Where’s The Crash?

The YouTube weekend ‘consensus’ was for a Monday morning massacre.

So, where is it?

Bert Dohmen, said it best in this interview, (paraphrasing), ‘If everybody agrees with our analysis, then we have to get a new analysis’.

Monday’s First 15-Minutes

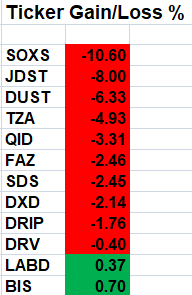

After the first 15-minutes of trade, an assessment was made on the ‘Leveraged Inverse Funds’.

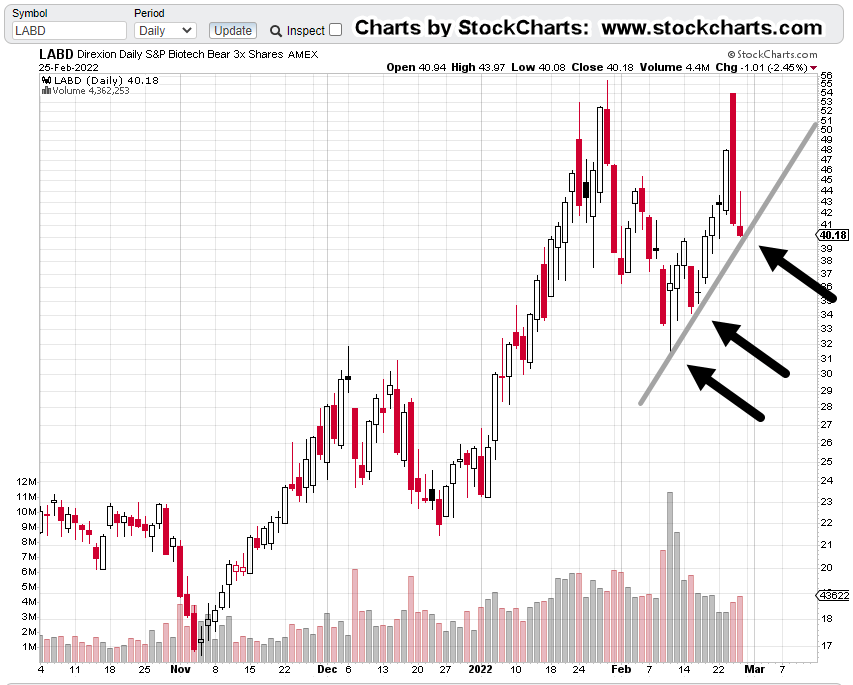

The point being, since this site’s maintaining a short position in biotech (via LABD), how did it fare when compared to the other funds?

After the first 15-minutes of trade, the table at left shows all inverse funds being tracked, in the red, some painfully so (like SOXS, JDST, DUST).

All red, except for the two biotech’s, LABD and BIS.

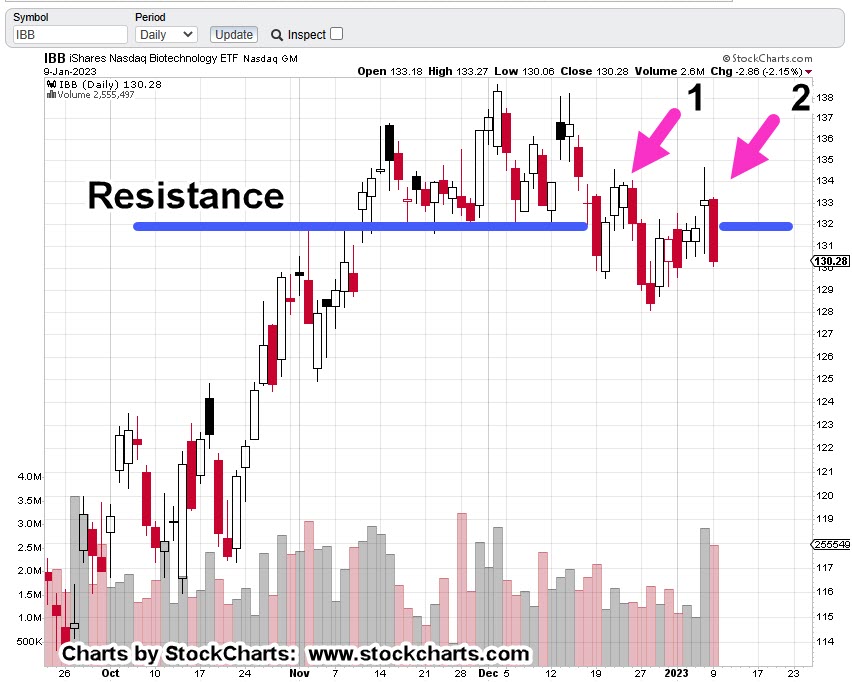

Those two funds are short vehicles for biotech XBI and IBB, respectively.

The XBI index has not (yet) made a new daily low.

Conversely, the inverse fund LABD, has not made a new daily high.

With that said, the stop on LABD-25-13, remains at last Friday’s low of 33.17 (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279