Is This It?

We’ve gone form “Not Happening” to this morning’s action; ‘maybe it’s happening?’

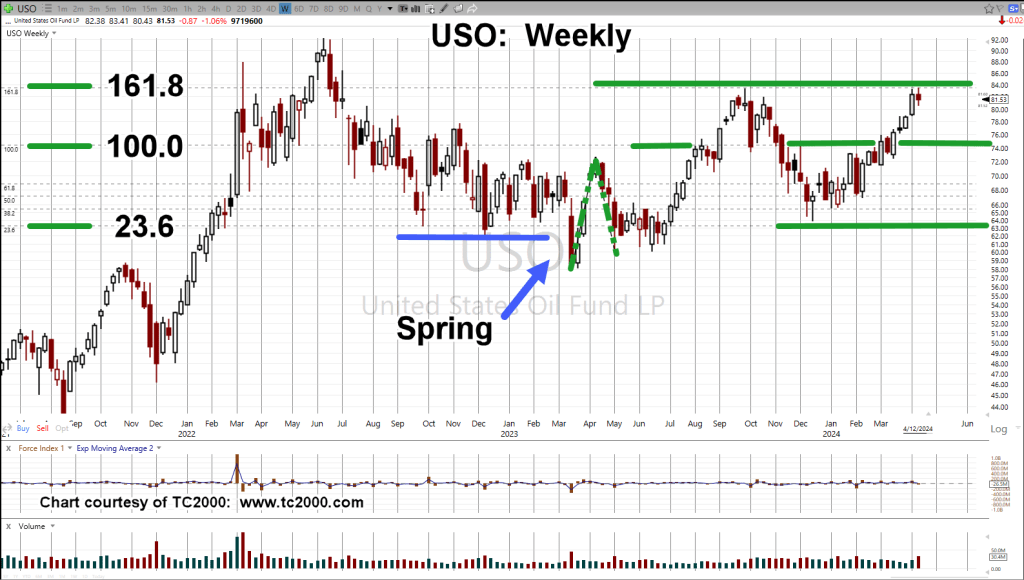

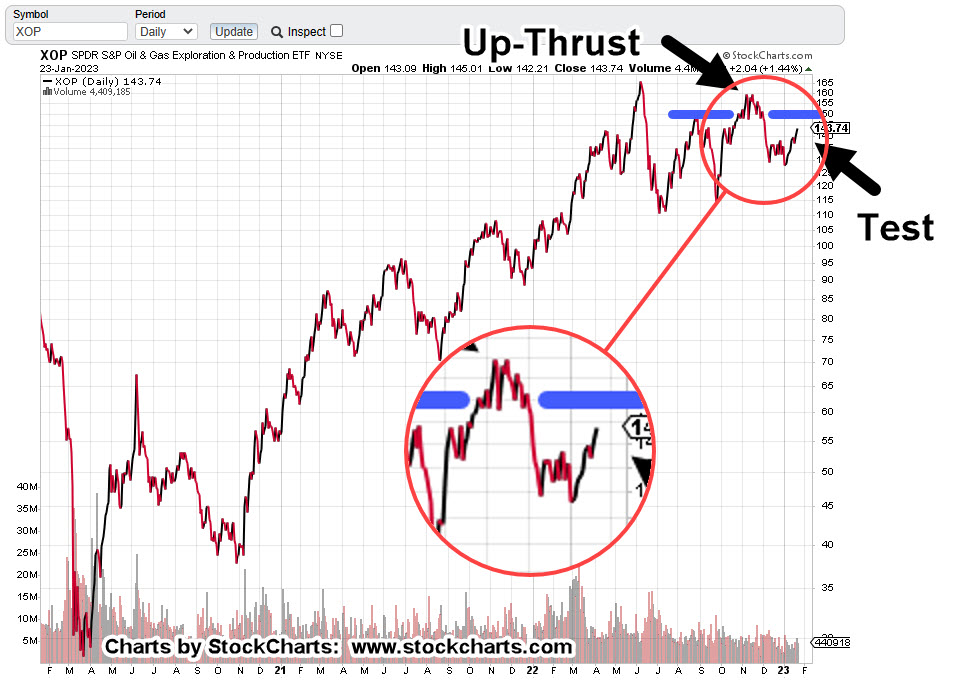

As was done with Oil & Gas exploration XOP, we’ll now take a look at the oil patch itself and proxy, USO.

Oil tracking Fund, USO, Close

“What do you see?”

Marking up the chart.

We either have the ‘tradable bounce‘, or a potential contact point for the right-side channel line (not advice, not a recommendation).

The Fed announcement is just out, essentially accommodating a rate cut in September.

There was talk of some ‘cooling’ in the market (Ya think?).

With that, demand for oil seems like it would take a hit putting it lightly (not advice, not a recommendation).

Positioning.

The market itself is telling us where to go and what to do.

The important item for the day; what is the market not doing? Specifically, the Semiconductors, SOXX.

The SOXX, has not made a new (daily) high (at least, not yet) after the Fed’s announcement; it can even be seen as the ‘proverbial gut-check’, a la David Weis.

With that, all other positions have been closed save the short in the semiconductors via inverse fund SOXS (not advice, not a recommendation).

Danger Ahead

The ‘rate cut’ has yet to happen and September is a long way away.

It can’t be re-iterated enough how dangerous is this environment; prices stretched via a narrative that’s false (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279