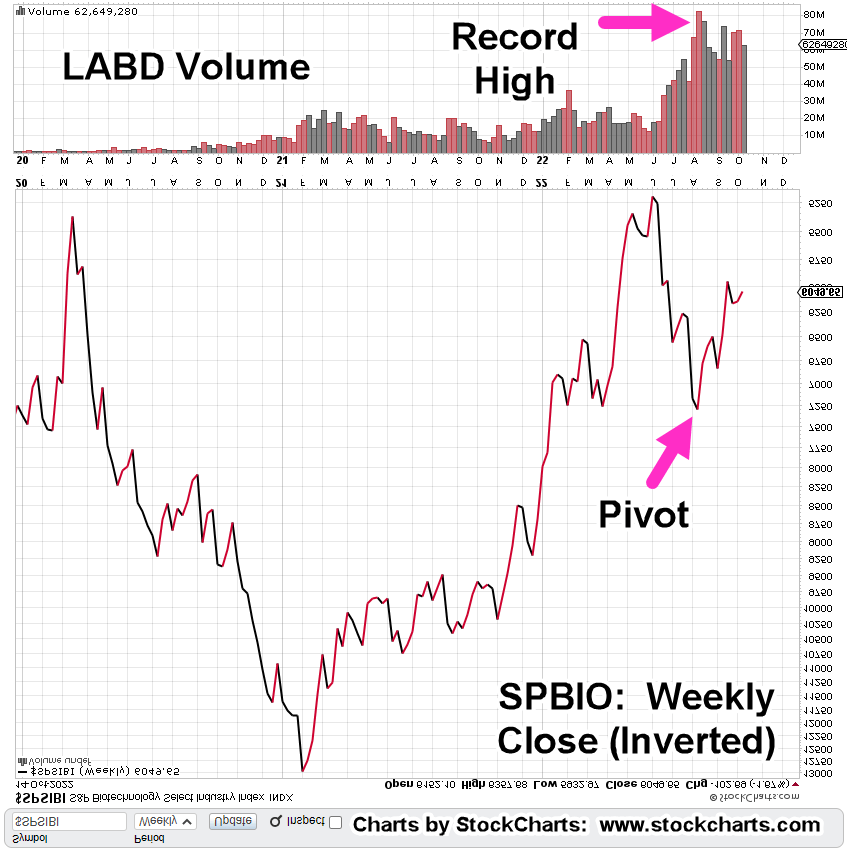

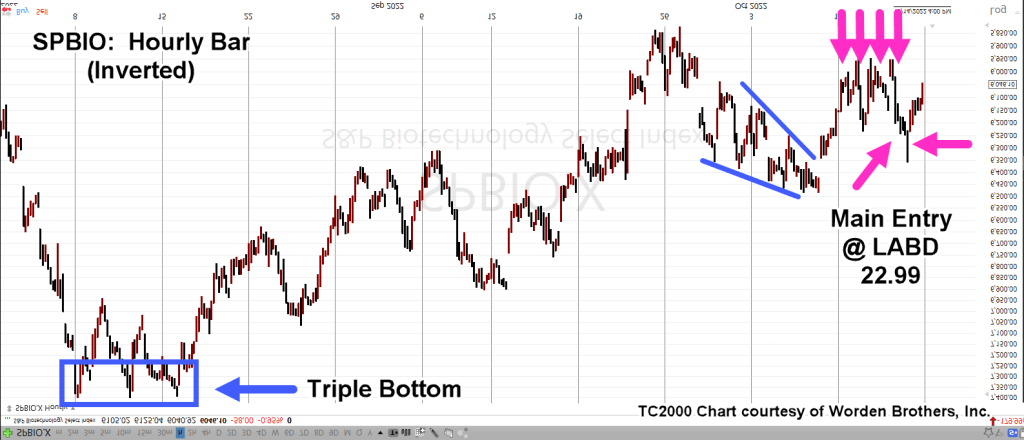

Trend Contact … Then, Pivot Down

With a potential right-side trend (and channel) contact confirmed; shown below at – 86% annualized, odds are now favorable for a Put strategy.

In addition to the technical factors discussed, listed at the bottom of this post are no fewer than 22-links to the current fundamental state of biotech and their ‘handiwork’.

The weekly chart of MRNA, has a Wyckoff Up-Thrust and a test, confirmed by the downside pivot.

Moderna MRNA, Weekly

Notice the reversal action took place at a very weak Fibonacci 23.6% retrace.

The two blue lines on the daily chart (below) are exactly parallel.

The grey lines are parallel to the blue lines and intended to show MRNA, exhibits a repeating (downtrend) pattern.

Moderna MRNA, Daily

The expanded version on the daily has support being penetrated (horizontal blue line) and then ‘spring’ action last Friday as a result.

Of course, it’s ‘what happens next’, that’s the question.

In a prefect scenario, price action would thrust lower for a day or several days and then come back up to test the underside of resistance.

Elder Option Strategy

This strategy is taken from Elder’s book ‘Come Into My Trading Room’, and seeks to use as short-dated options as possible.

Doing so, requires the discipline to wait sufficient amount of time for price action to get into position and for option time value to bleed-off.

Potential Upside

Since we’re already in spring position and price action moved off the lows on Friday, MRNA could continue the upside right back to, or past the downtrend line.

However, with massive (undeniable) fundamentals building buy the day, and MRNA being mentioned specifically in at least one link below, probabilities favor the downside.

Supporting Links For The Bearish Stance

Florida Surgeon General Warns Life-Threatening VAERS Reports Up 4,400 Percent Since COVID-19 Vaccine Rollout

US Says Government, Not Moderna, Should Face COVID-19 Vaccine Lawsuit

New Medical Codes For COVID Vaccination Status Raise Concerns Among Experts

Watch: Rand Paul Grills School Of Nursing Head On Student COVID Vaccine Mandate

US Navy Lifts COVID Vaccine Mandate For Sailor Deployment

Mainstream Media Continues To Push False ‘COVID Heart’ Narrative To Explain Excess Deaths

NFL Players’ Association Urged To Screen for Heart Issues Over Vaccine Side Effects

WHO Suddenly Shelves Plans For Second Phase Investigation Into Origins Of COVID-19: Report

Watch: CDC Director Suggests It Will Never Change Child-Masking Policy

Rand Paul Introduces Bill To Halt Funding For Hospitals Denying Care To The Unvaxxed

Welfare State Weakens… 30 Million Americans Are About To Lose ‘COVID’ Food Stamp Handouts

IMF Says World Needs To Prepare For The “Unthinkable” After COVID, War In Ukraine

COVID Emergency, Climate Emergency: Same Thing

Novavax To Sell US Government 1.5 Million More Doses Of COVID-19 Vaccine

“World’s First” Unvaccinated Dating Service Launches In Hawaii

Living The Lie

‘COVID-Curing’ Sorrento Therapeutics Plunges After Filing For Chapter 11 Bankruptcy Protection

What Can We Learn From The Biggest Lies People Believed About COVID?

Censorship Operations: COVID, War, And More…

CDC Director Defends Mask Mandates After New Study Shows Masking Has Little Effect

Bivalent COVID Vaccines Perform Worse Against Variant Now Dominant In United States: Studies

COVID NEWS COMPILATION WITH NUMBER 33

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279