Exactly, What We’re Doing

At this juncture, the ‘money’, is heading out of Eli Lilly.

According to this link, LLY is the heaviest weighting in Health Care Sector, XLV.

Wyckoff analysis pointed to XLV, starting with this post. That short was stopped-out along with another (XLV-25-02), which was not discussed.

Thís update, let the site-visitor know (from the sidebar), there was a third attempt to short (XLV-25-03).

That trade is active and in-the-green (not advice, not a recommendation).

Confusion A-Plenty

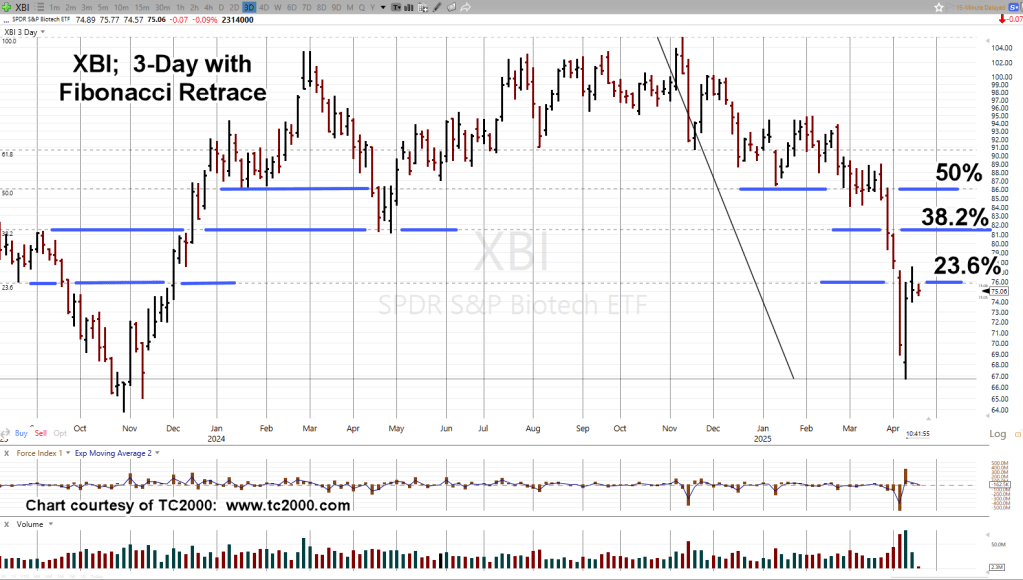

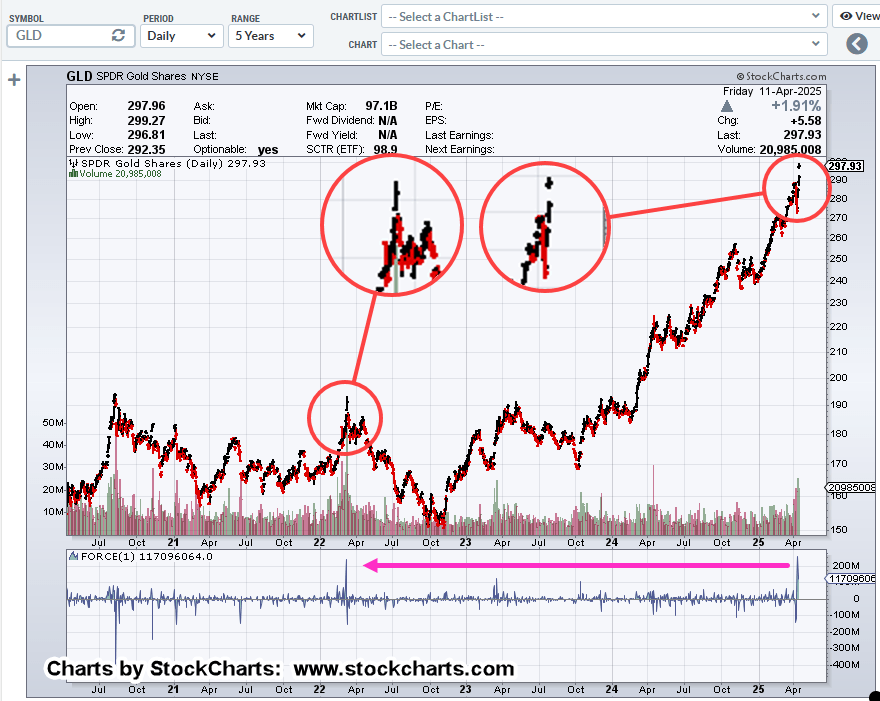

Gold up, silver down, interest rates up, dollar down, then up, biotech down, drugs down, healthcare down, defense up; on it goes.

Then, what does ‘retail’ do? They ‘buy the dip‘

What ‘dip’ exactly, is that?

Let’s move on to LLY, and see what it’s telling us.

Eli Lilly LLY, Daily

Volume (churn) increased significantly from the earnings release on October 30th, 2024, onward.

There have been two ‘breakaway’ gaps (down) since the May 1st, earnings release.

It’s also possible there’s a trading channel.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279