Establish Full Position(s) … Early

As the ‘About‘ page says, we’re emulating trading and analysis techniques, used by Livermore, Wyckoff & Loeb.

Livermore’s listed first, as he figured out through many gains and losses, he’s primarily, a strategist:

‘What’s likely to happen, in a big way?’

Wyckoff is next as the tactician, with Loeb as the focus; meaning, concentrate positions, do not ‘diversify’ (not advice, not a recommendation).

Incremental Entries

The potential for reversal in the semiconductor index, started with this post.

From that post, the sidebar shows an initial short, labeled as: SOXX-25-01.

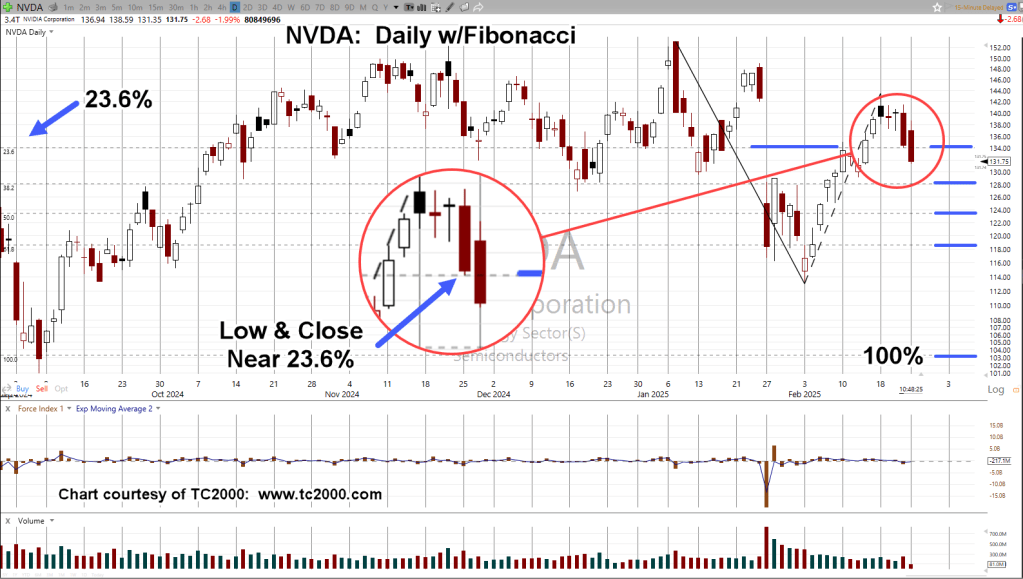

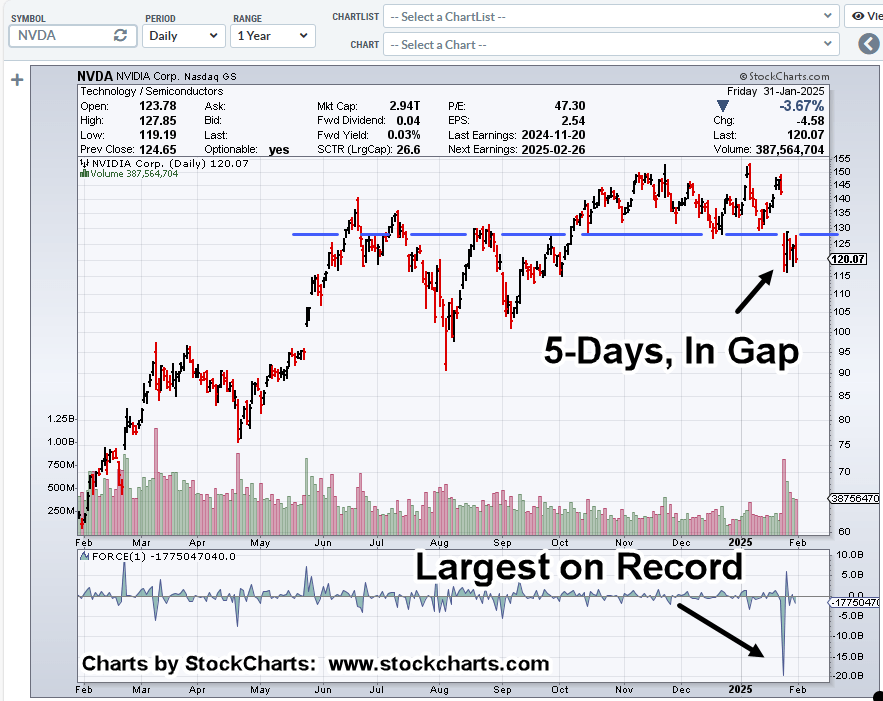

Moving on to this post, Nvidia was used as a proxy for the SOXX; once again, we see SOXX-25-01, in the sidebar.

The short is active, size increased by 50%, last Thursday.

Today, price action posts a new daily low, dips below resistance in 240 – 242, area, increasing probability it’s an up-thrust (reversal).

SOXX-25-01, size increased again by 30%, and we’re done.

The amount of capital planned for the position has been fully allocated.

Set The Stop, & ‘Walk’

From this point, anything can happen.

With that said, the obvious stop location for the current position, is just above today’s high (not advice, not a recommendation).

With a combined entry of 242.26, getting stopped out just above 242.13, would be at break-even.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279