It Was Never A Bull Market

The bottom’s falling out of the equity markets and the miners are going right along with them.

For long-time users of this site, this lack of a sustainable bull market in the mining indices was identified long ago.

Fifteen months ago, we had the following post. Let’s review and give it an update:

‘What’s wrong with this picture?’

The Charts:

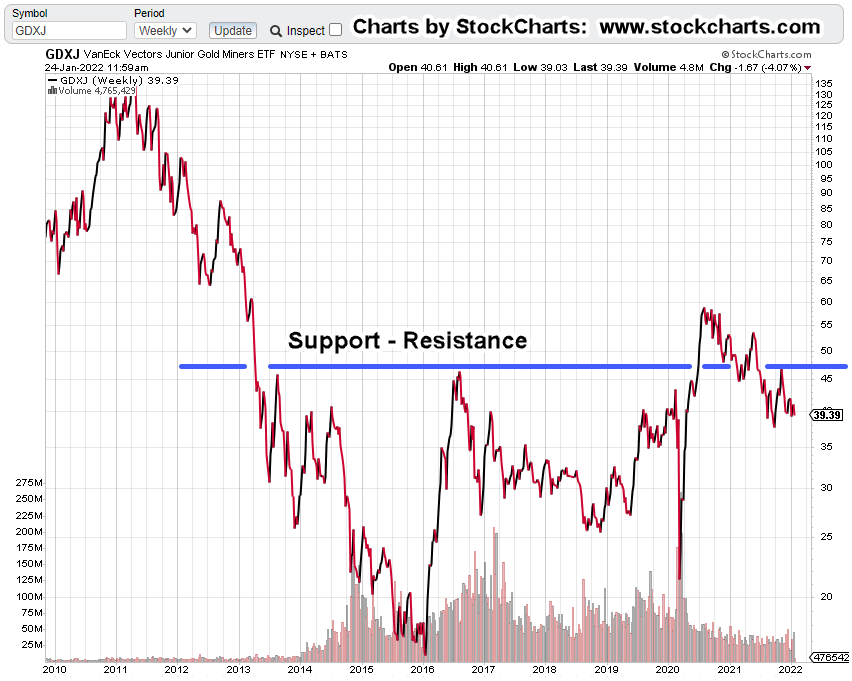

First off, we’ll re-post the weekly close chart of Junior Miners, GDXJ as it was then (October 25th, 2020):

The following quotes were also part of that report:

“One way to look at it is, the junior sector does not believe gold (and silver) prices can be sustained at current levels.”

“Or, if they are sustained, there must be something else at work that would prevent them form obtaining a substantial profit.”

Now we know, nearly a year and a half later, that “something else at work”, is what we call The Speck and the Speck-Effect.

Not only that, energy (and money) that’s being diverted to solve non-problems (covered in the last post) may be having an effect as well.

Let’s not forget supply chain problems with no end in sight.

If there ever was a case for Wyckoff analysis, this is it.

Reading price action, making calculated (intuitive) decisions will keep one away from what by now, has become useless prattle from the mainstream sources.

Remember ‘blue skies ahead’?. Seems like it was almost yesterday … oh, wait. 🙂

This garbage-in, garbage-out, is not exclusive to just the financial media.

As Dr. Vernon Colman points out in his video (linked here), it seems to be pervasive in all types of media world-wide.

Junior Miners GDXJ, At Present:

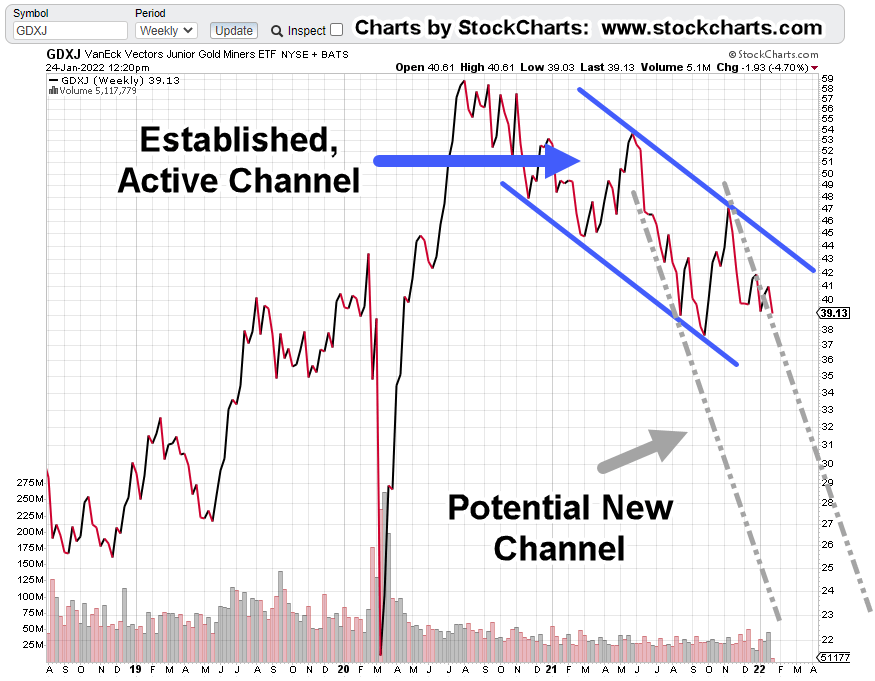

Here’s how the weekly close of the Junior Miners looks today (approximately, mid-session):

Downside Trading Channel(s)

We’ll stay with the weekly GDXJ but zoom in and mark it up:

GDXJ, has been in a well-established down-channel, beginning around late November of 2020.

As shown with the grey dashed-line, there’s a possibility of a new more aggressive channel.

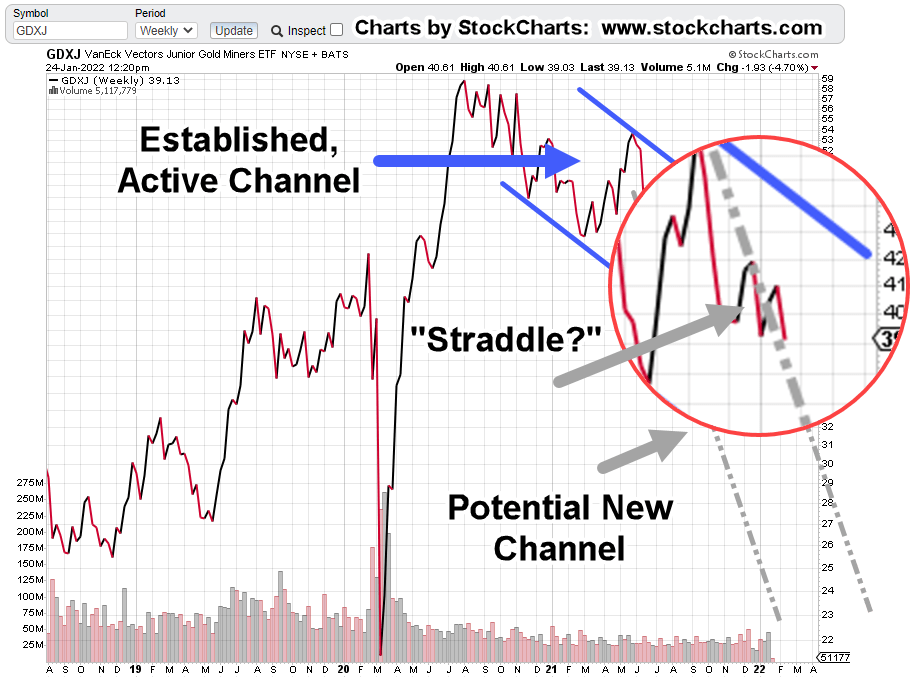

The chart below shows the potential right-side trend line is currently being ‘straddled’ by price action; this can happen when the equity or index is unsure there’s been a change.

If GDXJ really has pivoted more aggressively to the downside, price action will ‘get itself into the channel’ by accelerating sharply lower.

Where’s It Headed?

For this update, we’re going to use the P&F projections for GDXJ. Fibonacci projections (which have a similar target) may be covered in tomorrow’s update … price action depending:

Downside projection is for a drop of approximately – 35% to -50%, from current levels (not advice, not a recommendation).

Summary:

As always, anything can happen. The markets could be rescued yet one more time.

However, at this juncture we’re at least in the established down channel shown above. Price action will let us know if there’s been a decisive acceleration to the downside (grey dashed-line).

Remaining short GDXJ via JDST; labeled as JDST-22-01 (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279