Bull Market, or Not

Overnight, oil futures launched higher.

Selected news links, below:

Oil Could Hit $130 In “Worst Case Scenario”: JPMorgan, link here.

Images Emerge Of Tehran Destruction After Major Israeli ‘Preemptive Attack’; IRGC Chief Killed. link here

Crude propelled by Israeli attacks on Iran; ES -1.1%, DXY +0.8% – Newsquawk US Market Open, link here

Crude +8%, ES -1.5% after Israel conducts strikes on Iranian nuclear & military targets – Newsquawk Europe Market Open, link here.

Oil, Bull Market?

Even as this post is being created (8:54 a.m., EST), oil futures are backing off overnight highs.

It’s what happens next, that’s important.

If oil and related markets like XOP, can’t hold or surpass those highs, well then, we have our answer (not advice, not a recommendation).

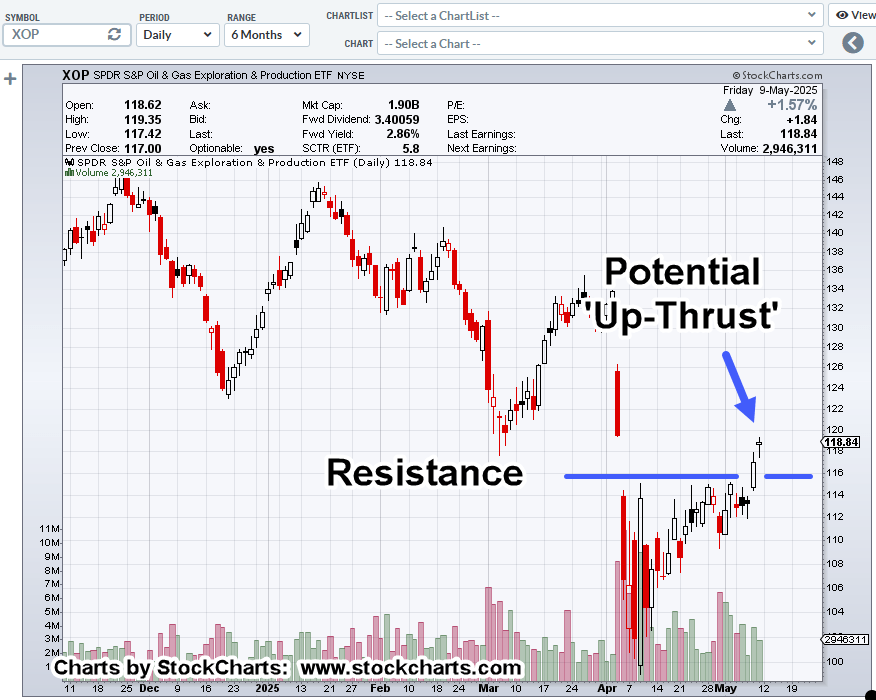

Oil & Gas, XOP, Daily

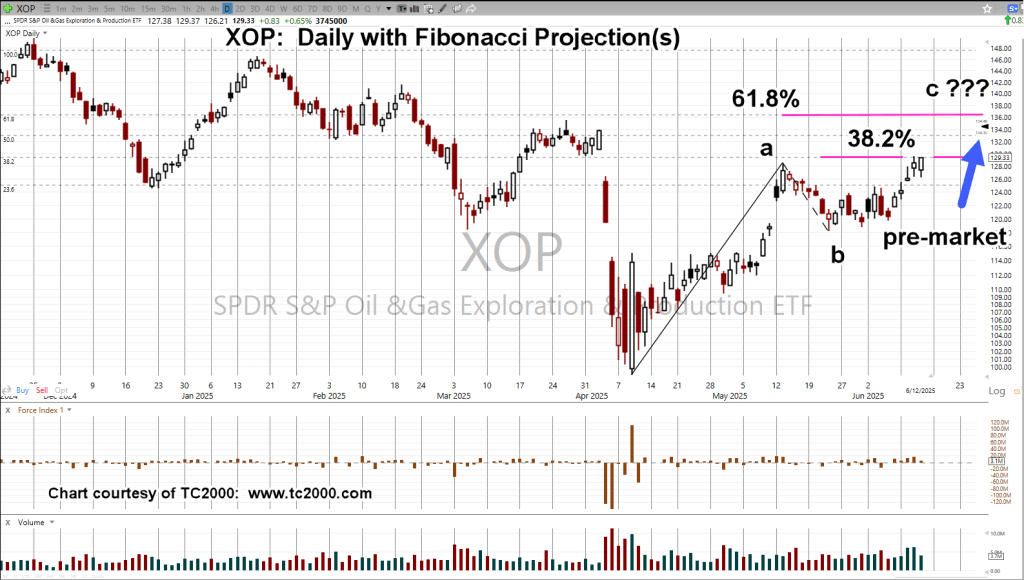

In the pre-market session, XOP is trading just below the 61.8%, Fibonacci projection.

If the XOP wave is ‘corrective’, shown as ‘a-b-c’ above, that means it’s against the main trend (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279