4:36 p.m. EST: Updated with additional data below in red

10:26 a.m. EST:

If the adverse event database can be trusted (a question in itself), the number of people recently injected with ‘speck’ protection, has fallen off a cliff.

The April 16th update linked here, had this to say:

“You would think it’s just a matter of time before this reaches some kind of tipping point; where enough of the herd realizes all at once, the lie.”

The abrupt halt in reaction uploads would indicate a jump in collective awareness the ‘speck’ is a lie … just in time for the next ‘event’ (likely to be food supply or cyber disruption).

Before we get to any market analysis, there’s one more thing concerning biotech … the masks.

Since investigative reporting has been usurped by controlling entities pushing false narratives, information now has to come from the individual(s).

That data is typically in raw form; unlike the slick presentations (i.e. lies) we’ve grown used to on the mainstream.

It’s now up to the researcher to do the leg-work on what’s real or not.

However, this link, appears to be above-board. Download the file if your viewer will not work.

A medical professional has investigated (internet rumored) mask contamination and has found disturbing results.

She is visibly shaken by her findings … probably realizing for the first time, the level of evil that’s directing controlling interests, world events.

She can’t fathom that someone would intentionally put parasites in a product that’s being pushed by the mainstream for us (and children) to wear ‘two … or three’.

Unfortunately, that’s where we are.

This author knows for a fact, a certain big-box home improvement store, handed out boxes of these same (type of) masks ‘for free’ to its employees.

When those employees for the most part, refused to wear them …. it then became a corporate directive, subject to termination.

Most of those employees eventually replaced the paper with a nylon-based covering. However, looking at the video, it seems like just one exposure to the paper masks is enough to inflict unknown levels of harm.

Intentional parasitic contamination … one more brick, in biotech.

Update: A contrary opinion is here:

‘Harmless textile fibers.’

You’ll have to make your own call. Both sides (parasites non parasite) are presented in this update.

Since the author of these posts has never worn a toilet-paper mask (or any mask), what’s on them does not apply from a personal standpoint.

Nonetheless, many in the public can be seen using this type of so-called protection.

Either way, the technical condition of biotech remains …

Moving on to the markets:

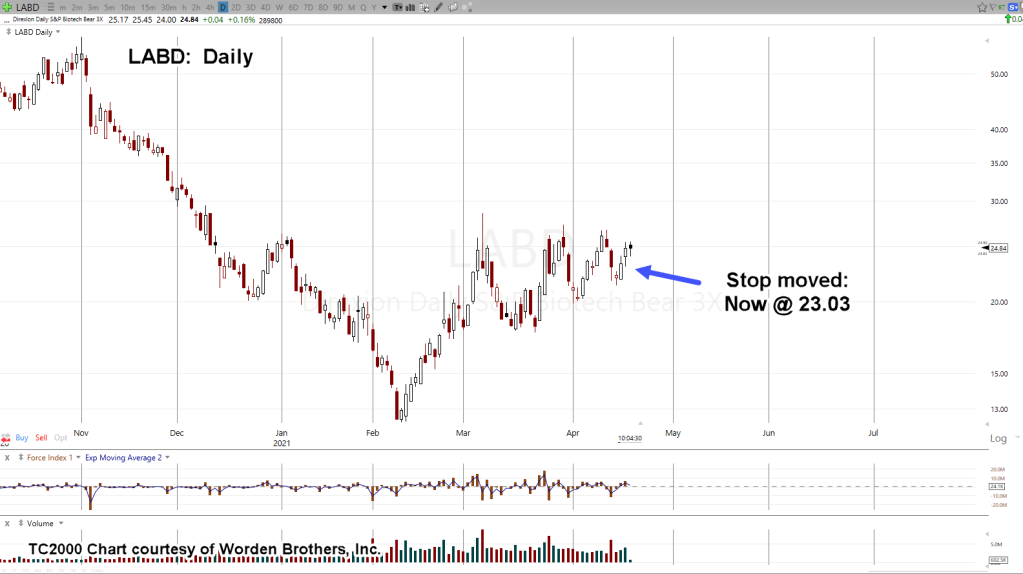

The chart of LABD (3X Inverse SPBIO), continues to move higher.

Our project position is being maintained (see table) and the stop has been moved up as shown:

Obviously, there’s a lot going on in the markets and elsewhere. There’s no telling when or if it will all break loose.

No matter; If that happens, we’re positioned (not advice, not a recommendation) in a market that’s already moving lower … pushing LABD higher.

Stay Tuned