Paul Harrell likes to start his videos with:

‘The next twenty minutes are going be long and boring. You might want to skip to the end to see the conclusion.‘

His rabid and loyal fans then proceed to hang on every word of his self professed ‘boring anecdote’ until the very end.

Not saying this site’s in the same league as Harrell’s.

Just saying, the following is going to be a tedious discussion of American Tower (AMT) and how it just might be ready to start an Elliott Wave III, down.

Market Extremes:

Its been no secret. The markets are at price levels and valuations never before seen.

In this site’s opinion, going long anything, is insane.

There could be a break, upset, world event, container ship run aground (oh, wait…), cyber attack, volcanic eruption (oh, wait …), major earthquake, nationwide weather freeze (oh, wait…) food supply disruption (oh, wait…) bond bear raid (oh, wait…) currency devaluation, or any myriad of disconnects that would instantly change the dynamic.

Change the dynamic in such a way as to make low-risk long exit, or short positioning impossible.

This site has documented several times where major brokers have already gone off-line as a result of markets fluctuating to the upside.

What happens when it turns down? Good luck getting out.

Looking for the (short) entry:

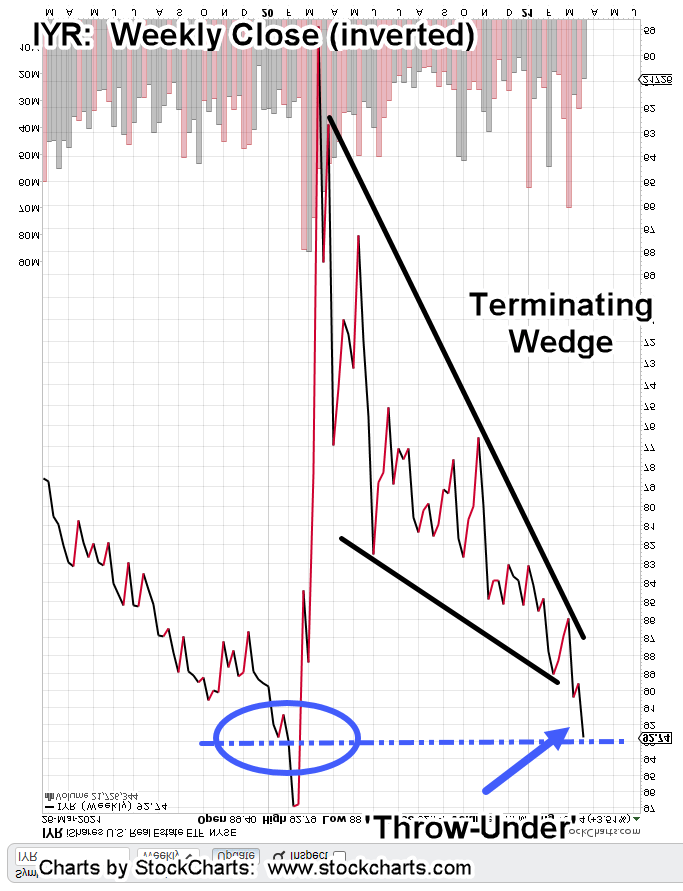

Its been an on again, off again, and back on again affair with shorting real estate, IYR. Anecdotal evidence such as Jerimiah Babe’s updates from his area, show the market’s been vaporized and is not coming back.

We’ve shown from a Point & Figure chart perspective, IYR has built significant price action congestion.

In Wyckoff terms, congestion equals potential.

The IYR index has built enough congestion that if/when the reversal comes, price action has potential to decline below the 2009, lows.

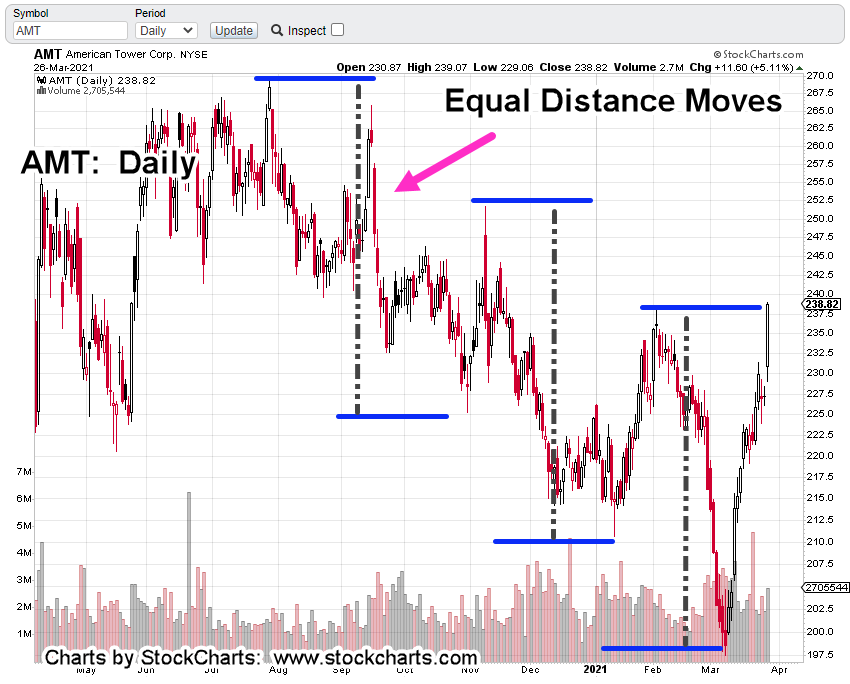

American Tower (AMT) Symmetry:

Now, for the analysis of AMT.

We’re going to start with the daily chart which has an interesting pattern of equal distance moves (or waves):

This equal move structure gives a hint that something’s up. The market’s moving in an orderly fashion. But what order?

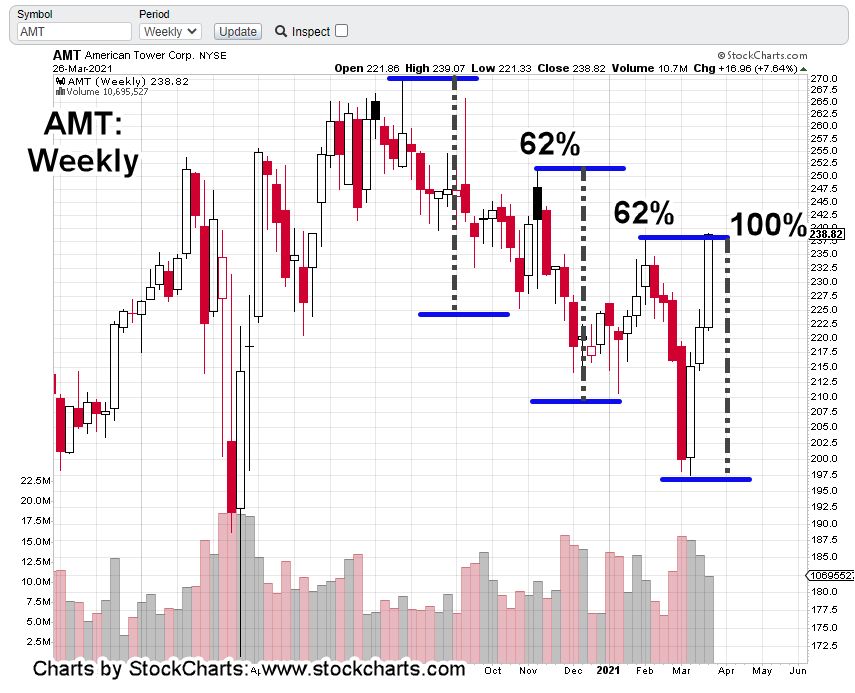

To add more intrigue, we’ll go to the weekly chart. We see each retrace of the two initial waves, was Fibonacci 62%.

The last retrace (up to Friday’s close) is essentially 100%.

Looking up Elliott Wave “equal waves” turns up this presentation. It helps some but does not cover the current situation. The take away from the video is that equal waves do occur.

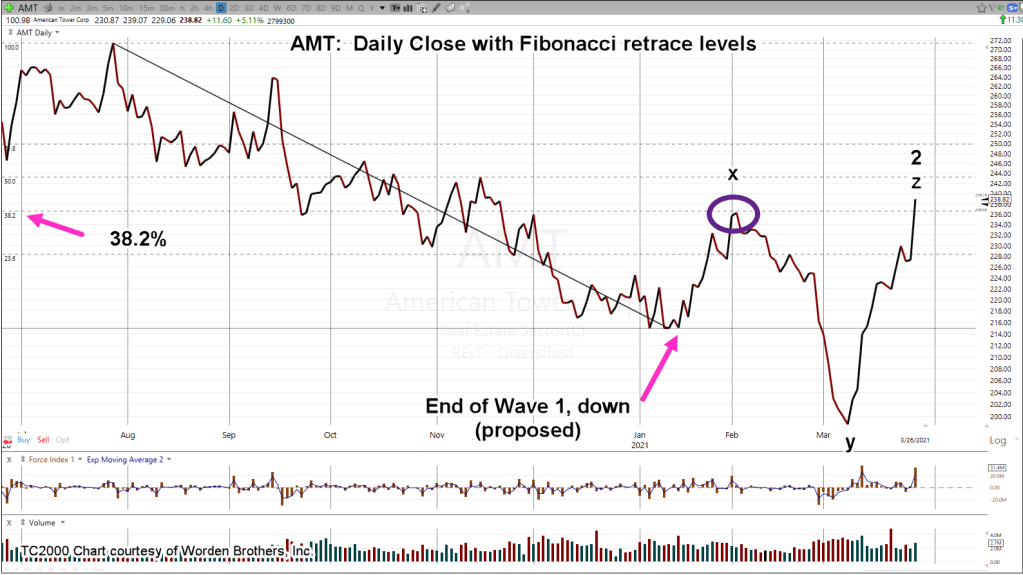

Looking at the daily close chart of AMT gives us this:

The Wave 1, down is placed at the low extreme. Price action then corrects to pivot (magenta oval) at the Fibonacci 38.2% retrace level.

It’s a near perfect retrace.

The reason to think AMT just finished a complex correction that terminated at “z” which is also “2”, is the structure of the fifteen-minute chart below.

The first chart is unmarked except where price action changes character:

Then we put in the Fib projection tool at that location; the inflection point, to get the following:

Incredibly, the top of Friday’s price action is also a Fibonacci target (423.6%) projection.

Getting back to the daily chart and labeling it using the above information gives us this:

Removing all but the labels is more clear:

There could be other ways to label the structure. It may become (very) apparent at the next open whether this interpretation is correct.

However, coupled with yesterday’s analysis of IYR, and its technical condition (at the extreme), we get the sense we’re close to some type of price action hesitation or outright reversal.

Summary:

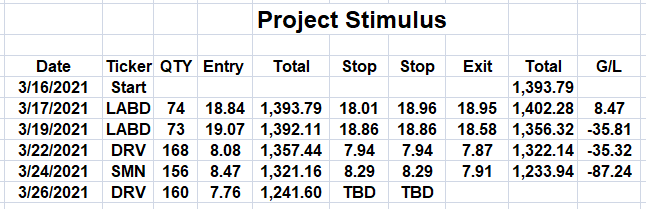

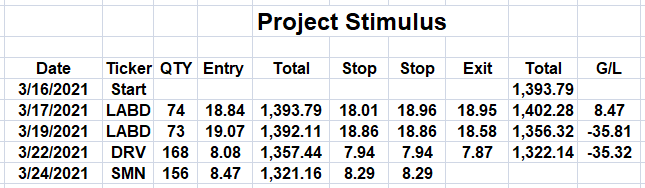

We’re short this sector via DRV (not advice not a recommendation).

Price action appears to be at extremes and is meeting Fibonacci and support-resistance levels simultaneously.

Not related but an interesting coincidence (maybe): Van Metre’s update on Friday night:

“Is This a Sign Real Estate Prices Have Peaked?”

The futures markets just opened … S&P down 7-points. Let’s see what happens next.

Stay Tuned

Charts by StockCharts