BEAM, TWST & FATE

It looks like having a real (positive) P/E, may be about to be important.

The prior biotech update said that so far, no P/E, negative P/E, and ‘no money down’ was not affecting the sector.

That is, until now.

Well, ok. I made up the ‘no money down’, part. 🙂

That little jest does not take away from the fact, biotech SPBIO, and its top three weightings, BEAM, TWST and FATE, have all reversed, decisively to the downside.

For the week just ended, BEAM is down – 22.86%, TWST down – 19.18%, and FATE down – 14.16%.

Back at the ranch in the IBB index, Moderna (MRNA) is also down – 14.65% for the week.

So, we have confirmation the entire industry is now continuing its downward course.

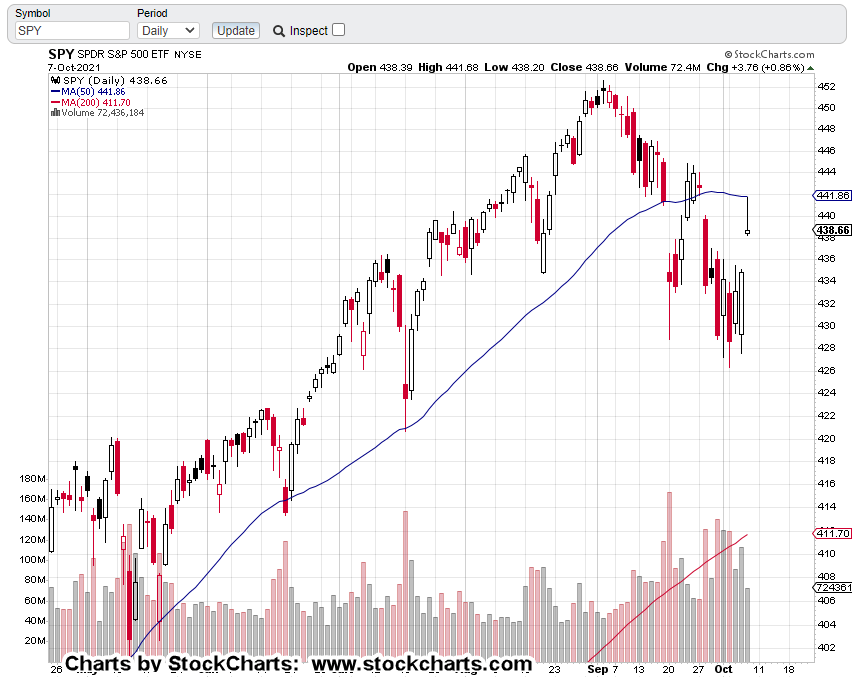

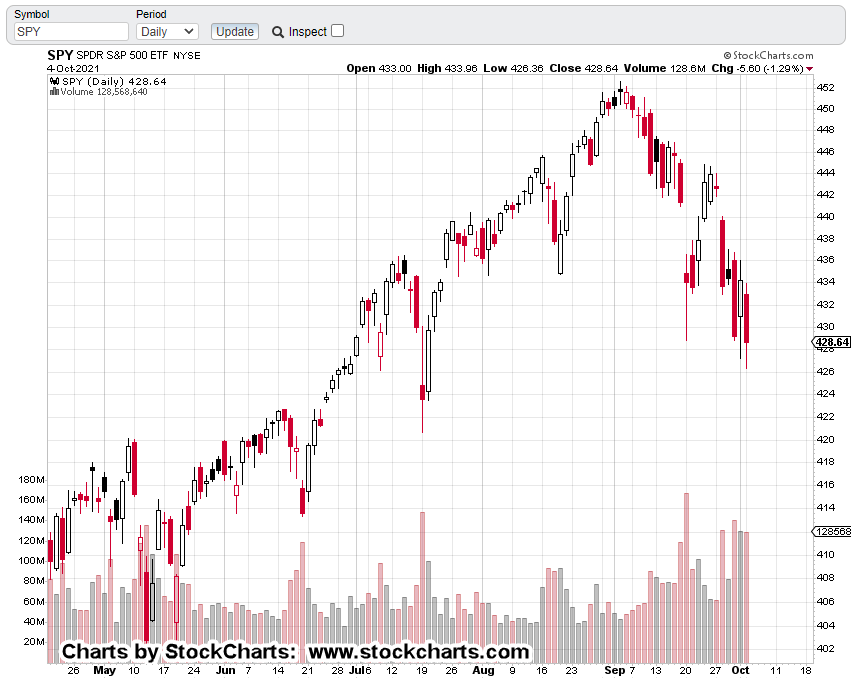

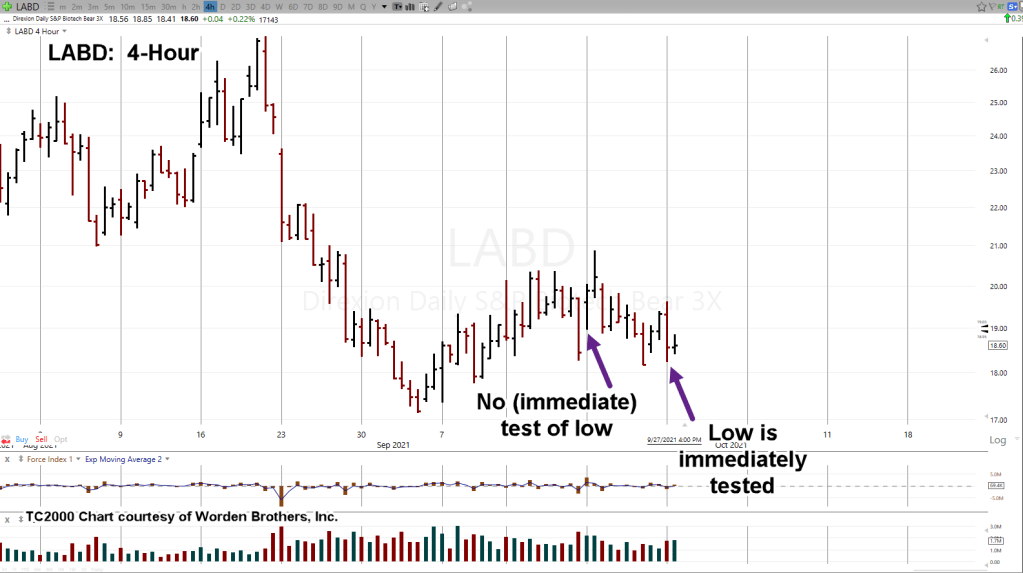

Contrast the reversal of index SPBIO, at – 7.04%, with S&P (SPY) at – 1.16%, and the market itself is telling us where to go for opportunity (not advice, not a recommendation).

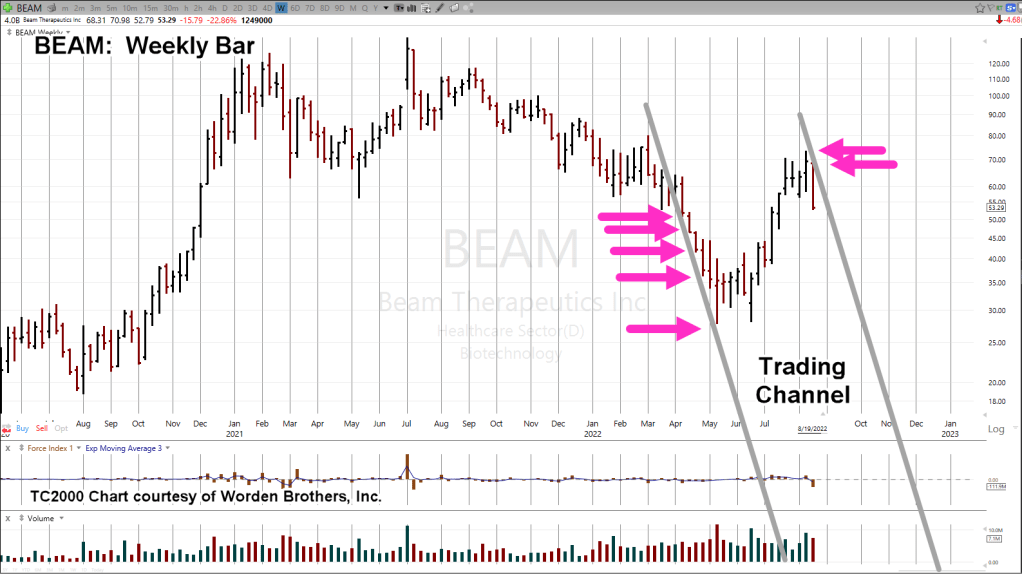

At this point, all three amigos (BEAM, TWST, FATE) are in downward trading channels.

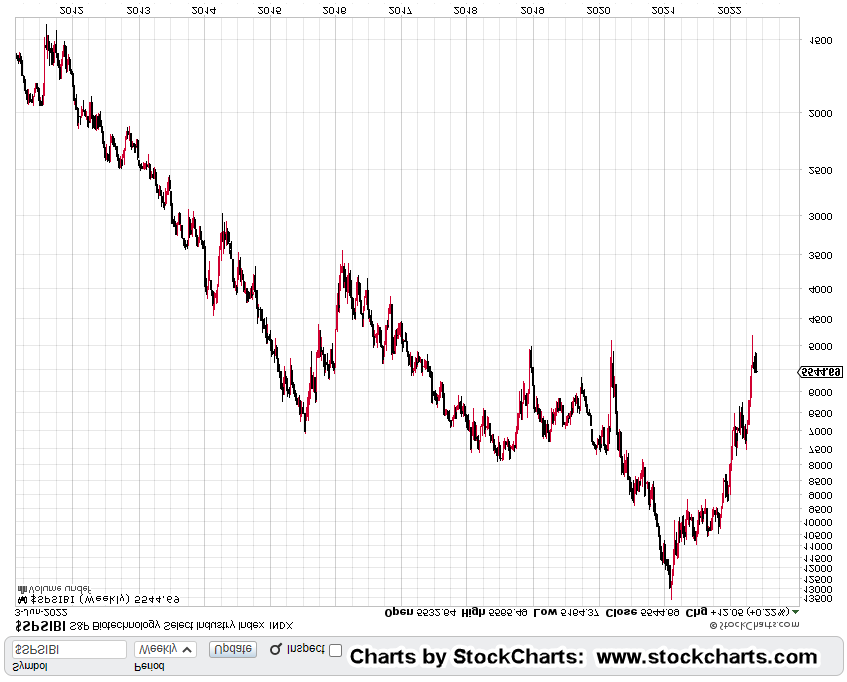

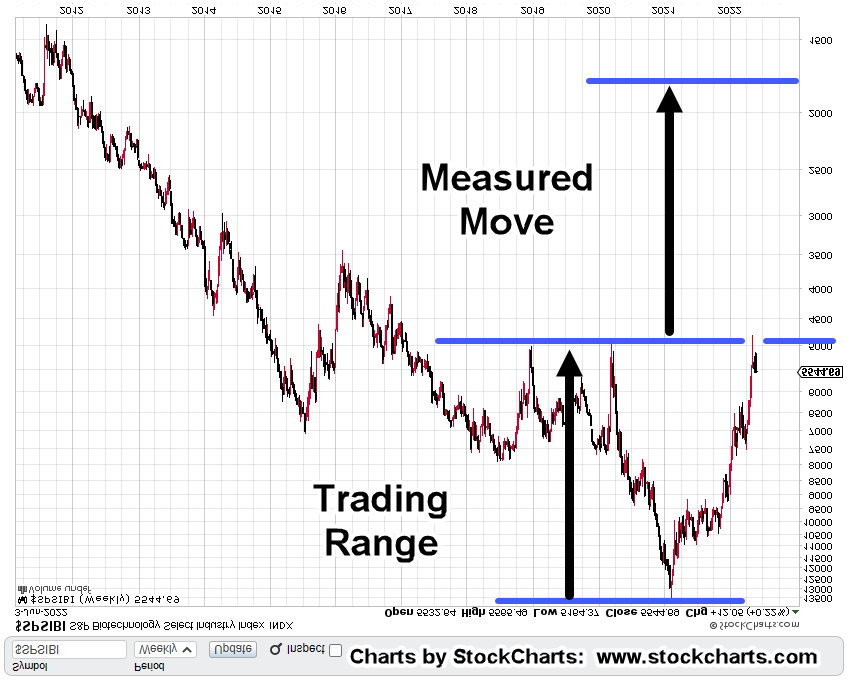

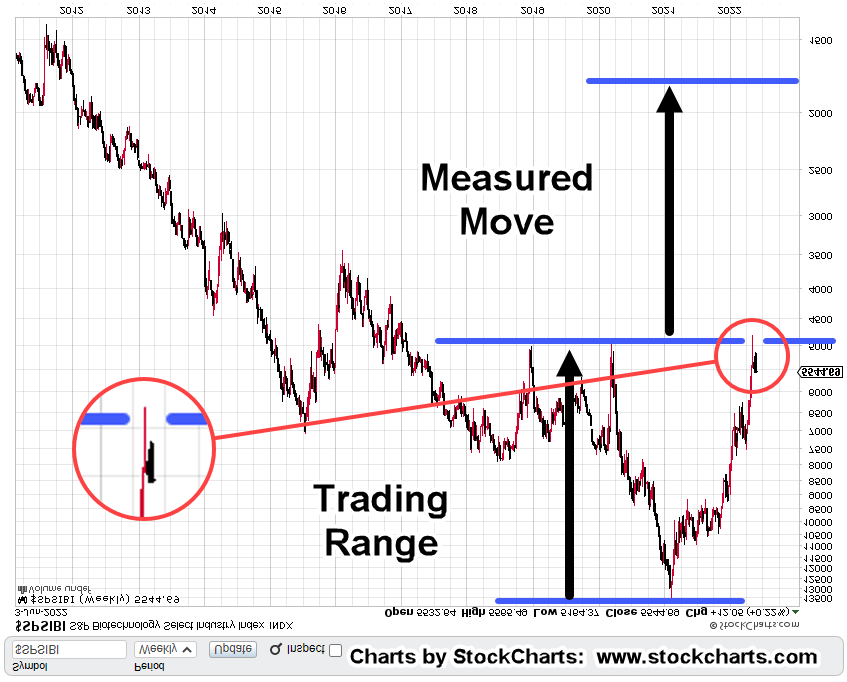

Trading channel for BEAM is the most aggressive. The weekly chart is below.

Beam Therapeutics (BEAM) Weekly

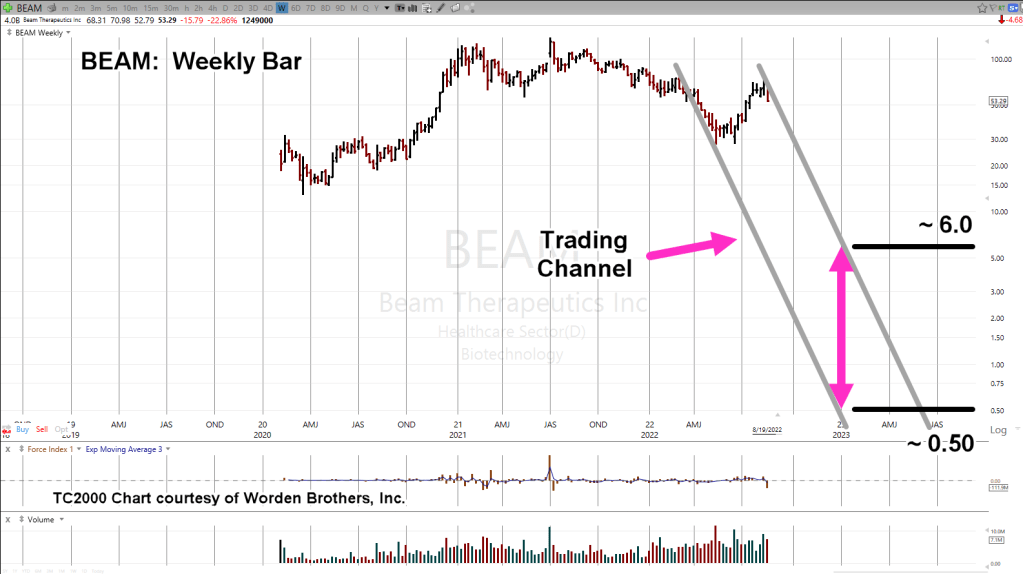

If BEAM maintains its channel for the rest of this year, the chart below shows the target area(s) for price action.

The coming week may let us know if this channel will be confirmed or negated.

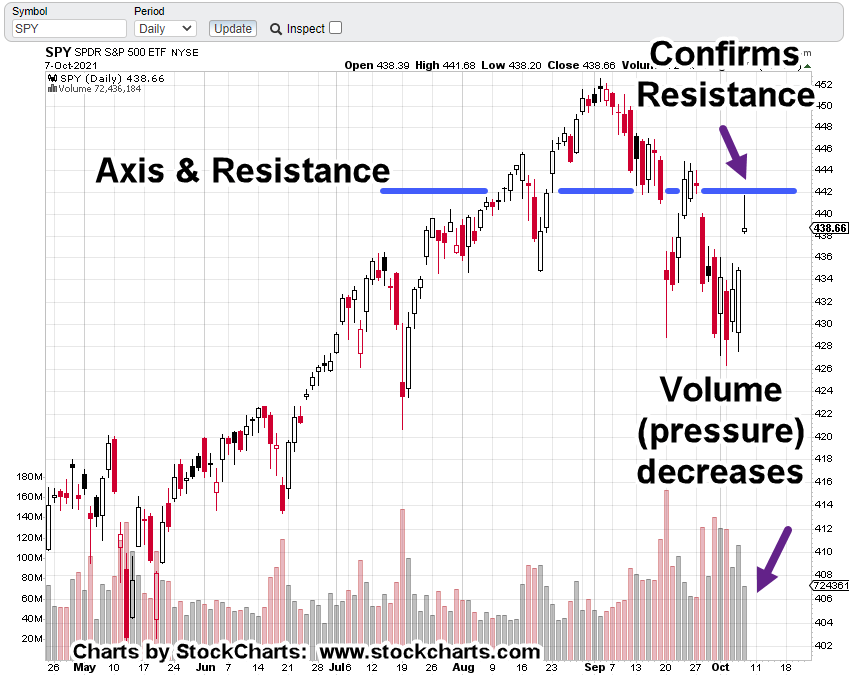

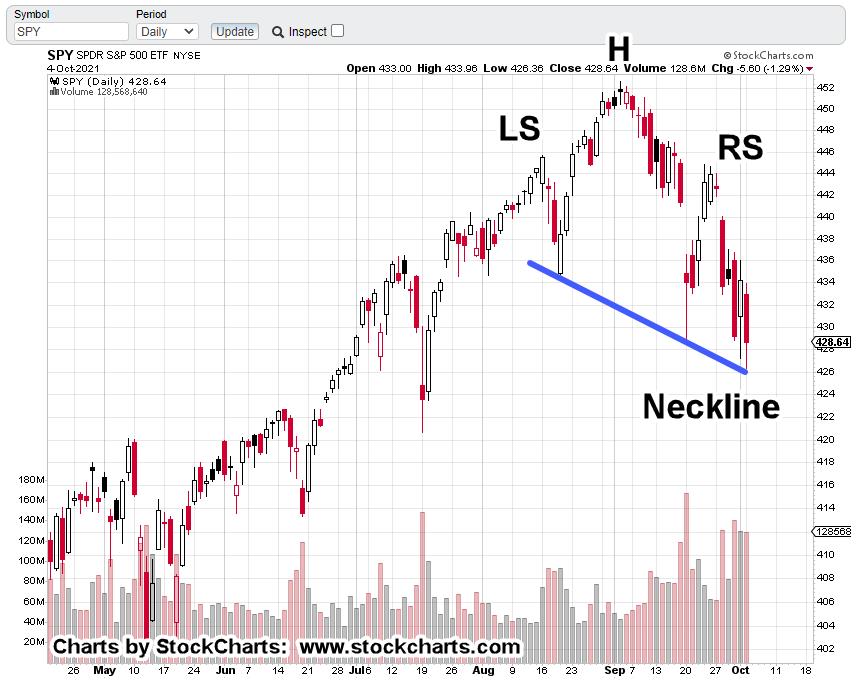

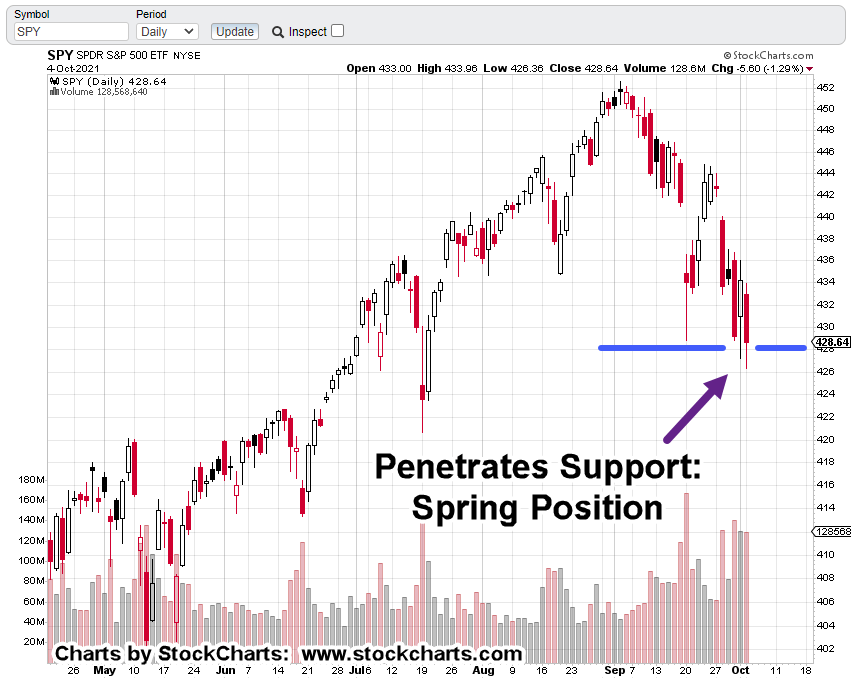

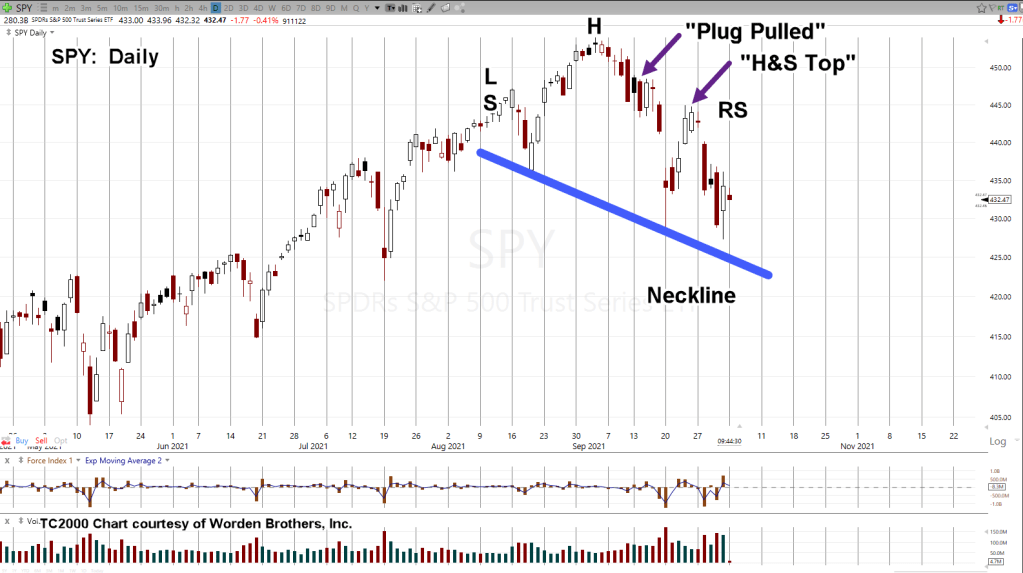

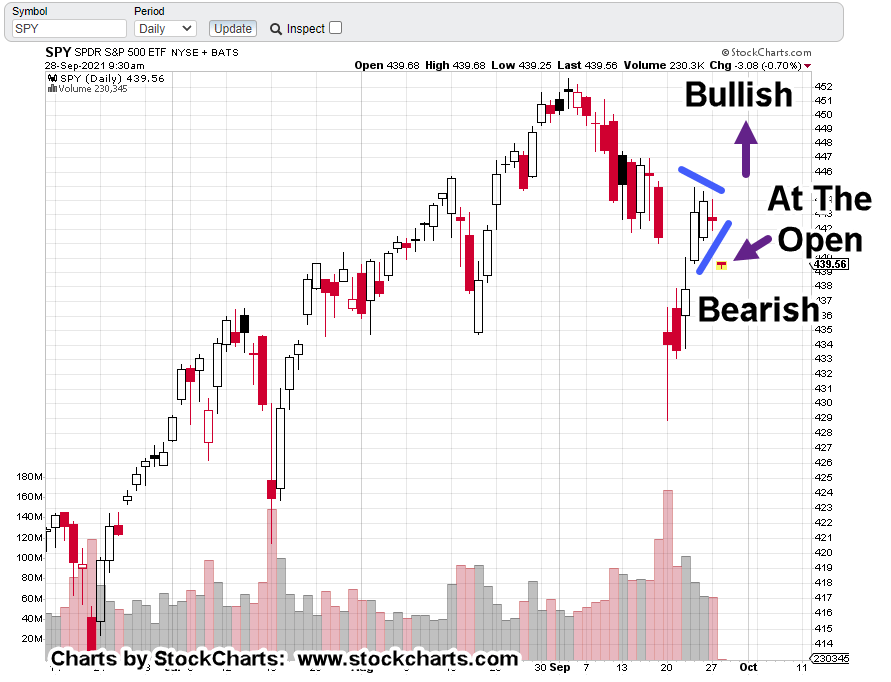

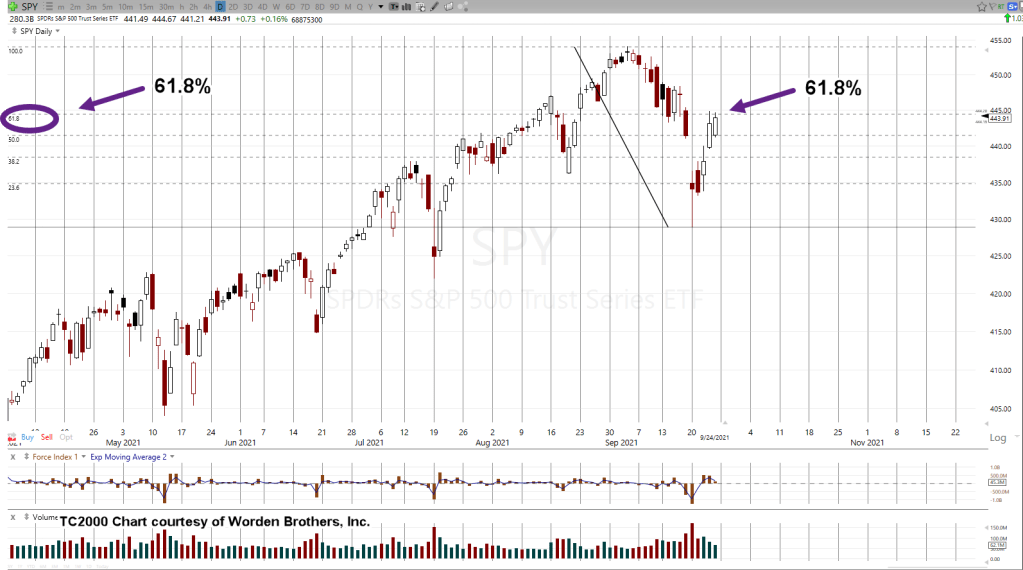

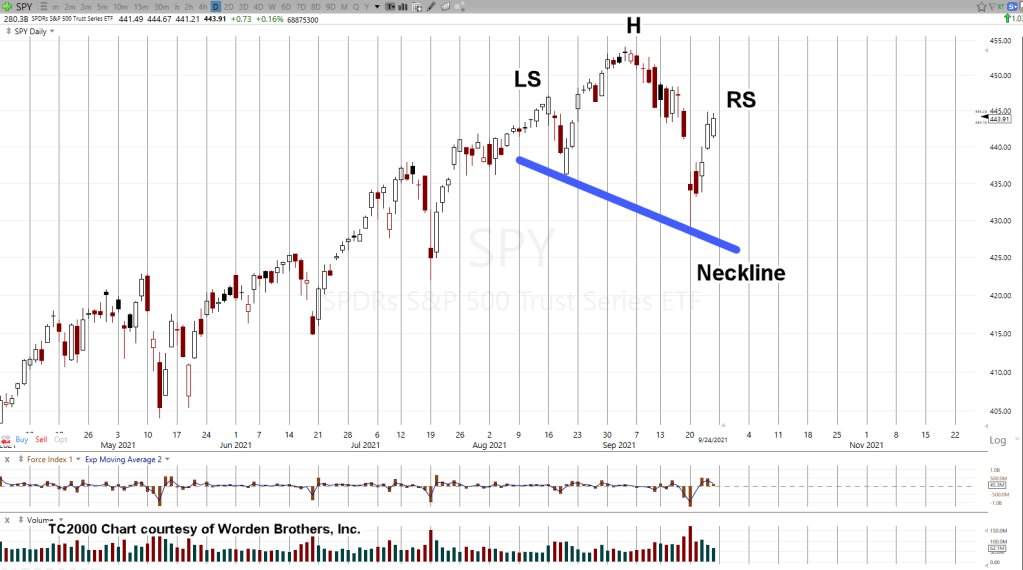

Recall, the S&P is topping out and appears to be reversing.

Goldman says the squeeze is over but that ‘downside is limited’.

We’ll see.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279