11:43 a.m., EST

When the break comes … it’s not coming back

Nearly 100-years ago, Wyckoff, stated:

‘If you can’t completely ignore the news and the financial press, you will never be successful in the markets’ (emphasis added).

In line with that, we have this: The very first sentence from this article out of barchart is questionable to say the least.

First:

There is no rapid ‘re-opening’. There never was. There is no ‘pent up’ demand.

Massive credit card usage shows the U.S. consumer has been decimated; using credit just to survive.

It should be (but somehow for some, it’s not) obvious we’re in a controlled demolition of the economy (including the food supply) on a world-wide scale.

Second:

Price increases are the result of supply chain (also, controlled demolition) shutdown not inflation.

Uneducated Economist has probably done the best job of ‘boots on the ground’ work to completely dispel the inflation false narrative.

He called the current and now waning lumber price spike two years ago. That’s how you know who to trust or believe. Take a look at their past analysis and see how it ‘aged’.

Third:

The U.S. population collectively, has never experienced real hardship. Those who made it through the Great Depression have all but died off.

There is no one around to give said population a swift kick in the pants and tell them to ‘suck it up’.

Northman Trader

Sven Henrich has come out with an excellent market update, linked here.

Towards the end of his analysis he states; ‘when the break comes, it will be quick, deep, keep going and most (if not nearly all) will be psychologically unprepared.’

Which brings us to biotech.

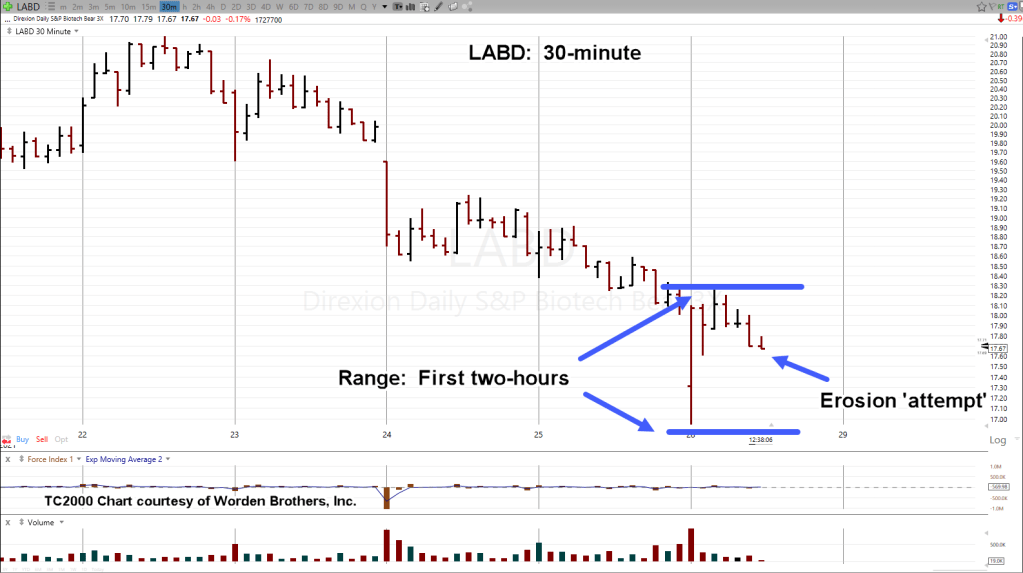

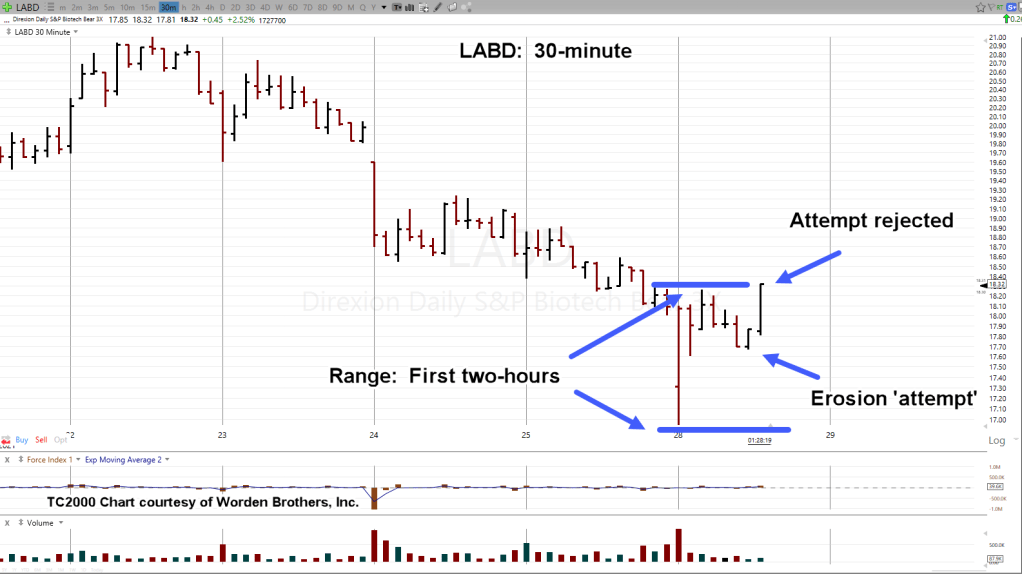

LABD Analysis:

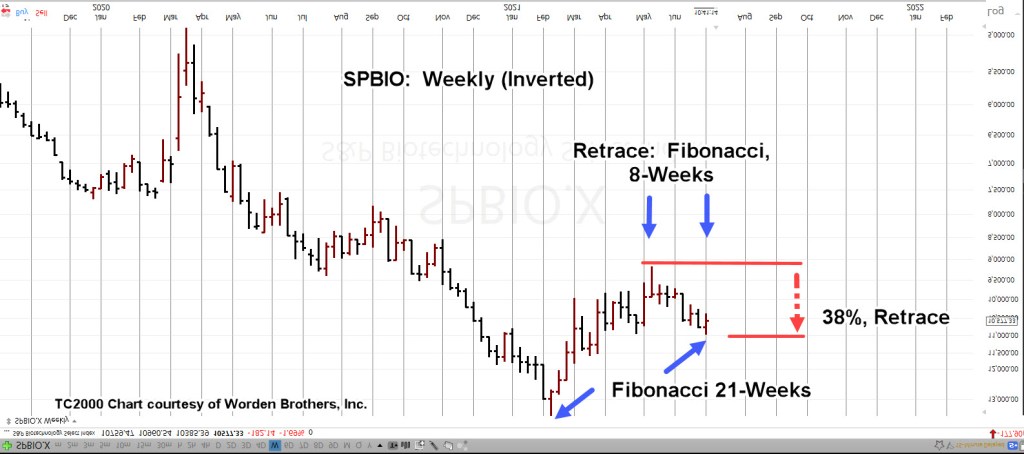

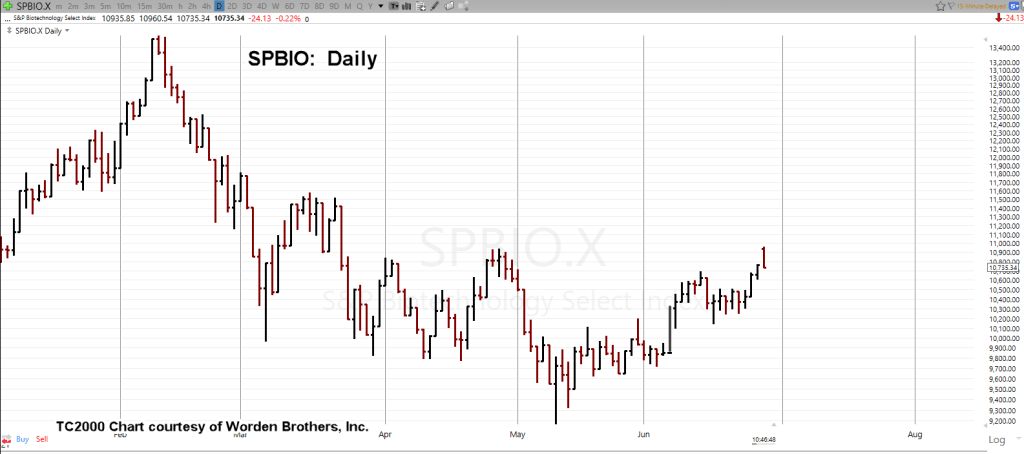

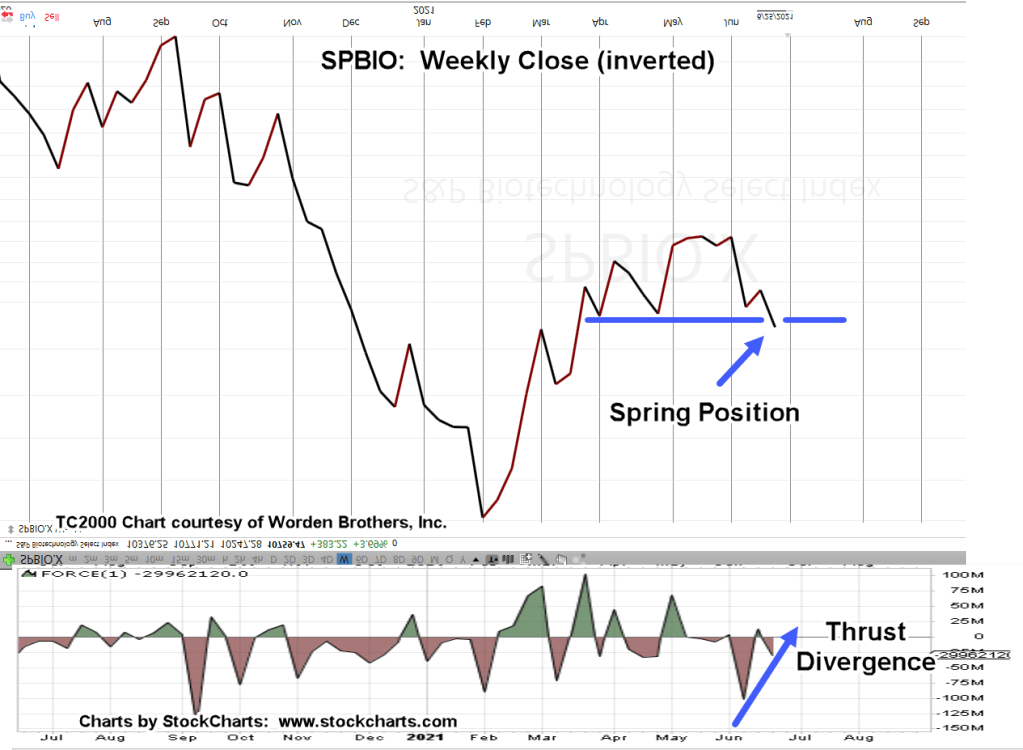

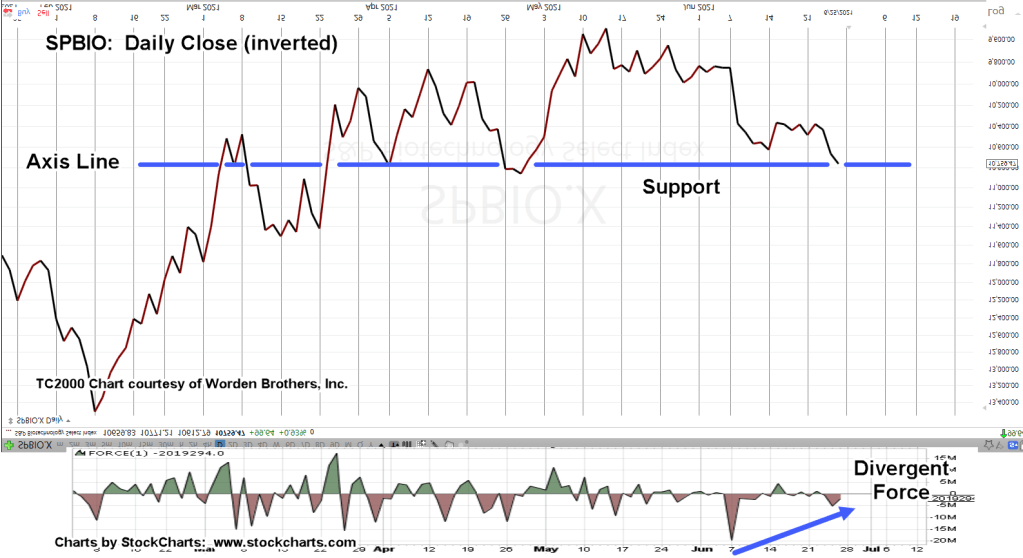

Biotech SPBIO, is back as downside leader: Down just over -25%, from its highs in February, this year.

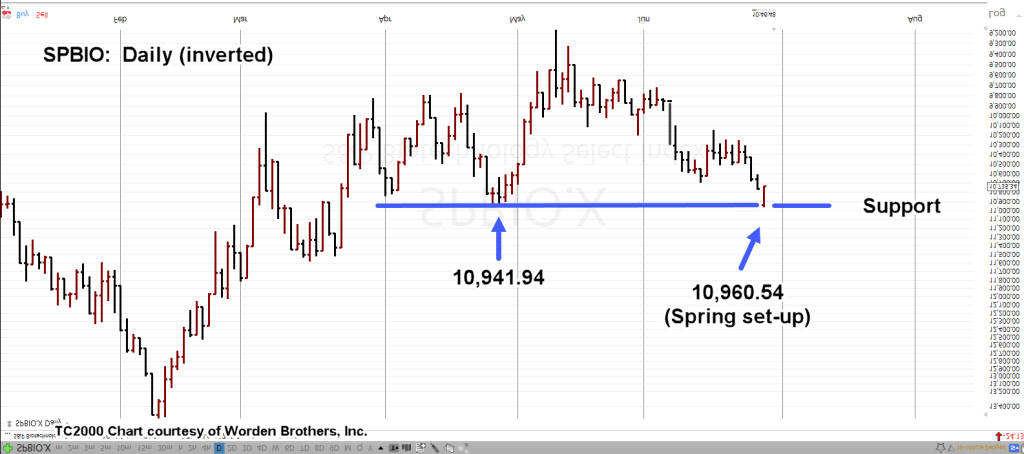

The daily chart of (inverse fund) LABD is below. The market itself is showing us it wants to follow the repeating pattern of trendlines (not advice, not a recommendation).

If the entire structure (from the February low) is actually a trading channel, it’s hard not to overuse the word ‘massive’.

Non Confirmation:

As of this post, the Dow, the S&P and the Composite are unchanged to slightly higher. Yet biotech SPBIO, is down -1.2%.

We won’t know until it’s all over … but it looks like biotech could somehow be the catalyst (along with the dollar and gold?) that precipitates the final reversal in the overall market.

Stay Tuned

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.