Amidst The Confusion, The Biotech Set-Up

Let’s remind ourselves with a paraphrased quote, long ago:

‘Until you can completely ignore the financial press and focus strictly on price action, you will never be successful in the markets.’

Richard D. Wyckoff, circa 1934

New Highs … Except

It’s new highs for the AI insanity; all the while, CEOs and other insiders are cashing out, as reported by The Maverick, and J. Bravo.

Notably absent from this drunken cyber-bash are biotech IBB, and XBI.

Fibonacci Retrace Compete?

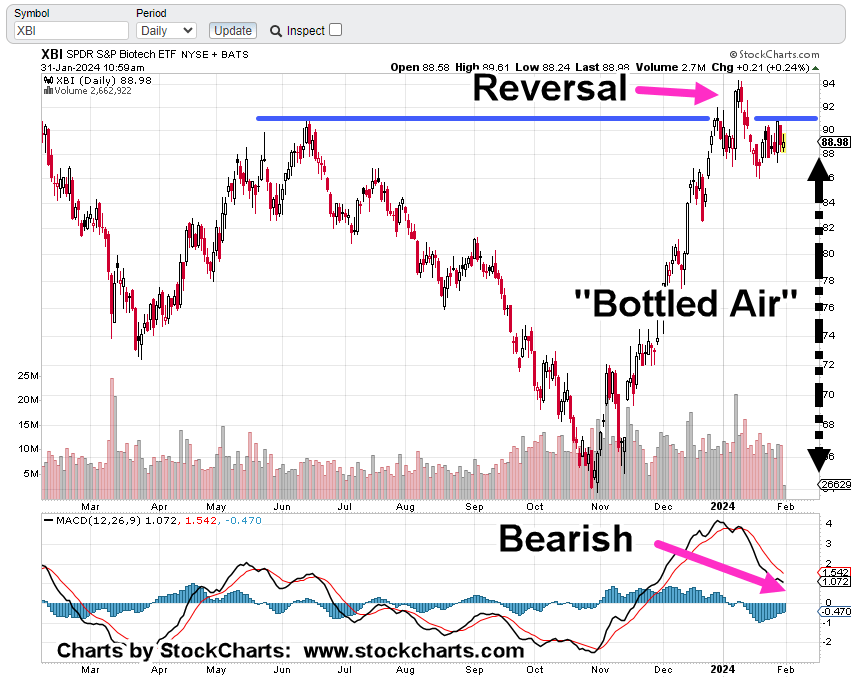

Both indexes (ETFs) posted a Fibonacci retrace (from 2021 highs), doing it simultaneously; IBB at 50% and XBI at 38%.

Potential reversal of XBI, link here.

We have below, even more (technical) weight for XBI pivot from up-to-down (not advice, not a recommendation).

Biotech XBI, 3-Day

Attempted breakout above resistance (magenta line) puts XBI, at The Danger Point®

Price action’s hovering above resistance while at the same time posting climactic volume.

Note that it’s just touching the underside of the 38.2% retrace level (blue line).

The last time we had a similar volume climax was the pivot point from down-to-up, in early May of 2022.

Does that mean the current volume spike signals a (potential) reversal from up-to-down?

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279