All The Same ‘Look’

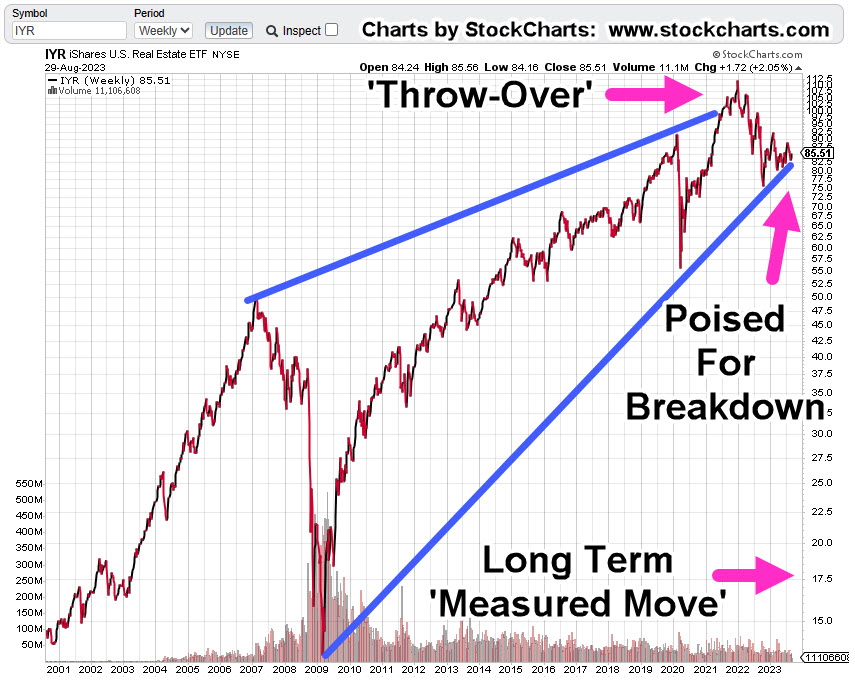

Did we just have the largest bull trap in market history?

Now, after the bulls (may) have been caught off-guard, we have this; the specter of ‘deflation‘ and demand destruction.

Last Tuesday’s CPI report provided a backdrop for the continued squeeze higher.

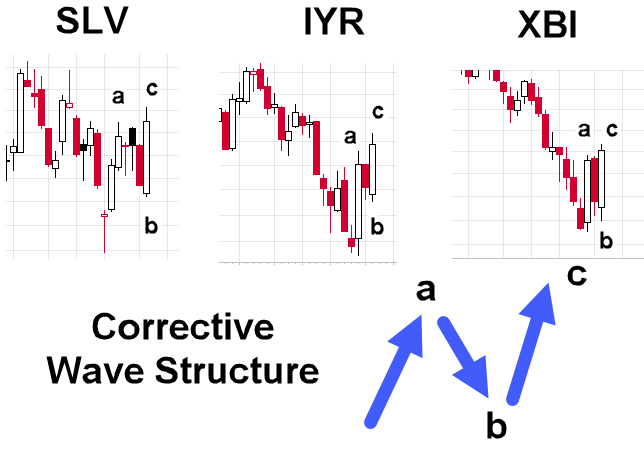

Over the past several weeks, at least three markets have developed the same (bearish) ‘look’.

They’re posting corrective ‘a-b-c’ price action, going against the main trend.

SLV, IYR & XBI, Weekly

Take a look, all similar in their formation.

Positioning

As of the close on Friday, I have positioned short in all three markets (not advice, not a recommendation).

The IYR short was initiated this past Wednesday, the Silver short on Thursday, then just minutes before the close on Friday, the biotech short.

Trades are labeled as SRS-23-04, ZSL-23-01, LABD-23-13

Next Steps

The coming week is likely to see one, or a variation of the following: all trades stopped out, one or two trades with discretionary exit, then followed by potential concentration on the best candidate.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279