Work and think in isolation

Intuition does not ‘collaborate’

If you’re serious about your growth with market analysis and trading, at some point in the journey, you’ll discover this fact:

The most successful and effective market speculators operate alone.

Livermore had his office with the ticker, ‘board boys’, and not much else.

Wyckoff (from his autobiography) refused over and over the overtures of his wealthy clients to establish a more personal relationship.

The late David Weis was the same; managing his own account.

One difference with him; he provided a mentoring service that passed on his valuable insight.

It was a steal of a price (back in 2011) … just $1,500.

Personal Anecdote (being mentored by Weis):

It was April, of 2011:

As Weis interviewed me on the phone, asking all sorts of questions about my background (engineering), my parents (my late father, a Yugoslav national, shot by Germans in an attempted execution during WWII), and my trading objectives, it became clear to me, I would pay whatever price necessary to gain an audience with him.

This all took place before his website was complete and before his book was published. It was sort of a ‘golden time’.

Stretched Growth:

Weis traded the futures markets. If I was to be mentored by him, I would need to get up to speed and trade futures as well.

I knew almost nothing (except they were highly leveraged) about those markets. However, I was determined to learn very quickly.

During the phone interview, which lasted maybe forty minutes to an hour, he did not mention (and I did not ask) the cost of his services.

As the call progressed, I was literally getting sick with anticipation.

Coming to a close, almost absentmindedly, he said: ‘It’ll be $1,500’.

I fully expected him to say, and would have gladly paid $5,000 or more … which was the going rate for a typical trading course.

He then ‘suggested’ that I open a futures account; our mentoring sessions would start the next week.

Fast Track:

After that call, three things happened in quick succession.

First: A check (he was old-school) was mailed off to him in Boston so that it would clear before the next week.

Second: I contacted TradeStation and got their futures paperwork to open an account. That happened quickly and $15,000 (an amount suggested by Weis), was wired to the account.

Third: Buy the time of the first session, I already had the futures account set up and had determined what markets I would be trading: The LIFFE mini-futures (now part of ICE Futures Europe) for gold and silver.

On The Fly:

One last thing about trading futures and learning quickly.

I noticed about two weeks into trading silver, the volume on the contract I was in, started to drop off.

I did not understand why the liquidity was drying up … that is, until I checked my e-mails.

Turns out, I was about to ‘take delivery’, and pay $37,000 for a bar of silver if I did not exit the contract (that day).

The entire time with Weis was a growth experience. Very painful most of the time as knowledge had be acquired on the spot.

During our sessions, I would have the phone to my ear and be feverishly taking ‘screen shots’ of his computer (via gotomeeting,com) as he progressed through the session.

This link is probably as close as one will come to a typical mentoring session.

No Group Consensus:

Going to the link and watching for even a few minutes, it’s obvious this type of analysis is in a class of its own.

Nowhere in the video does he mention P/E ratios, Sales-to-Book or any number of useless metrics.

Deciding to pursue this type of trading, will of itself, separate you from the crowd.

The mainstream financial press will never present this level of detail. The general pubic does not have the intellectual capability or discipline to really get down and craft this skill.

Of course the financial media, YouTuber’s and the like, are all too happy to cater this (mediocre) crowd by showing their supposed prowess on dissecting financial reports and/or pontificating on the latest Fed speech.

Little does the public know, this type analysis (fundamental metrics) is just a ruse; a distraction promulgated over the life of the markets to distract and disable the masses.

The fact that ruse keeps going, is proof in itself of its effectiveness.

Which brings us, once again, to biotech.

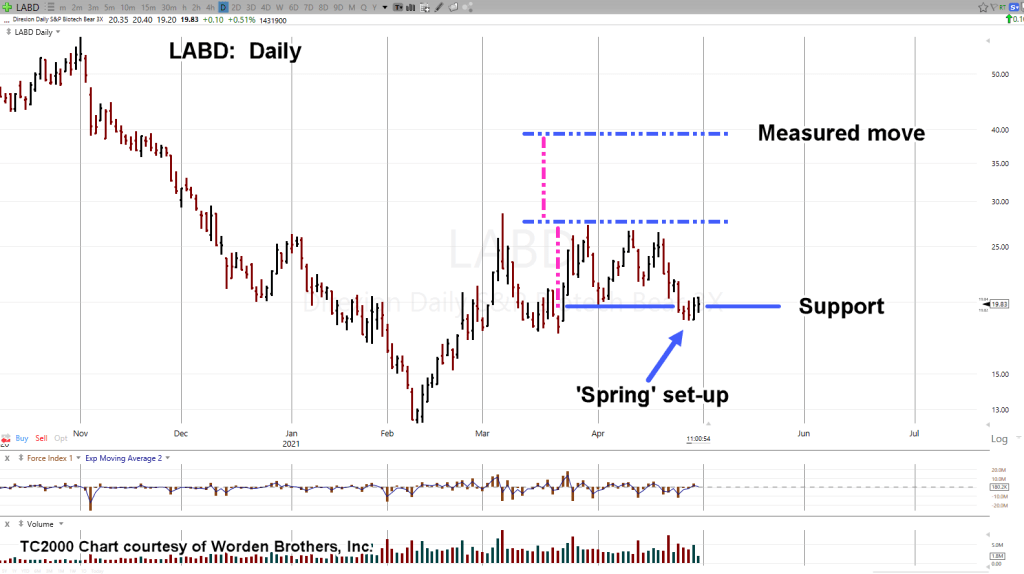

SPBIO (LABD): Analysis

In this case, which could be one of a kind in history, the fundamentals are important.

Those in the biotech sector have intentionally (depending on whose data is used) fatally poisoned millions if not billions.

Their natural immune systems have been forever destroyed and their life expectancy drastically shortened.

Even so, this fundamental backdrop must not cloud interpreting the market behavior at hand and the Wyckoff analysis.

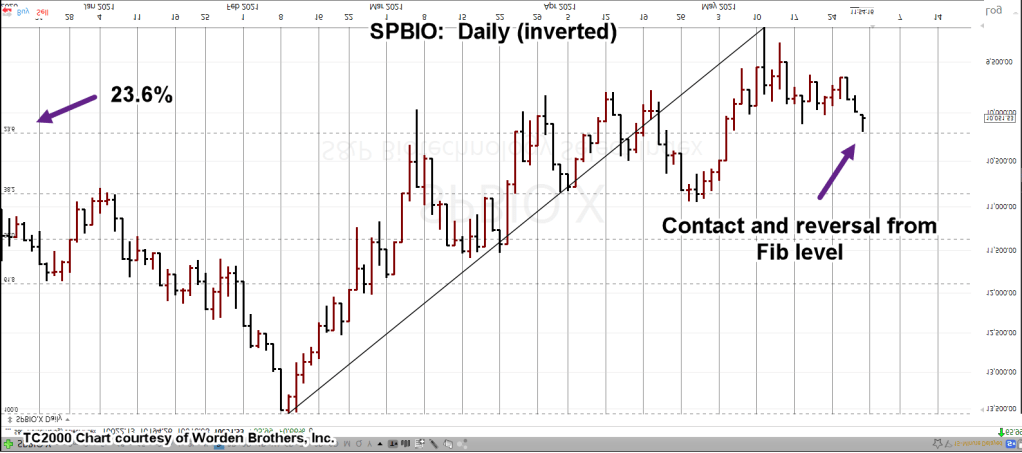

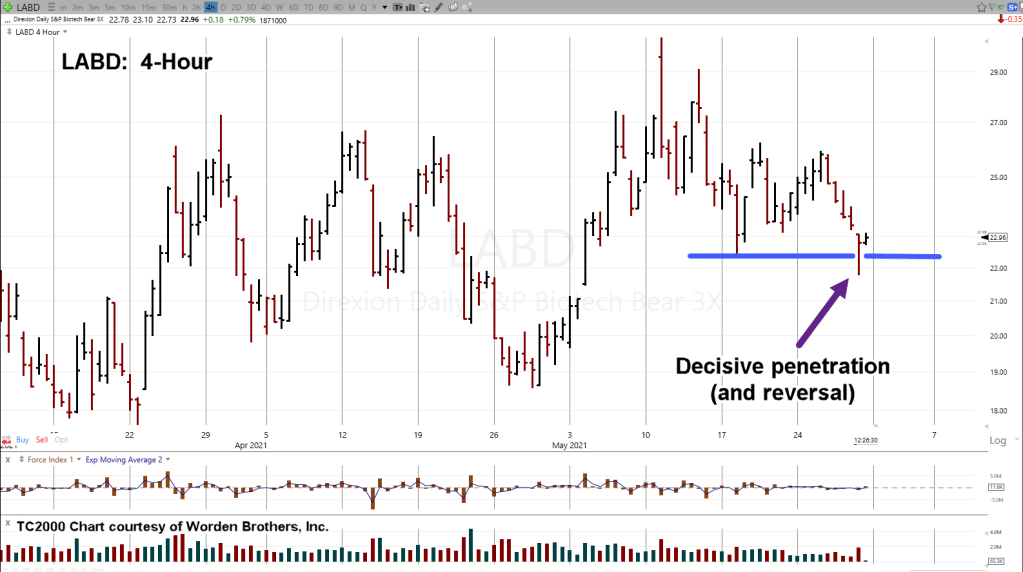

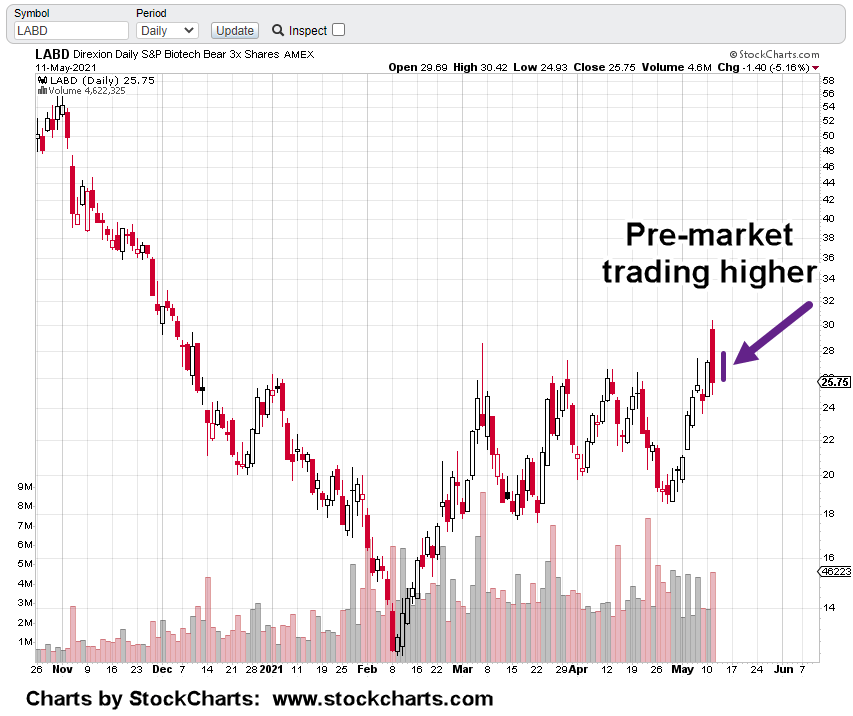

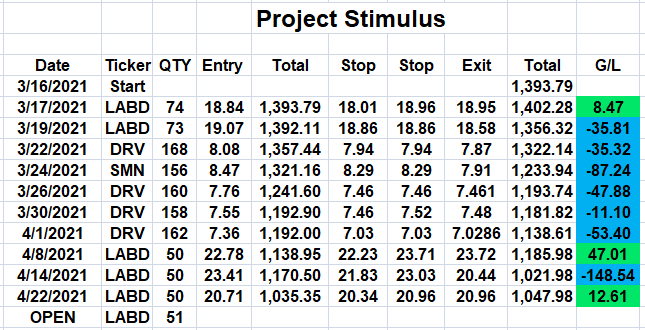

We’ll start as Weis does in the video link, with an un-marked chart. Daily close of inverse fund LABD:

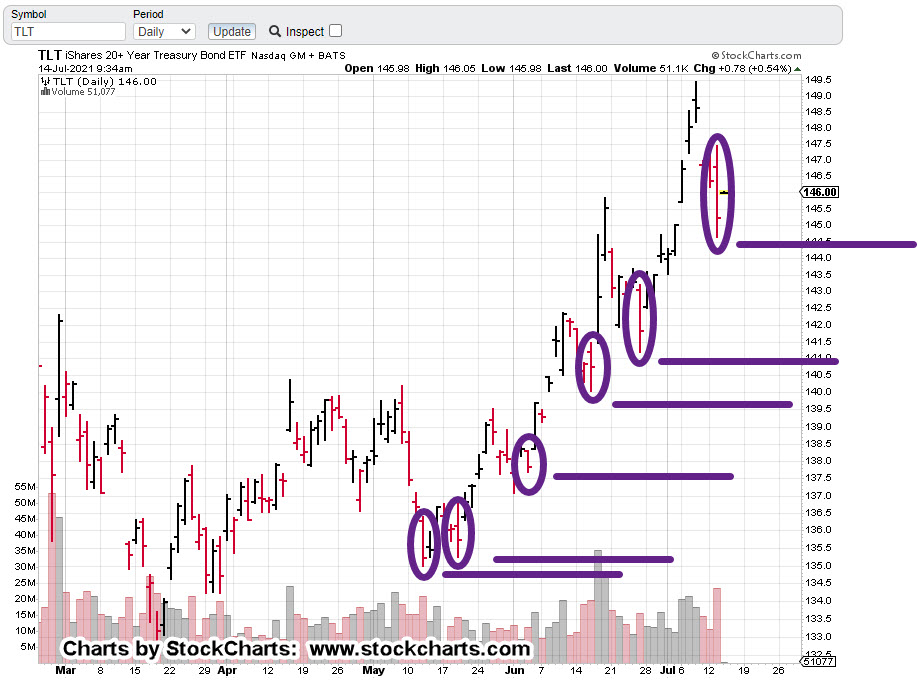

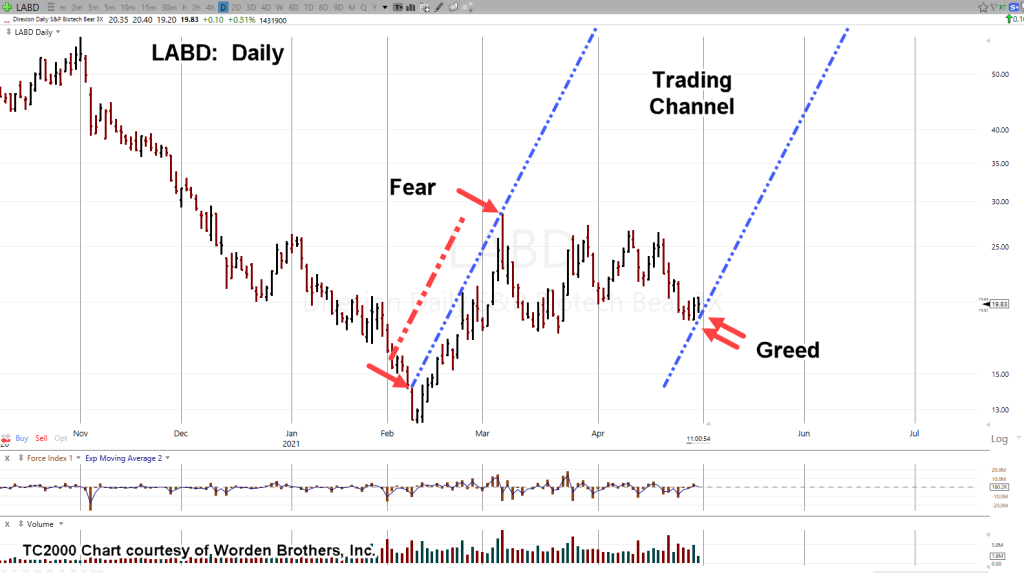

Next we’ll show how the right side action is alternating its behavior:

At this juncture, the market is not able to retrace.

Price action from the last intermediate low in late June, has formed a double, then single, and then no bottom.

Adding in the repeating trendline study, LABD is currently near a contact point on the right side trend:

Price action itself points to more downside for SPBIO (LABD higher).

With the overall markets closing poorly on Friday, the implication is for lower action in the coming week.

Consumer All Done:

The post on Friday, showed how the consumer is literally spent.

About an hour later, Steven Van Metre came in with additional details.

Then, couple that with Dan’s (iAllegedly) assessment: “The Party’s Over”; the pressure continues to build.

We might take the example of lumber futures as a model for upcoming price action; essentially, straight down -66.3%, in 48 trading days.

Wistful Conclusion:

David Weis is now gone (passed away last year).

After listening to his voice once again, I have let it personally admonish me to remain focused and diligent.

Even a decade after our mentoring sessions, with focused effort, the search for mastery is never ending.

To borrow a quote from Oswald Chambers: “One must determine to be limited and focus their affinities.”

We’re at a critical time in world history and that’s not overstated.

Our conditions have brought so many cowards to the fore.

In a way, it’s a tremendous public service.

It’s clear to see who is leading and who is cowering in place.

If anyone has a hope of surviving (even prospering) in this environment, for some it will be taking control of their own market decisions; separating themselves from those who want them to remain ignorant.

Stepping out into the raw edge of life, has no guarantee of success.

However, what is guaranteed, is stretching of oneself into a new level of thinking, experience, and wisdom.

That, is its own reward.

Stay Tuned