The Battle From The Trenches

To date, there’ve been 232 transactions in the firm’s main trading account.

Each one has its own story.

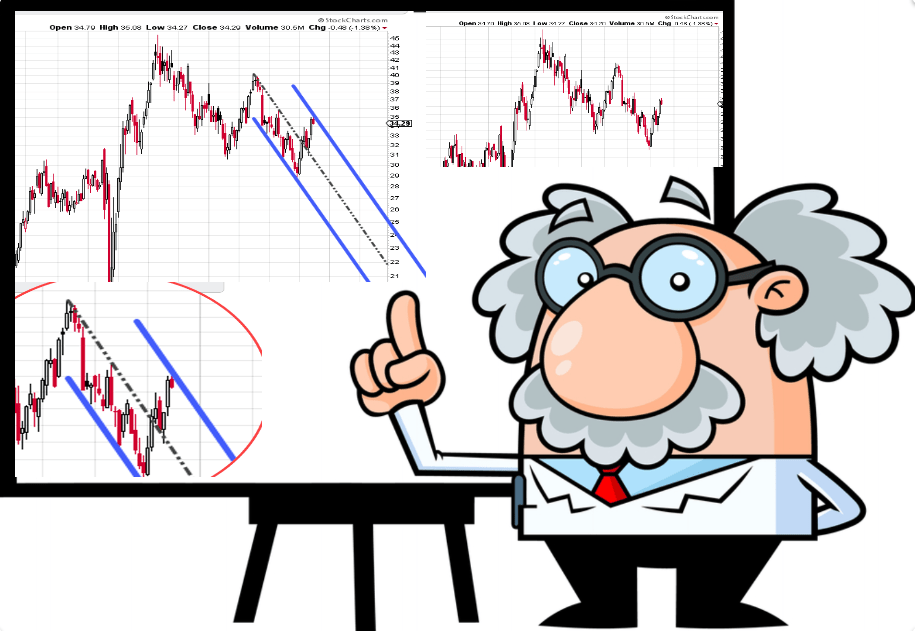

The big one for now, is shorting the gold miners GDX, via DUST (not advice, not a recommendation).

We’re going to pull out the ‘card catalog’ on that one and take a brief look.

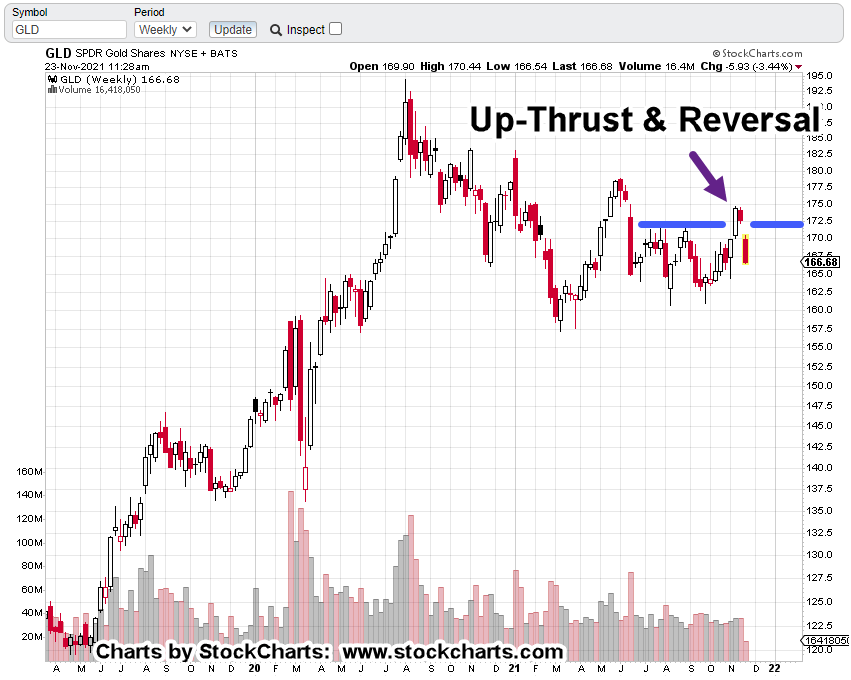

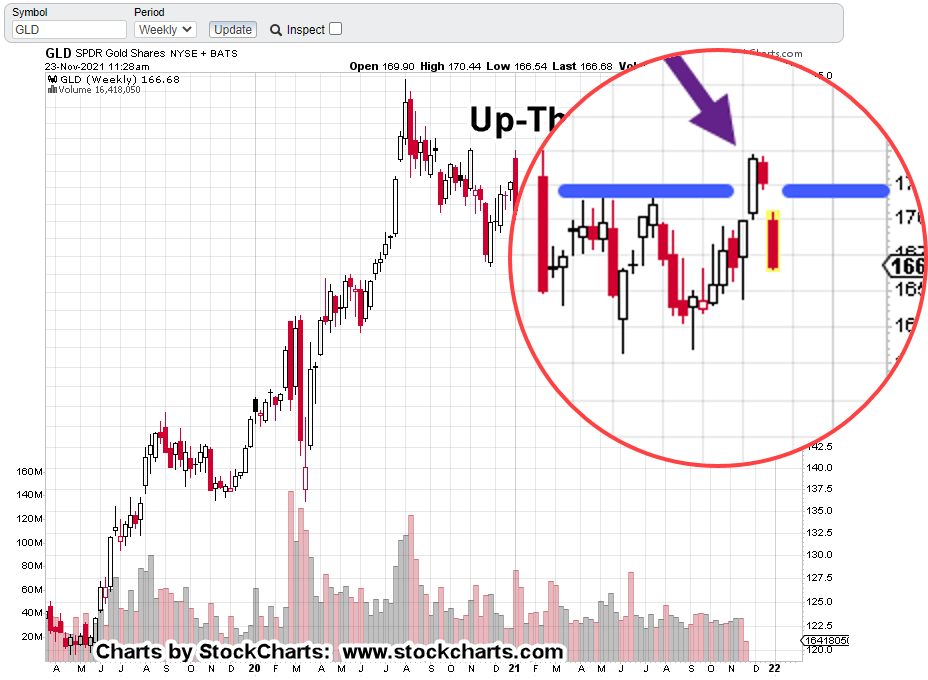

As a reminder, this post identified the breakout target for gold (GLD), months before it actually happened.

Also, in a prior post, it was discovered the miners had 3:1 downside response to recent down moves in gold.

Therefore, at this point in time, using leveraged inverse fund DUST, at -2X, the miners, gives an estimated, 6:1, market exposure.

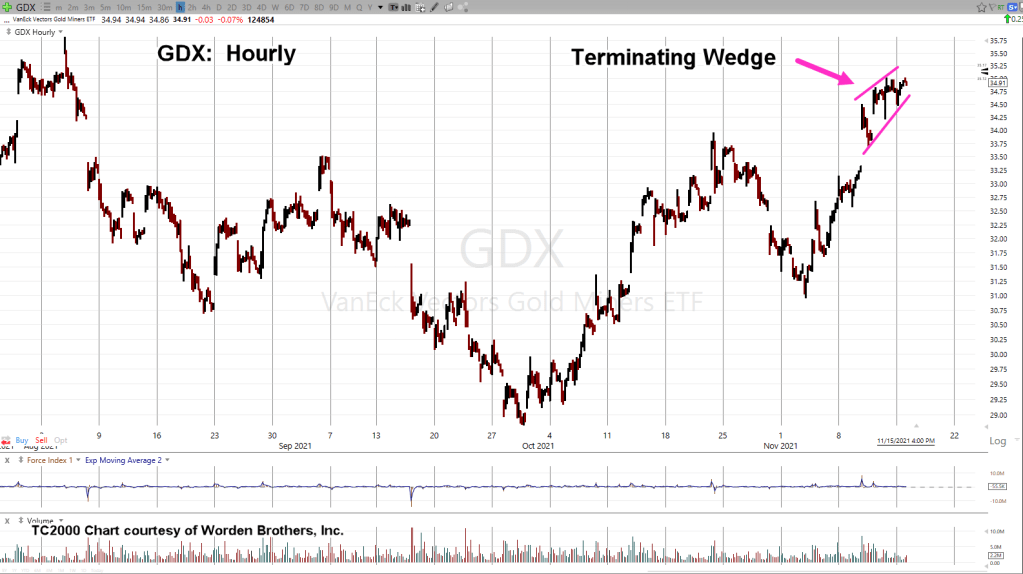

Short entries were opened (shown below) once the gold market and miners broke to the upside.

Hysteria First

Those who’ve been here a while, already know part of the short set-up, was the necessary hysteria needed to get nearly everyone on the wrong (bullish) side.

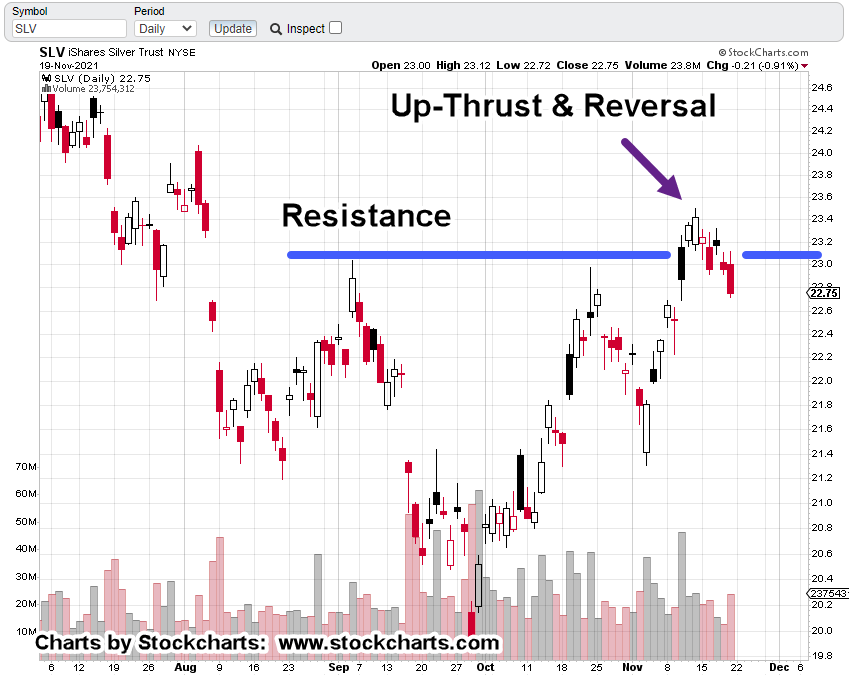

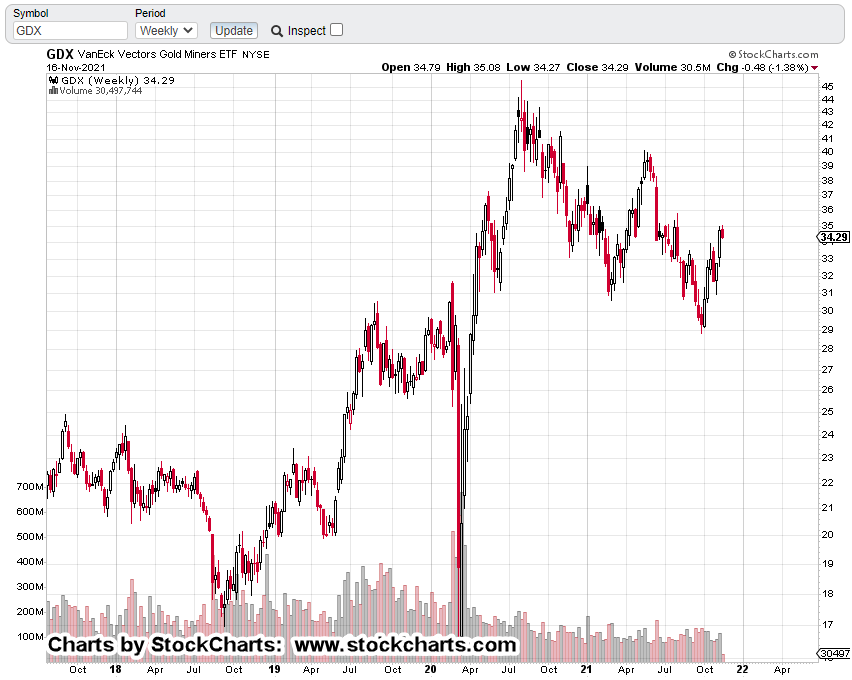

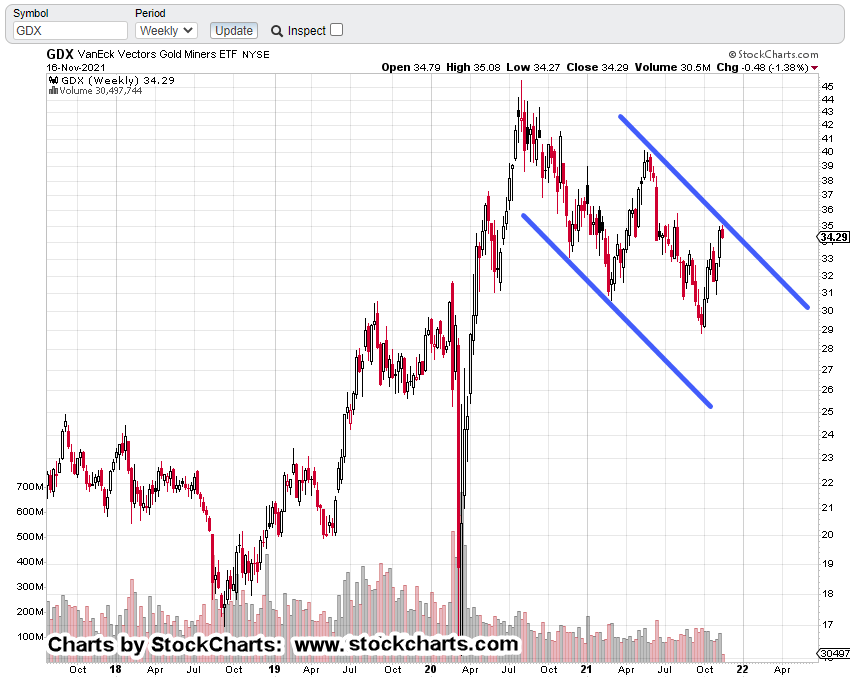

Senior Miners, GDX

Just for reference, the daily chart of GDX, is below.

The arrow is the last known transmission of the gold bulls.

Early in the morning it was (6:30 a.m.).

I suppose it must have been from behind enemy lines, with one of the gold updates warning us about archrival, Russia.

As we can see from the price collapse, the Russians must have found our gold bulls. 🙂

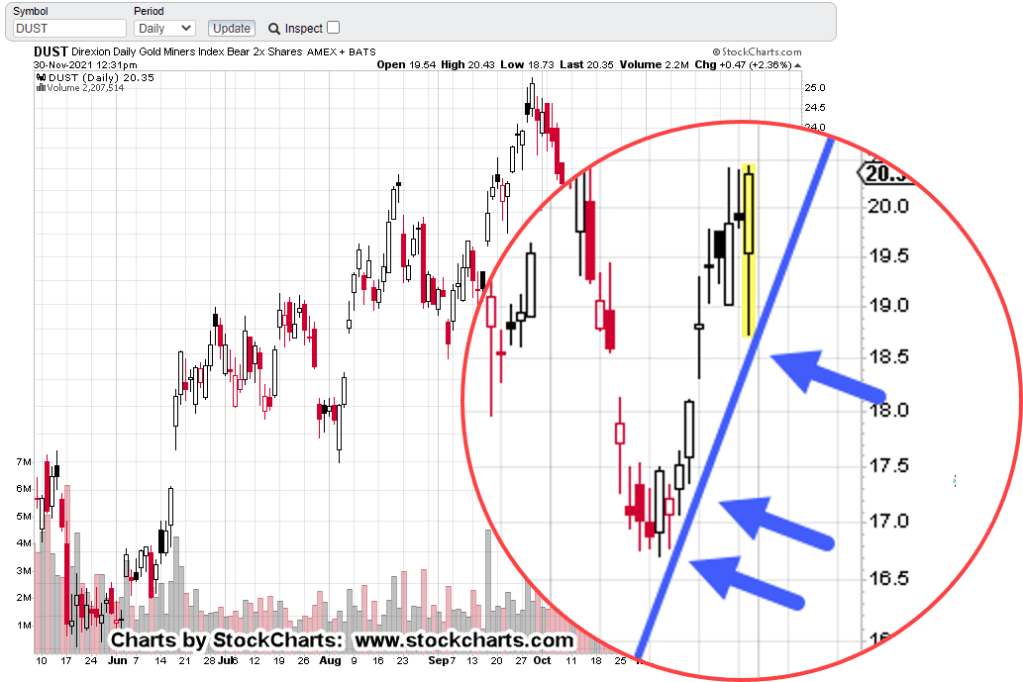

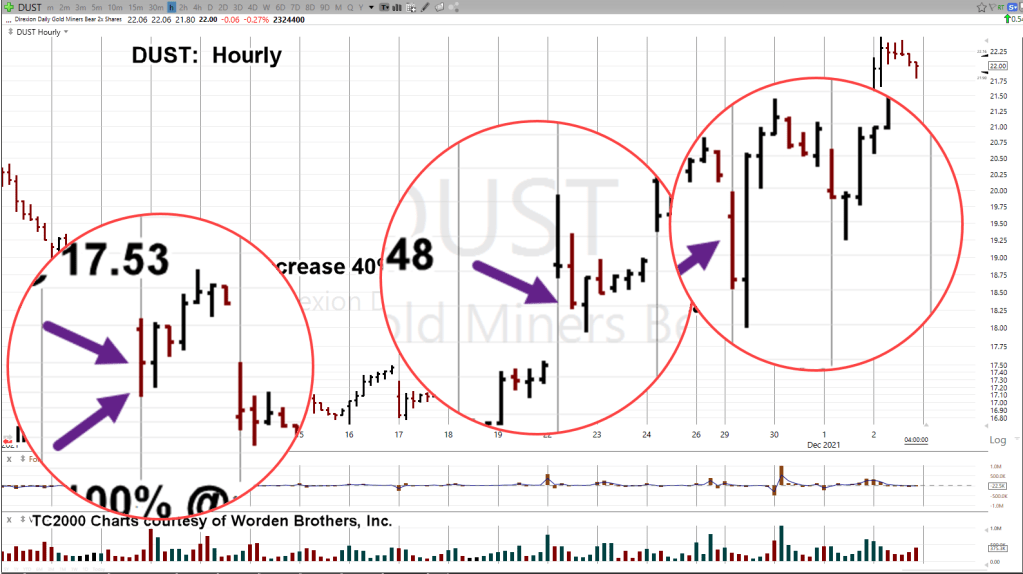

Meanwhile, Back At DUST

The daily chart of leveraged inverse DUST, shows trade entry locations to date (not advice, not a recommendation).

The hourly chart below, gives a closer look.

The next chart is a zoom-in of the entries.

Positioning in this market for now, is essentially complete.

At this point, it’s time to monitor and track for any potential trend reversal or trendline break.

Early Or Late

Years ago, sometime around late 2007, or early 2008, Robert Prechter Jr., said concerning his trades, he tends to be a little bit early.

That implicitly means he might suffer through adverse action including loss-exit, if action goes counter enough.

There’s no perfect entry. Early or late, take your pick.

Fixing Entry Errors

As can be seen on the hourly chart, every trade entry was on a red (declining price) bar.

The risk is, price action will just keep on going red.

The benefit is a big one; I’m not chasing the market.

If I’m chasing, it means I’m not on my game or I never had a game or worse, a coward that can’t pull the trigger on a trade without more ‘confirmation’.

David Weis covers in his video, how to properly get aboard a market that’s already underway.

After the initial entries, DUST banged around the bottom (GDX at the top) for eight trading days.

In retrospect and looking at the chart, the adverse action was not much lower but it did not feel like it at the time.

Because of the months of planning, there was an inference the size of this reversal would be significant.

So far, it is.

In the process of reversing, price action itself has fixed trade entries made a little too early.

Summary

Future updates will show potential trend and/or channel action as well as Fibonacci time correlation.

At this point, the DUST trade is well underway.

A reasonable stop area would be in the vicinity of DUST 19.37 (not advice not a recommendation).

Stay Tuned

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279