Markets, At Critical Juncture

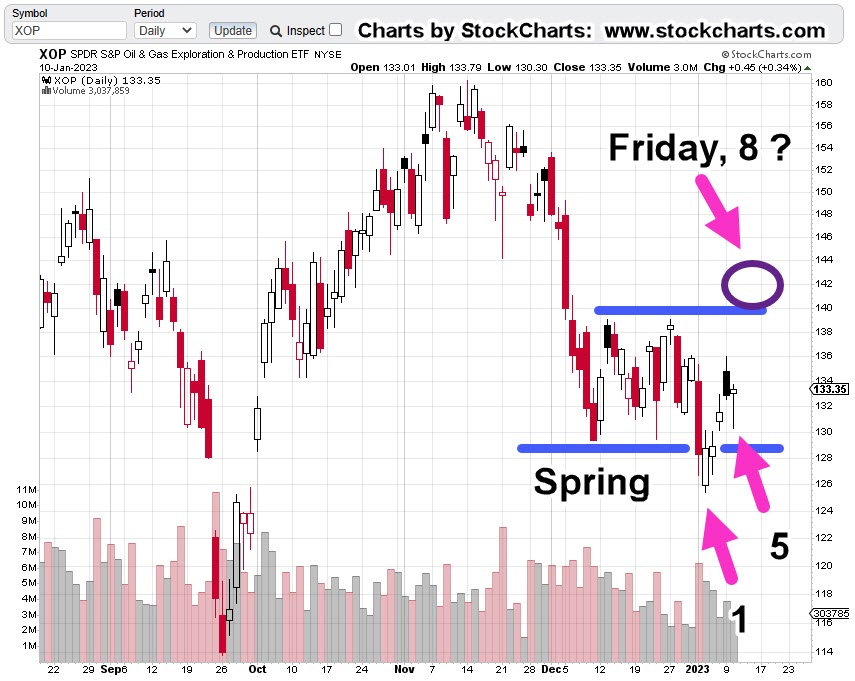

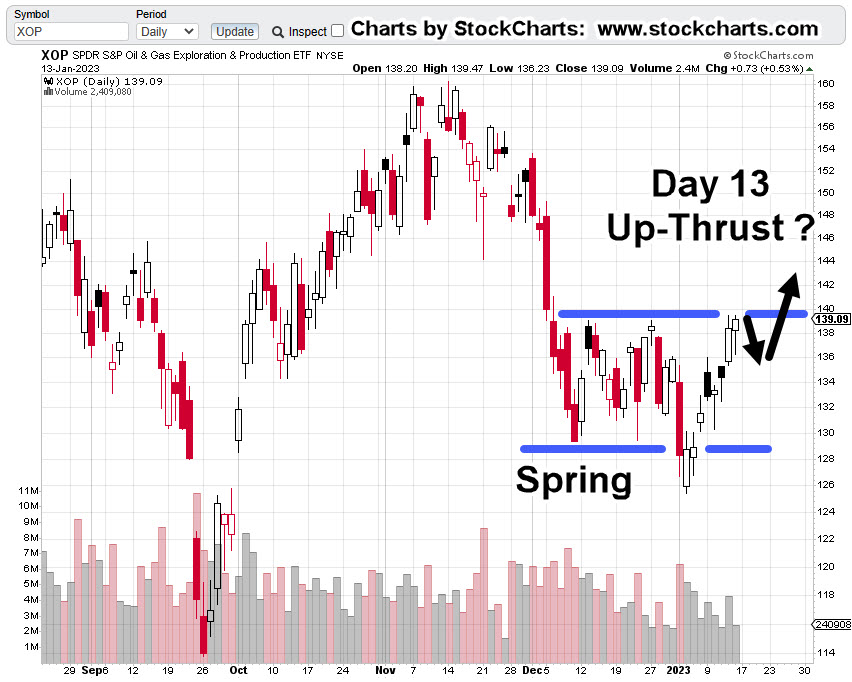

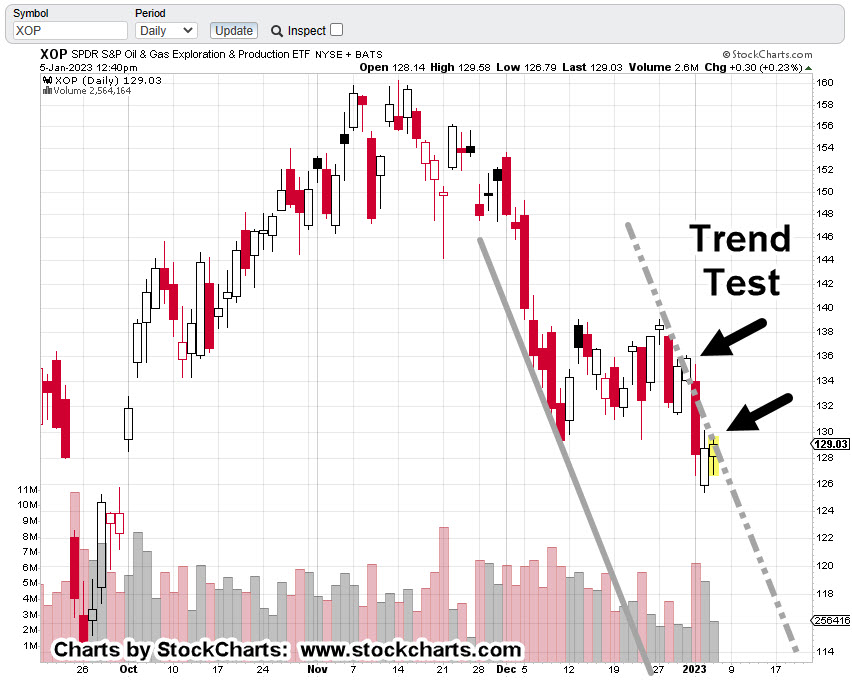

Nemont Mining (NEM), Gold, and the Oil & Gas Sector are at a critical juncture.

The rest of the major indices, Dow, S&P, QQQs, real estate (IYR), and so on, are in a similar position.

For this update, we’ll focus on Newmont (NEM), as it’s the largest cap in the Senior Mining Sector GDX, and a general representative of the commodities markets.

Financial collapse is a process, not an event.

Newmont topped-out in April, of last year. Exxon, the proxy for the Oil & Gas sector, may have reached its highs this past November.

Where’s The Inflation?

As Michael Cowan has just reported, banks are absconding with depositor’s money under the guise of ‘bail-in’.

If the fiat cash is so worthless, why are banks seizing it?

As Robert Prechter Jr., said years ago, ‘all fiat cash ultimately goes to zero’; the end game (most likely) for the dollar. However, it could be months, years, or even a decade before that happens.

For right now, today, this minute, the data is showing us, the banks want the money; ‘Show me the money‘.

With that, let’s look at the non-existent ‘inflation’ in the mining sector.

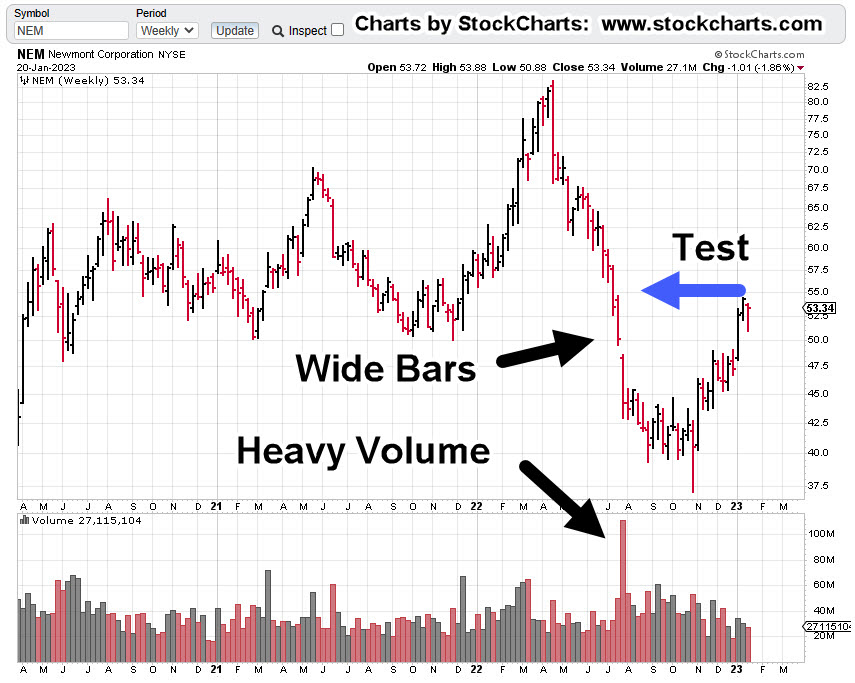

Newmont Mining NEM, Weekly

The first chart identifies the heavy volume and then test of wide price bars. This behavior is common in the markets; they tend to come back and test wide high-volume areas.

Next, we see there’s a terminating wedge developing as volume declines; the inference, is lack of significant commitment at these price levels.

We’ll get close-in on the wedge; last week printed a lower weekly low and closed lower for the week.

There’s no breakdown of the wedge … yet.

At this juncture, it’s up to the bulls to show they’re still in control.

Inflation vs. Scarcity

We have without a doubt, the effects of the event from the past three years gaining momentum. Whether or not those effects reach a peak this year, is unknown.

A lot of the mainstream and YouTuber’s alike talk about the upward move in gold as the result of ‘inflation’.

Here’s a little bit of insight you’ll not find anywhere else; how about gold rising because the above mentioned ‘effects‘ are causing production volumes to decline?

Maybe it’s because of scarcity (along with nearly everything else) that’s causing the increase in price.

Just to drive that idea home, the latest total gold production numbers, listed here.

Gold production for 2020 dropped -8.2%, from the year prior. Year 2021 was down -1%, from 2020.

From 2010 to 1019, gold production increased or was flat year over year … that is, until 2020.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279