Can It Get Any More Stupid?

It’s been a while since rounding up The Usual Suspects.

However, like last time, the stupidity, misdirection, misinformation, outright falsehoods, overall grift and schtick, has got to the point where an update is needed.

We’ll start off by repeating No. 1 from the prior ‘suspects’ as it encompasses the whole genre of ‘non-thought’ by the public and financial press alike; readers of this post excepted, of course. 🙂

No 1. There (still) is no Fed Pivot. Seriously, have rates really, actually been lowered? Everyone has a huge case of ‘normalcy bias’. i.e., what the Fed did last time will happen this time.

The 40-year bond bull market from the ’80s, ended in 2020. We’re in a different paradigm now.

We’ll add in this updated post, James Grant, of Grant’s Interest Rate Observer.

He second’s the motion: The 40-year bond bull market, is over. Period.

No 2. It has always been about the food supply.

Food is boring and gets no ‘clicks’ on my grifting ‘silver, gold stacking’ website or YouTube, so I ignore it.

After all, my business, is to get more business.

Just a reminder, if anyone really wants (inedible) gold or silver (cheap), this might be a way to get it.

No 3. The market has ‘thinned out’ to an incredible degree.

Now, instead of The Mag 7, there are only three and one of them, is a washed-up gaming stock.

How apropos, when considering the opening paragraphs about the overall public and financial press.

No 4. Is Artificial Intelligence just another lie?

Looks like according to this, it can’t be trusted. Who could have guessed?

I’m shocked! Shocked!

No 5. Ruh-Roh Scooby, fake meat’s bad for your health.

Didn’t see that one coming.

No 6. Well, there could be a new ‘scarient‘ in the works.

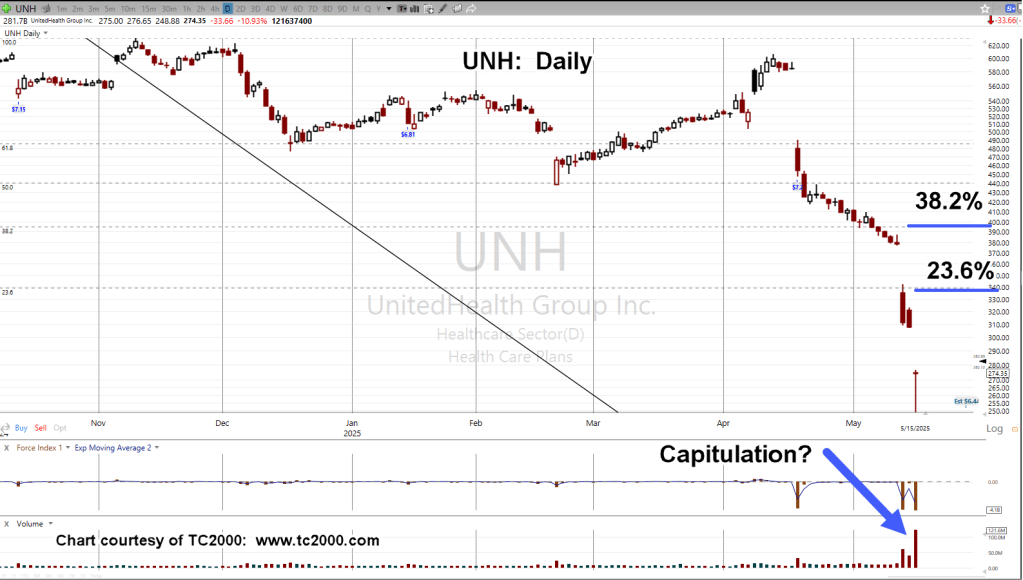

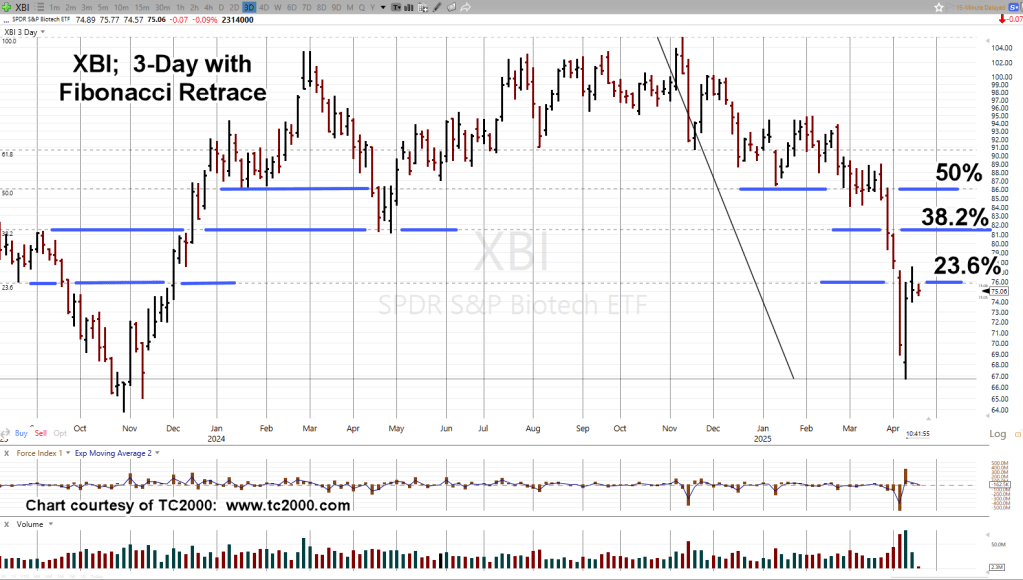

However, looking at price action of the biotech sector, far below its all-time highs, the market itself, is saying ‘No, not this time.’

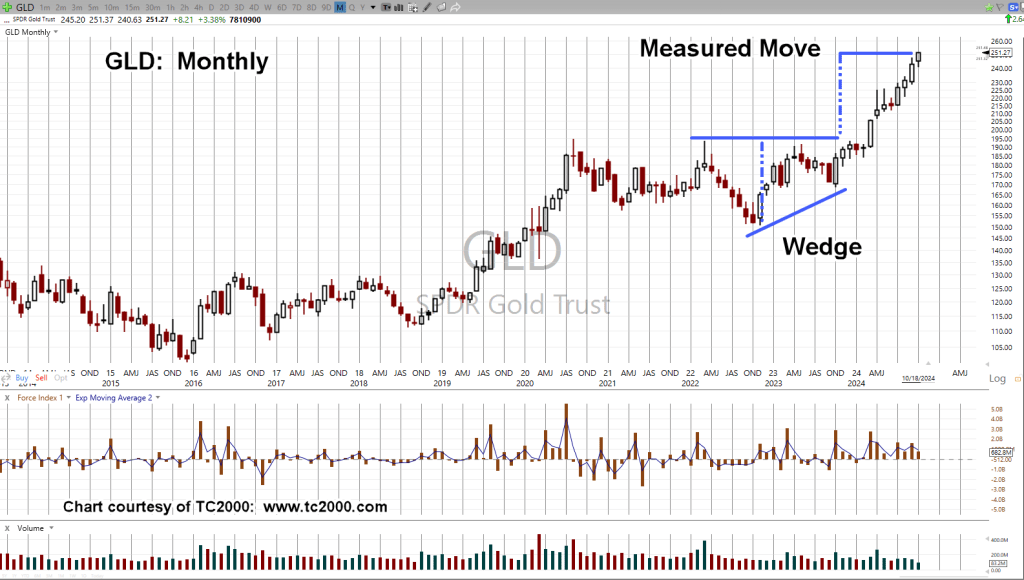

No 7. Could the S&P make it to 6,300?

After all, it’s all about the numbers, right?

The S&P bottomed at 666.67 on 3/9/09.

Summary

If there ever was a time as Wyckoff said, to ‘completely ignore the financial press’, this may be that time.

He also stated, ‘reading price action is hard, taking literally decades and many losses to master’, a skill which is never really complete.

As the ‘About‘ section states, this site is one leader’s perspective on that action; presenting it, in a strategically cognizant form.

As far as is known, no other site is doing the same.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279