Bonds & The Economy

Not getting much attention in the media yet, is what looks like a slow (nascent), upside reversal, of long-bonds.

Here’s an excellent description of what’s going on with the yield curve, link here.

However, there’s one potential error (depending on data used), in the link above, the job market.

Real unemployment numbers can be found here.

It says, we’re already at ‘depression era’ levels of 25% unemployment.

If anyone’s skeptical of alternate numbers, the official numbers have already been proven to be ‘in-question’.

One of the best examples of ‘official’ data, or lack thereof, is this report.

What’s a million jobs or so, between friends. 🙂

With mass layoffs starting, also, here and here, that 25% number above, is likely to increase significantly.

We can even add some anecdotal evidence, link here.

Strategy, Tactics, Focus

The price action of the market itself, is telling us where to go for opportunity.

Upside may still be there, if one wants to position in the A.I. bubble (not advice, not a recommendation).

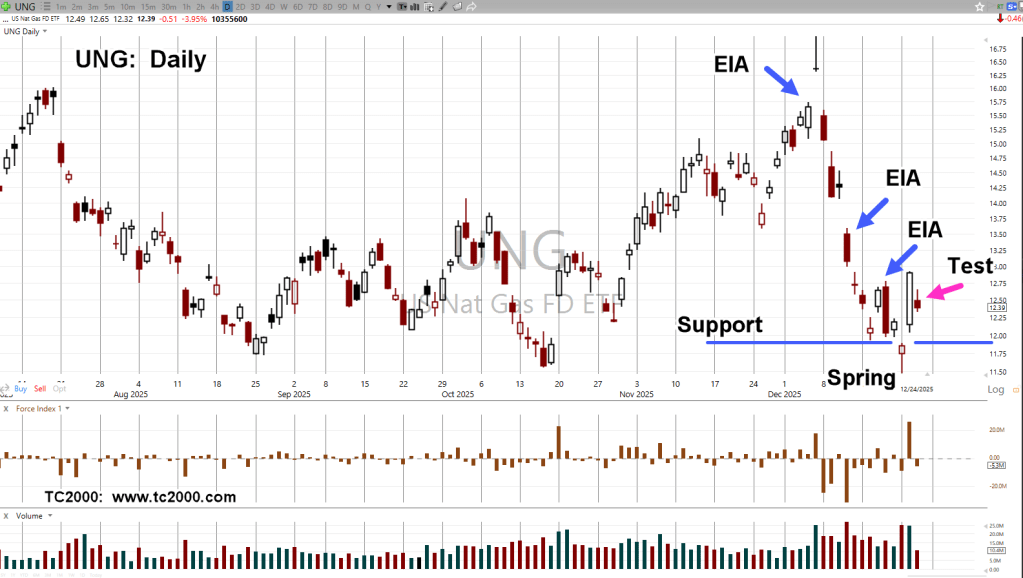

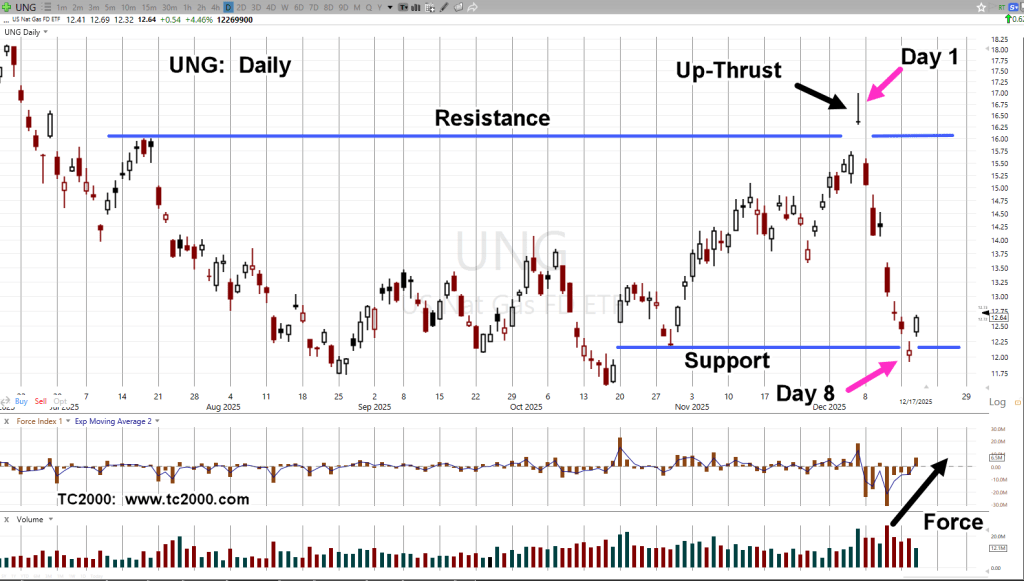

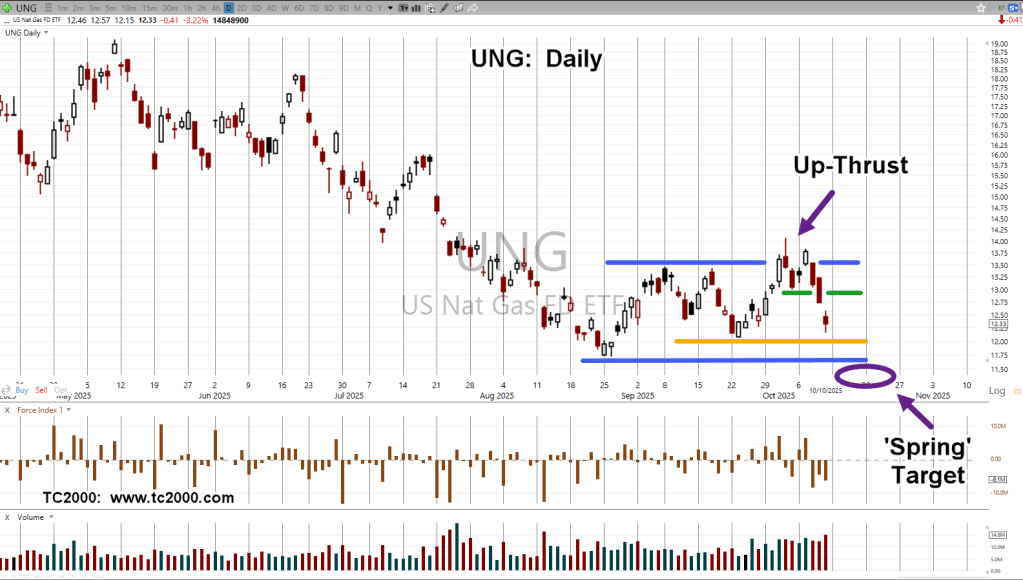

However, for over eighteen months, this site’s been profitable only positioning to the short-side (UNG, the exception) and sees no reason to join the crowd buying into the A.I. mania (not advice not a recommendation).

The current focus is on WMT, a sleeper, not-doing-much, for years, that may be about to get interesting.

Currently short as WMT-25-03, with stop at last week’s high (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279