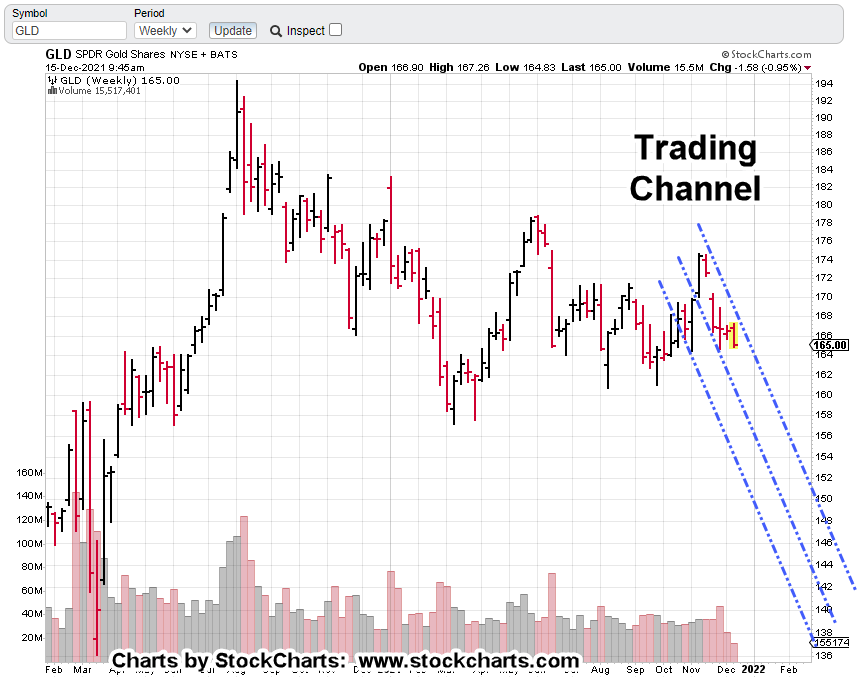

In addition to the reversal and breakaway gap, there could be a trading channel as well.

That’s a good thing for the bears as it gives a more clear exit area … negation (or break) of that channel (not advice, not a recommendation).

Zoom version

Of course, anything can happen. The Fed announcement is about two hours away.

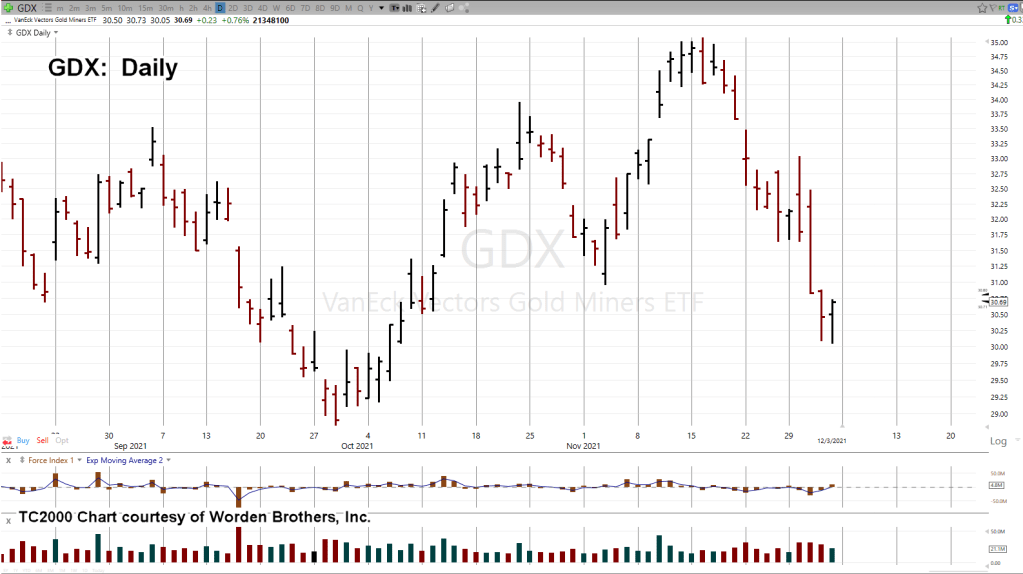

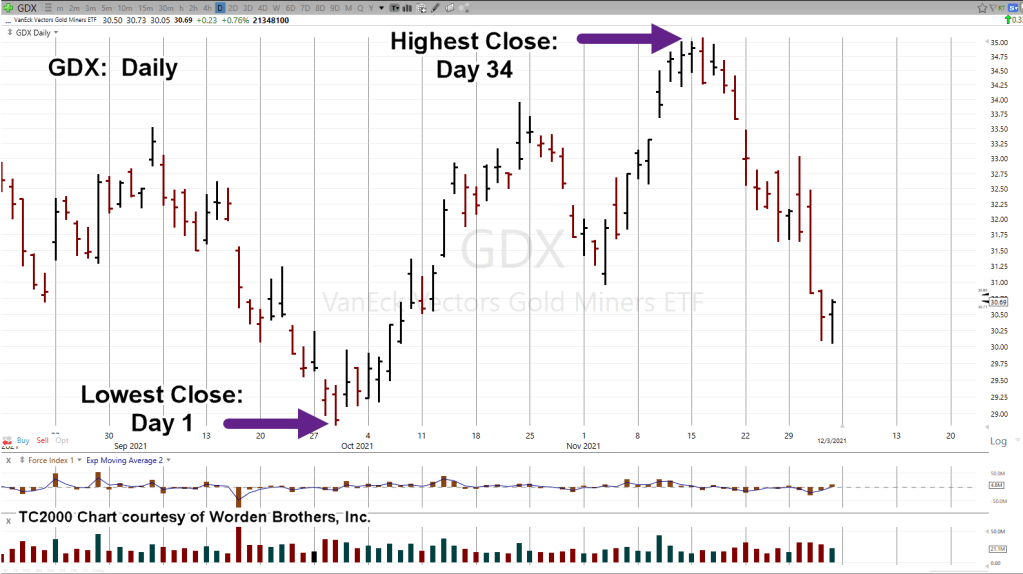

However, it looks like gold and miners alike, are not waiting around … potentially beginning their decline in earnest.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279