Let The Lawsuits Begin

Let’s see …

We already have lawsuits for ‘The Speck’, injury and death.

Then we have the lawsuits because the stock price went down (always happens).

Now, we’ll have lawsuits for paying too much over asking price, because my real estate agent told me to.

Couple that with grocery store shelves going empty, power outages, fake wars (with real consequences), more corporate layoffs and voila!

The court case for any of the above, might be heard before 2030 … if you’re lucky, not homeless and we’re all still alive.

Was That, The Bounce ?

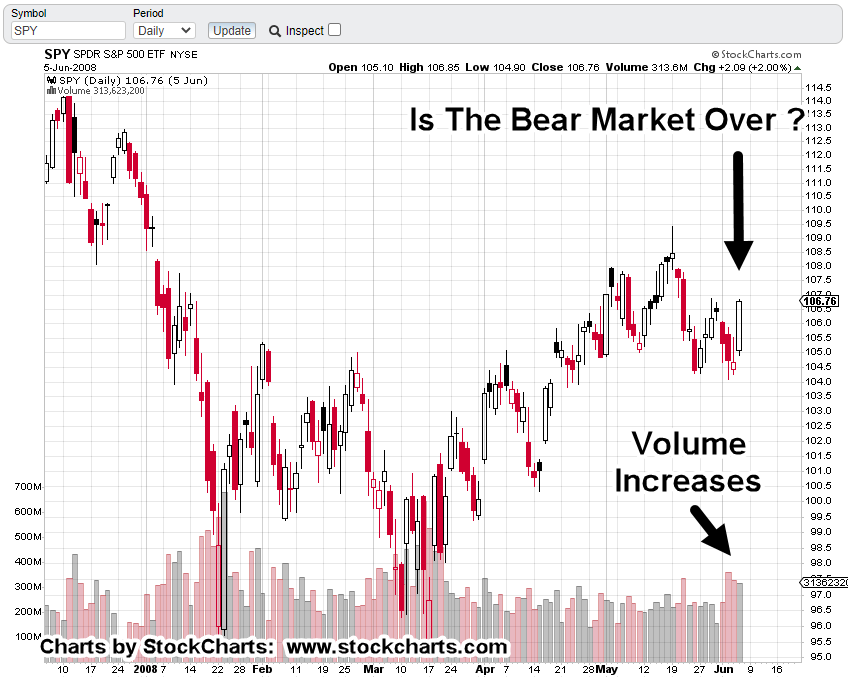

Yesterday, Wednesday was supposed to be the last chance for the bulls. The release of the CPI, being touted as a potential upward ‘catalyst’ for an already oversold market.

We even had helpful advice like this, saying ‘it’s so bearish, it’s bullish’.

Buried within that article was the caveat, extreme negative sentiment contrary indicators, only work in bull markets.

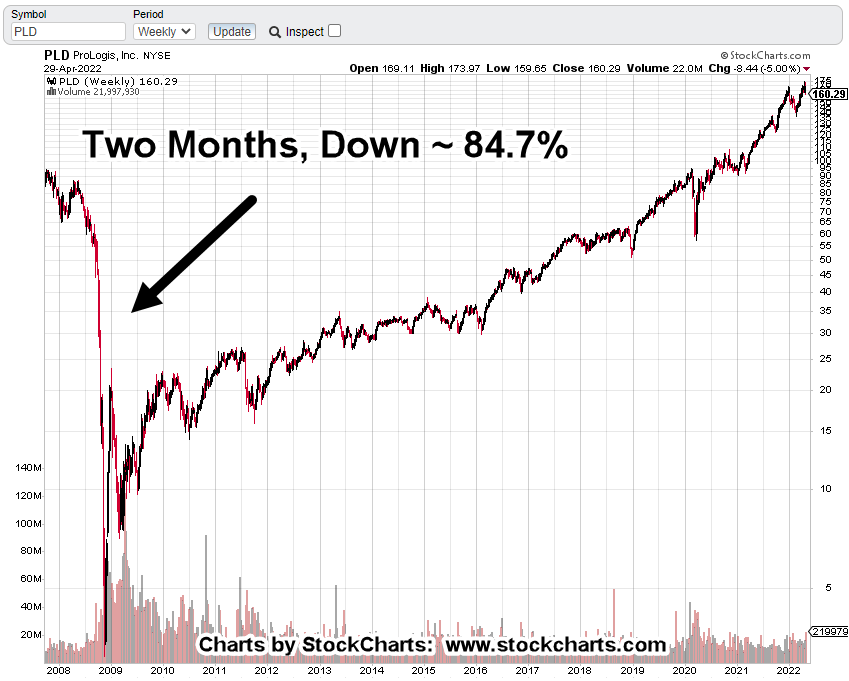

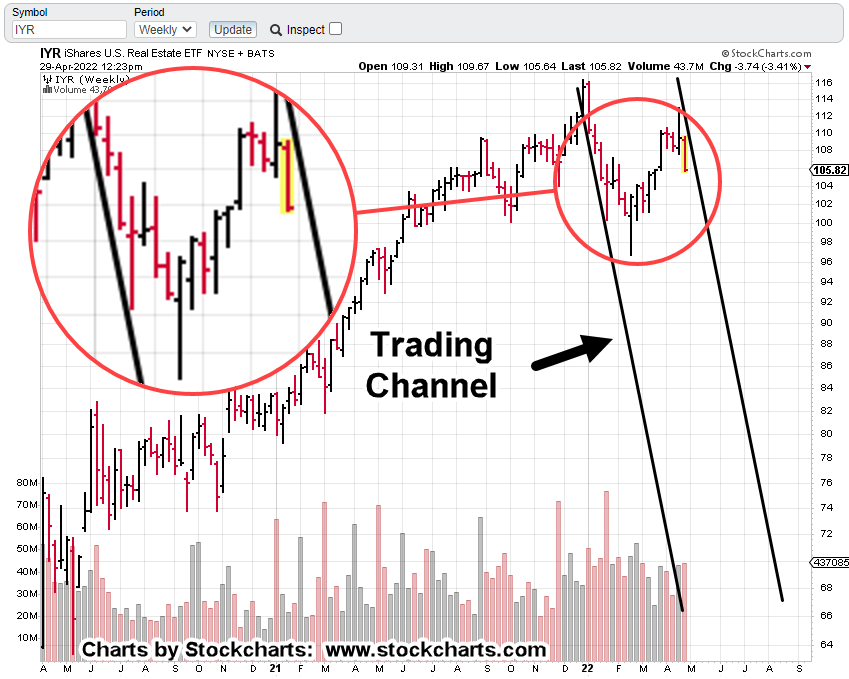

We’re not only in a bear market, it’s a full-blown collapse (so far). We’re on track for vaporization; all of which leads us to the market at hand: Real estate.

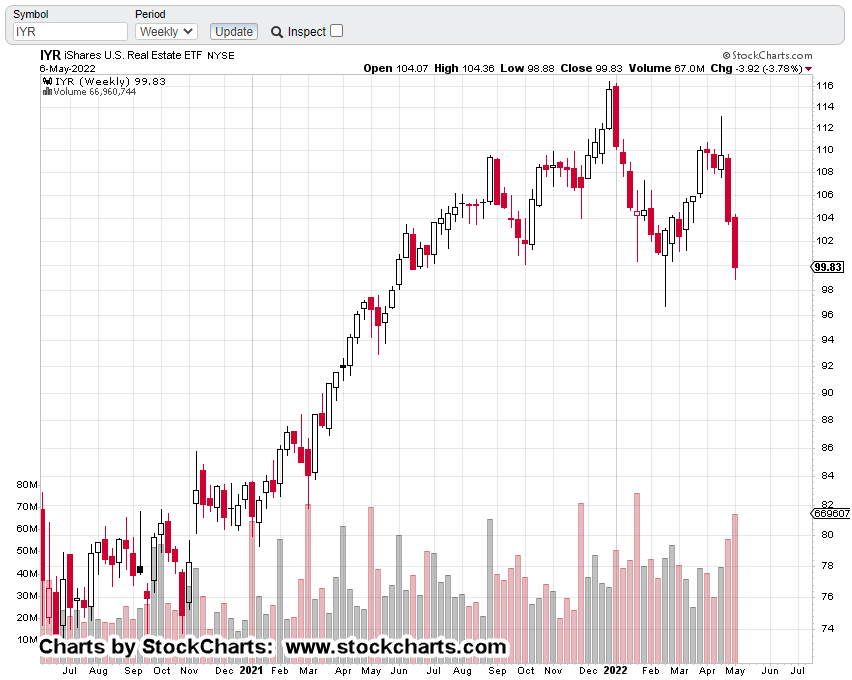

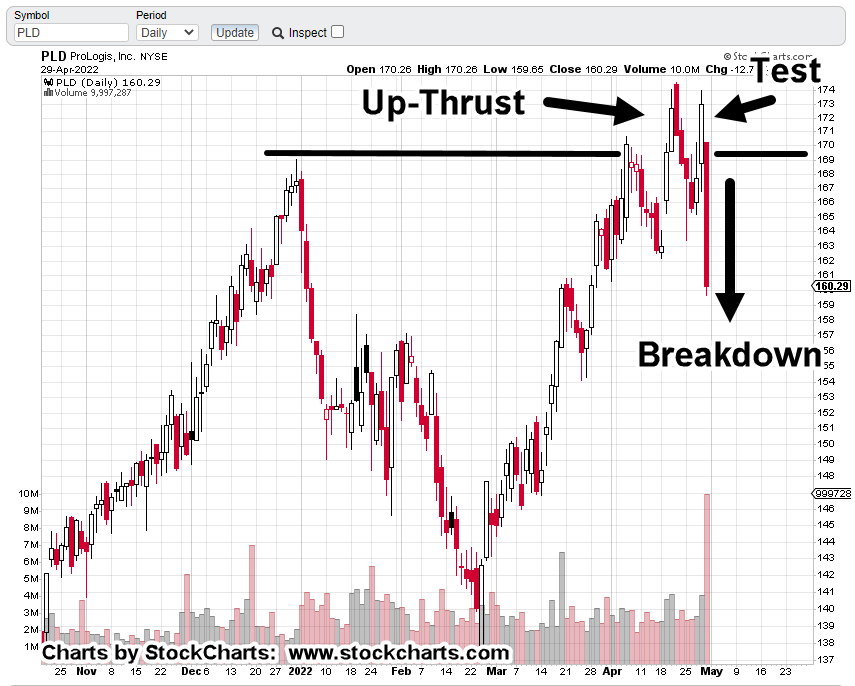

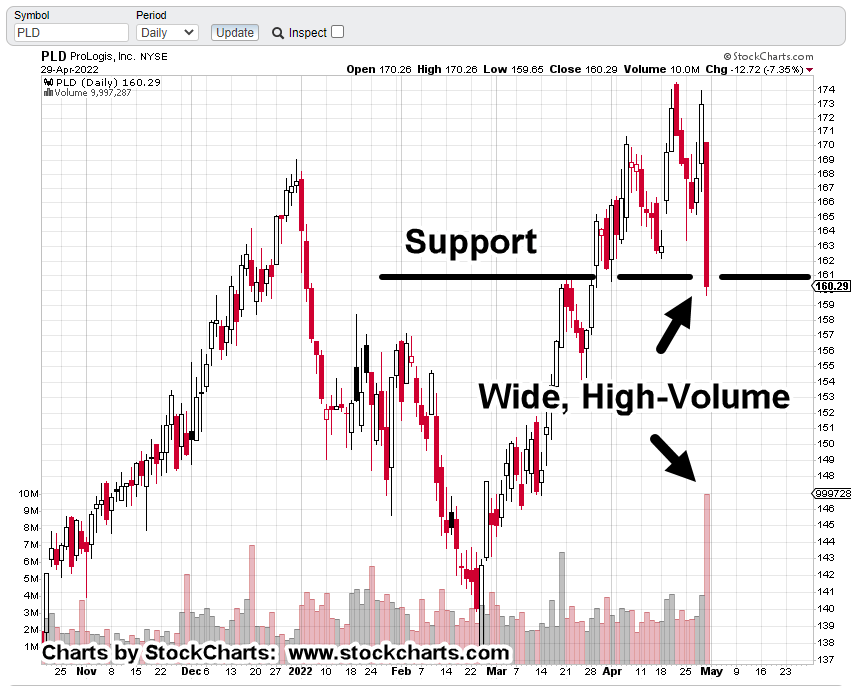

Real Estate, IYR, Daily Chart

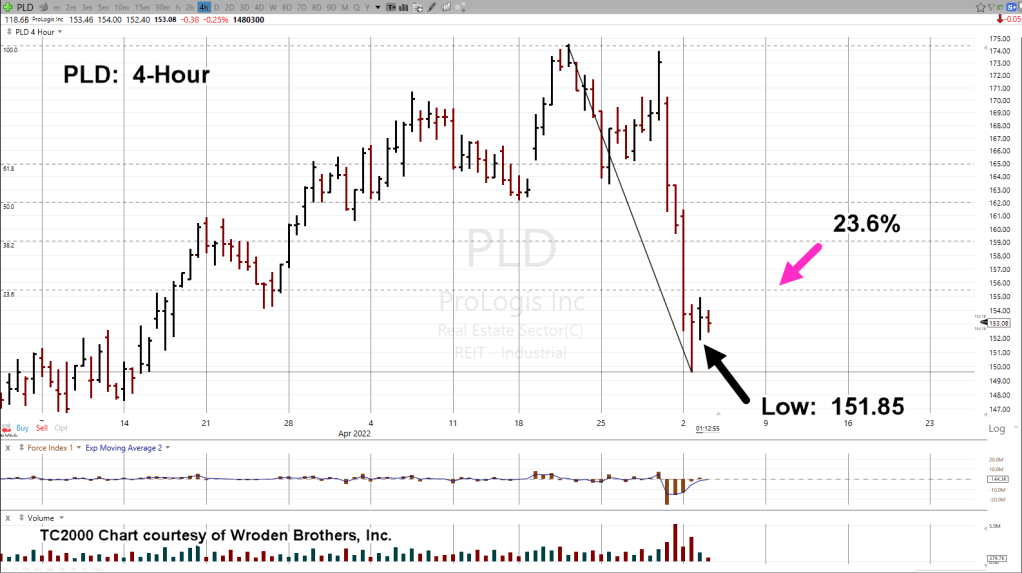

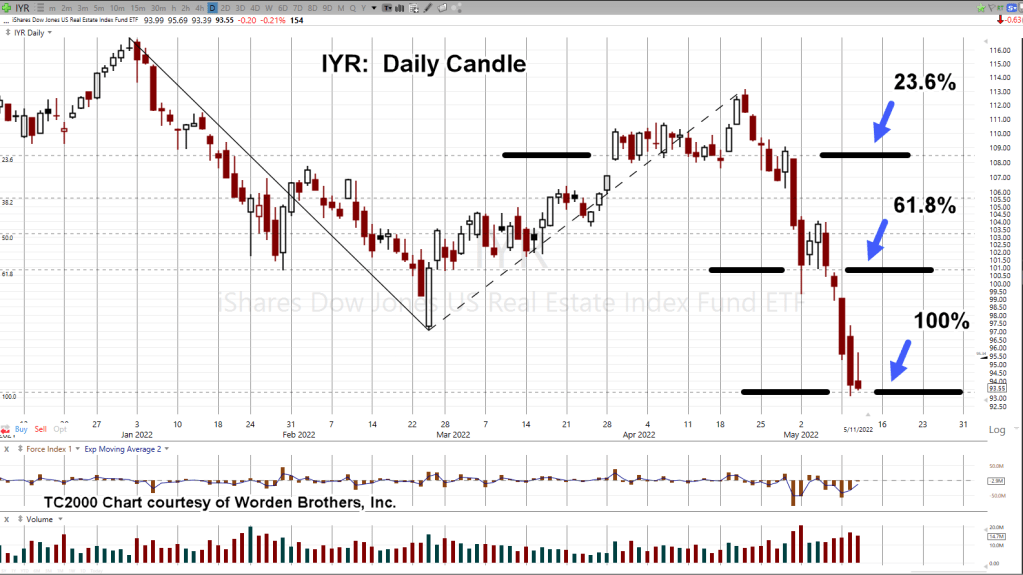

The following chart contains a Fibonacci projection tool, showing levels from 23.6% to 100%.

Lower values such as 161.8%, are currently, off the screen.

It’s obvious, the market’s ‘respecting’ these levels as it hesitates (to confirm) before continuing lower.

However, the real story is on the hourly chart below.

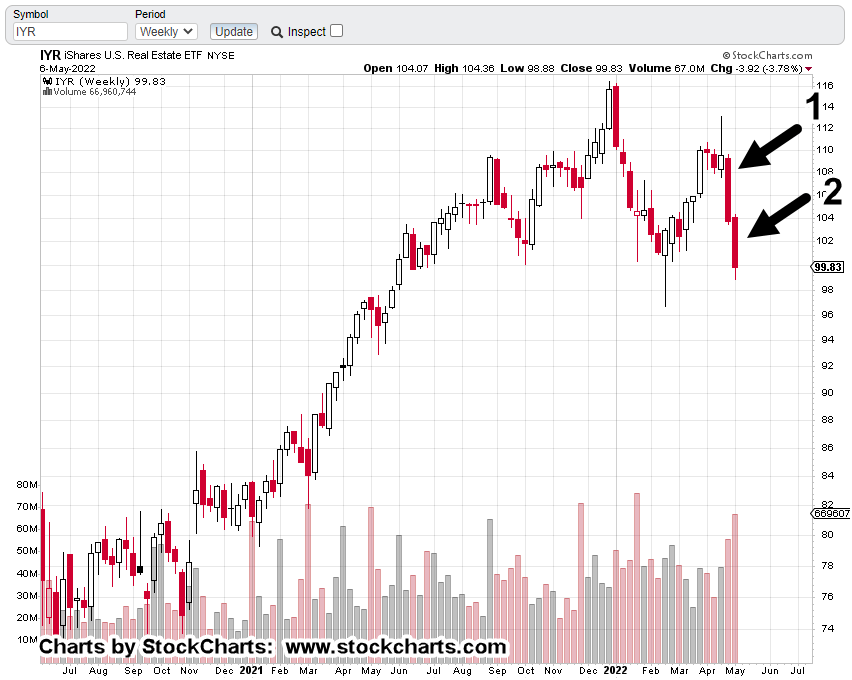

Yesterday’s bounce is shown as well as a trendline.

The scary part, or good part depending on one’s perspective, that trendline’s declining at approximately 99%, annualized … effectively straight-down.

E.F. Hutton, Vice Chairman, Loeb

The late Chairman of E.F. Hutton said in his book ‘The Battle For Investment Survival’:

‘Real opportunities are rare. When you find one, it must be used to its fullest extent’.

This site adheres to tenets laid out by three masters: Livermore, Wyckoff and Loeb:

Strategy, Tactics, and Focus.

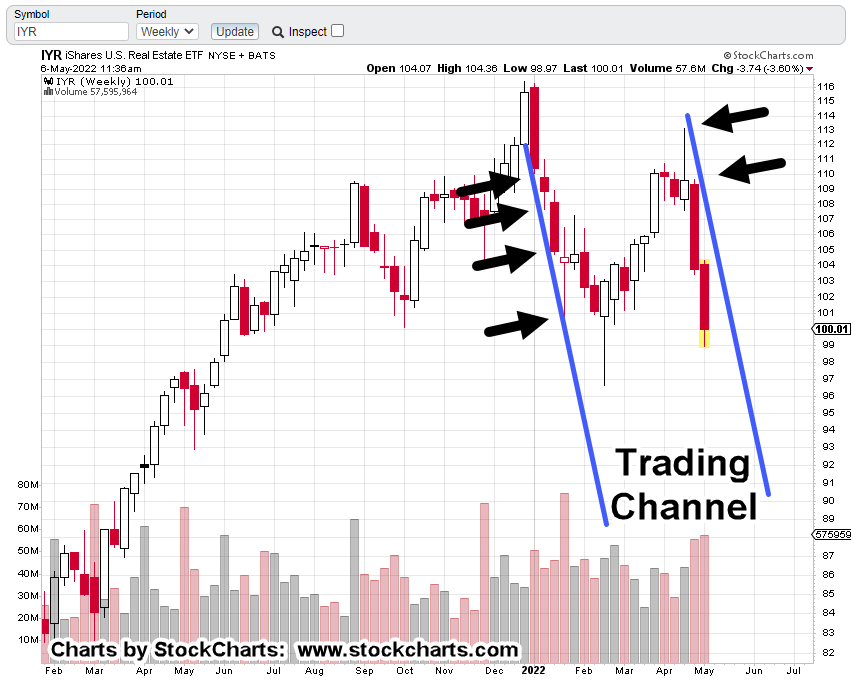

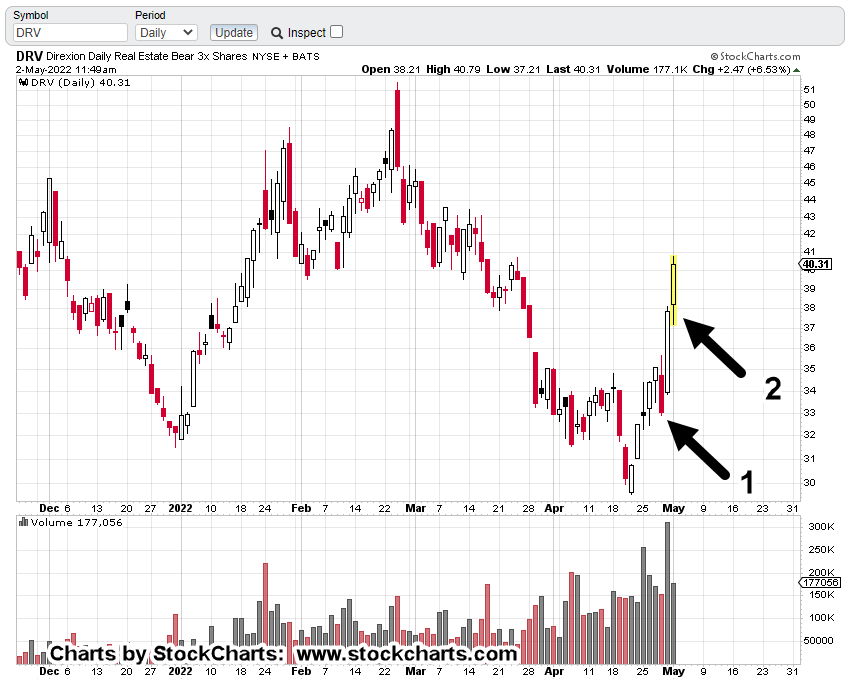

Shorting IYR via DRV (DRV-22-02) is our approach to what looks to be a significant opportunity (not advice, not a recommendation).

Summary

As long as IYR, price action continues to follow the trend lower, we’ll maintain short.

Anything can happen and the trend be violated … even at the next session about to start in 20-minutes.

However, at this juncture, probabilities for IYR, continue to point down.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279