‘Ending Moves’

Back in the day, Jesse Livermore nearly went bust attempting to short the downside of what became, The Panic of 1907.

Stopped out time and again, he finally (according to Wyckoff) hawked his car to rase capital.

Form nearly broke, to closing out short trades on October 24th 1907, net profit over $1-milllion.

With that, we have a strategic picture, in focus.

During a recent interview, Ed Dowd discussed the +35.95% gap (and close) on Oracle, as a result of ‘projections‘.

The take-away (from him) was these types of moves are ‘ending moves’, not the beginning of a new bull run.

Since then, price action has fully retraced.

ORCL, is currently down a whopping -41.6%, from its all-time highs. Hardly a bull market.

We’ve presented eBay in a similar position.

Carvana, launched itself above resistance at Friday’s close. In so doing, got itself into another wedge.

Now we have Expedia, looking eerily similar (not advice, not a recommendation).

Like eBay, we’ll start with the long term, quarterly chart.

Expedia EXPE, Quarterly

The latest earnings release pushed EXPE up, contacting the upper trendline.

A gap higher and close of +17.55%, in one day.

EXPE has since backed off the all-time high; currently down about -8.5%.

Edge of The Wedge

The following is a partial list of tickers either forming a (monthly) terminating wedge, or have broken out to the downside (not advice, not a recommendation)

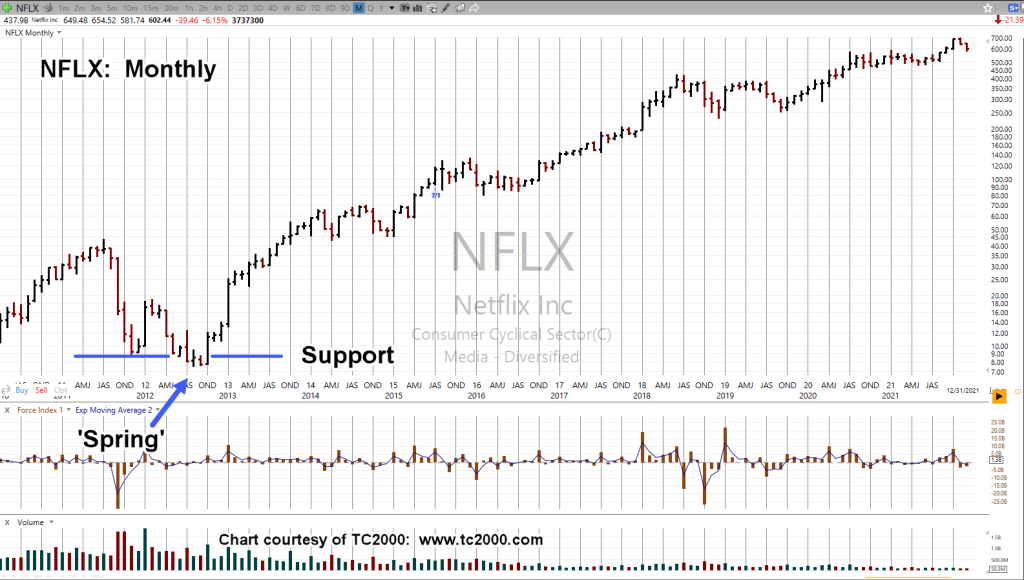

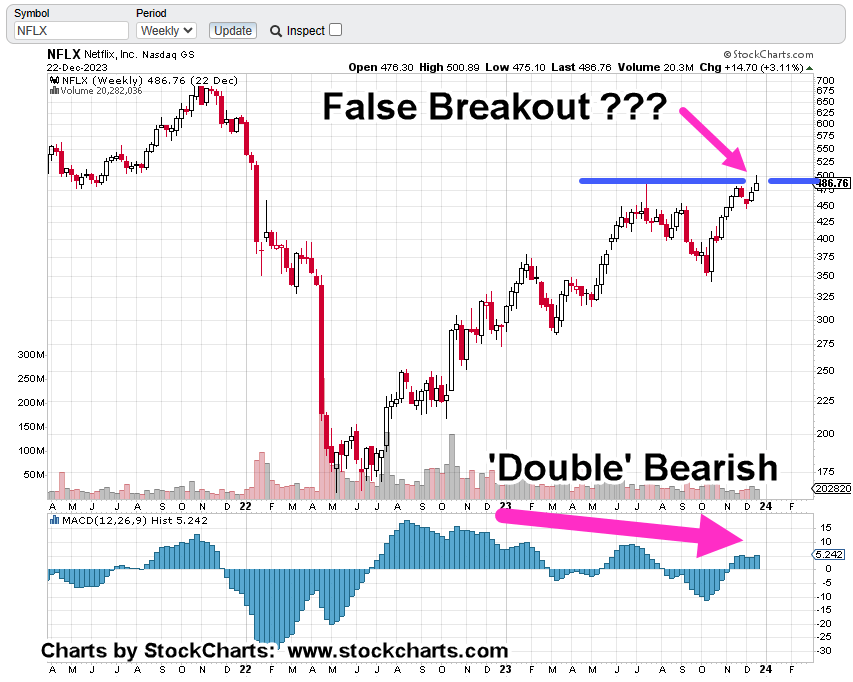

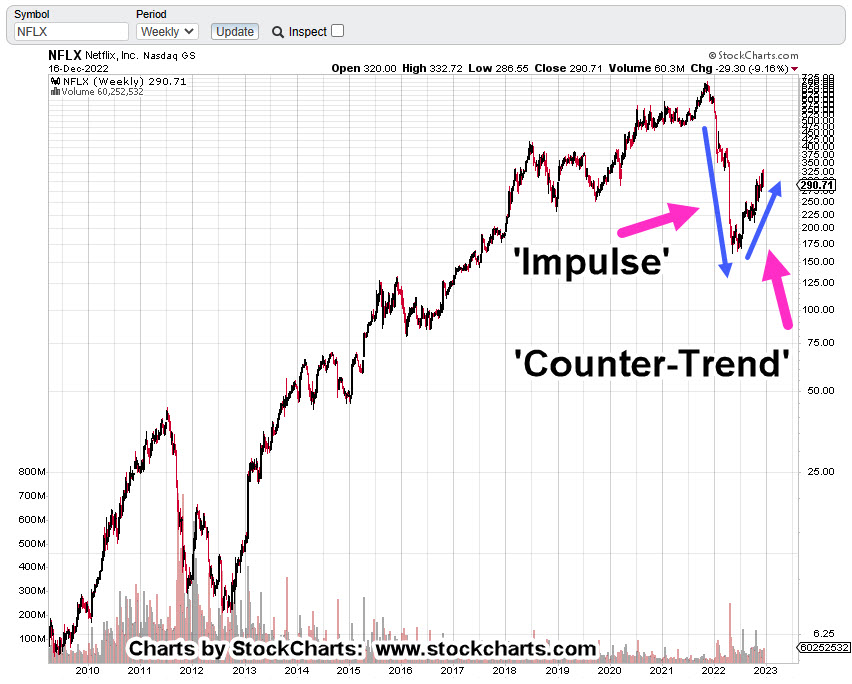

APP, CARR, CDNS, CVNA, EBAY, EXPE, NFLX, NVDA, SPOT, TEL, UBER

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279