Long Term ‘Changing of Hands’

A bearish analysis for gold?

What kind of idiot would think that gold (GLD) is going lower?

Well, for starters, it’s not what one ‘thinks’ that’s important.

Way back, when I was being mentored by the late David Weis, he never started our sessions with ‘what do you think’.

No, he always started by presenting a chart and then asking (and I quote), “What do you see?”

It was never ‘what’s the Fed doing’ or ‘what’s Cramer saying’ (that’s an easy one), or ‘what are earnings’ or any other number of useless, distracting rabbit-holes.

“What do you see?”

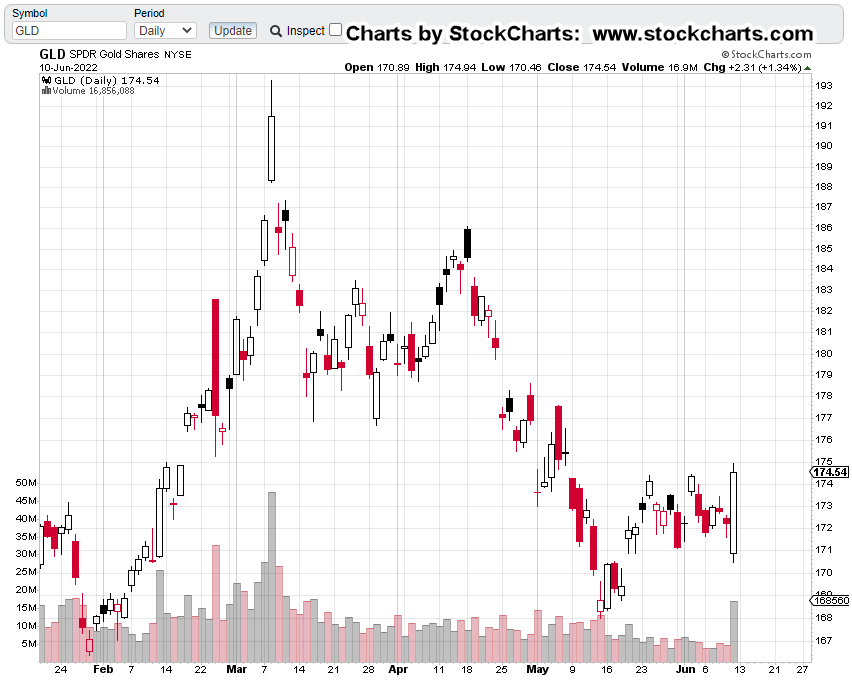

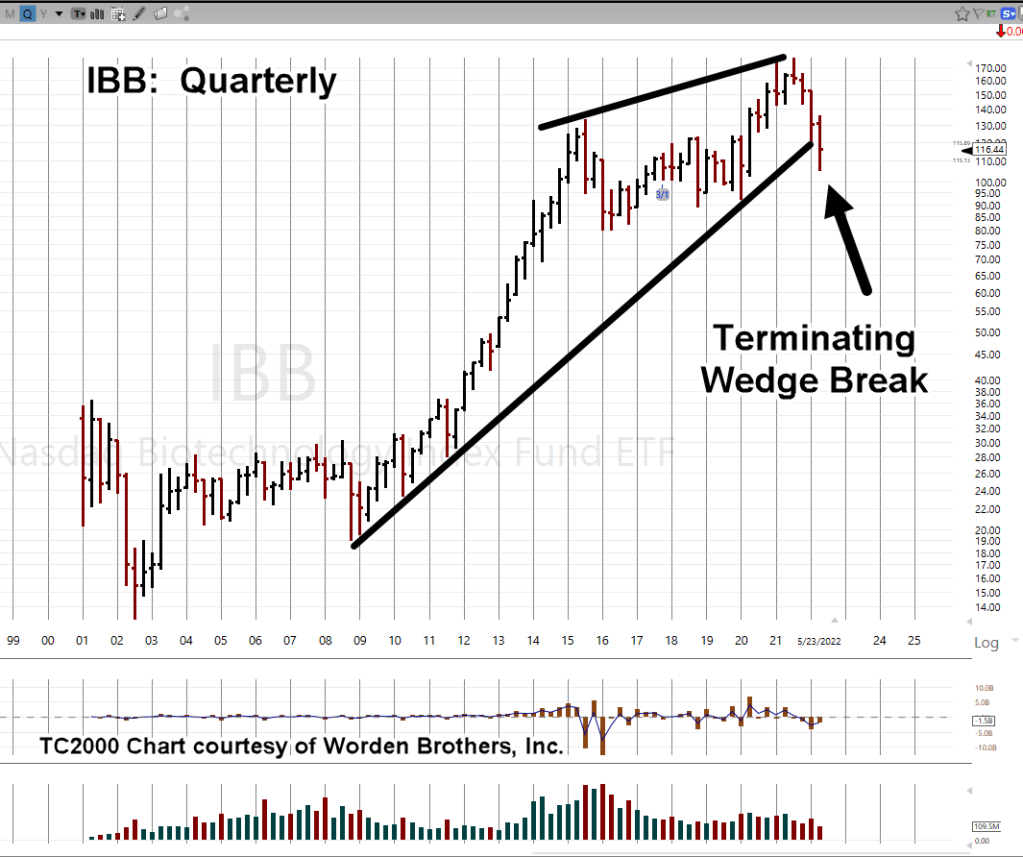

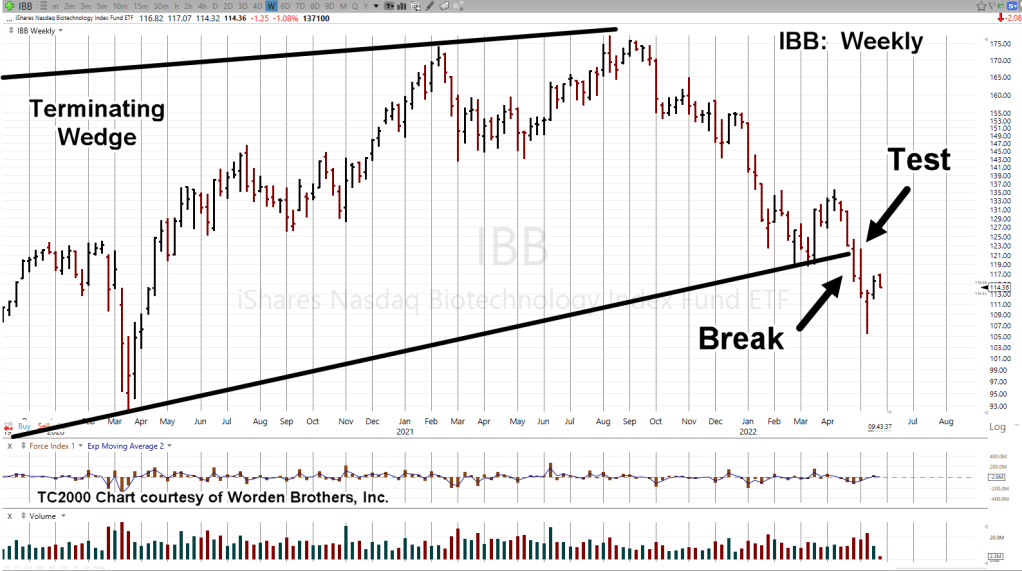

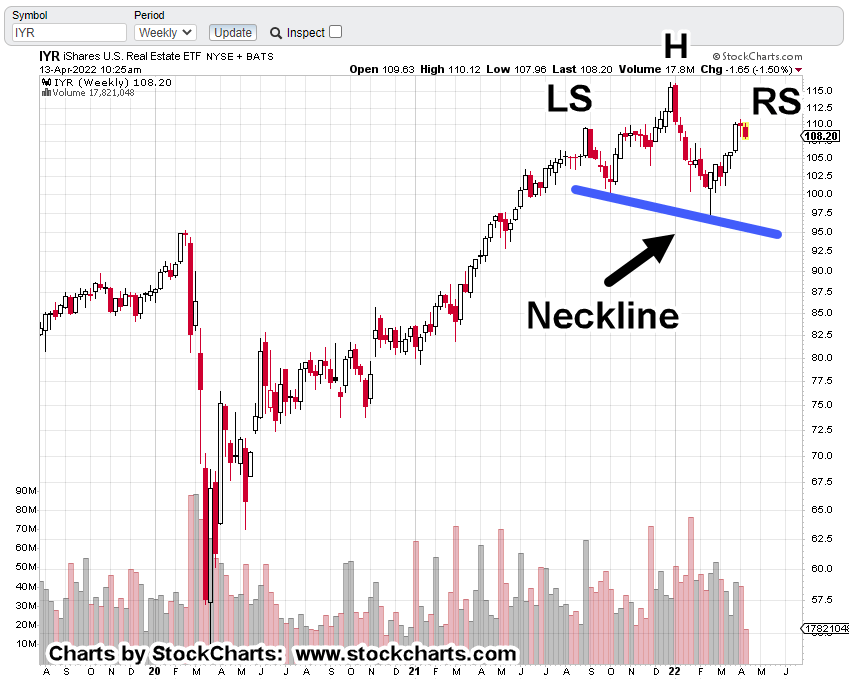

With that, we’re going to look at the long-term chart of gold (GLD) on a weekly close basis.

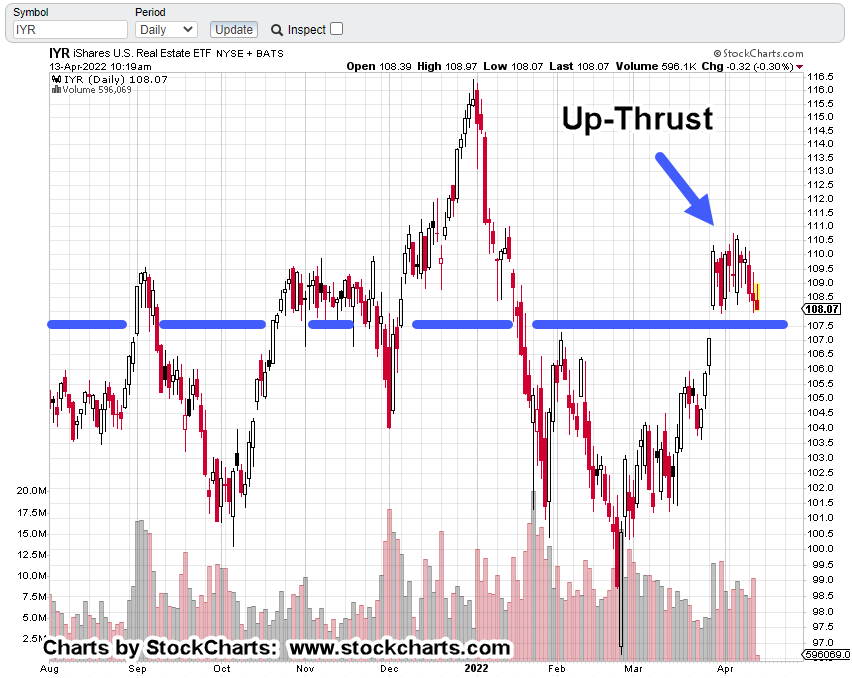

Gold (GLD) Weekly Close

With the passing days, weeks and now months, we can see there’s been a significant, potentially long-lasting reversal to the downside.

The prior report linked here, contains no fewer than seven other links to gold (GLD) that identified ‘changing of hands’ in various stages as it transpired.

Slow Motion Train-Wreck

So far, events in gold have been moving slowly and thus hypnotizing the gold bulls.

It was nearly two-years (20-months) between the Wyckoff Up-Thrust high (8/6/20), and the test of that high (3/8/22).

Enough time to put everybody to sleep.

At this point, GLD is back down near support levels … another bounce higher is not unreasonable.

However, it’s trading in a downward channel (not shown) that’s declining at approximately – 30%, annualized.

The above linked report presents long-term downside targets for GLD (not advice, not a recommendation).

The ‘Event’

As Pinball Preparedness puts it, each day that passes brings us one day closer to ‘the event’.

None of us in the proletariat know what the event will be.

It could be an excuse as disconnected as Archduke Ferdinand.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279