One Way Or Another …

The food supply is, and is going to be destroyed; one way or another.

The latest in this ‘planned’ series of events, can be found here and here.

More information on the first link, is here. The initial paragraph says it all.

That second link calls the news a ‘Black Swan’ event.

Really?

It’s been known for years and reported by those who are brave (moving forward despite ridicule, threats, bank account closures), and who had insight, times like these were coming.

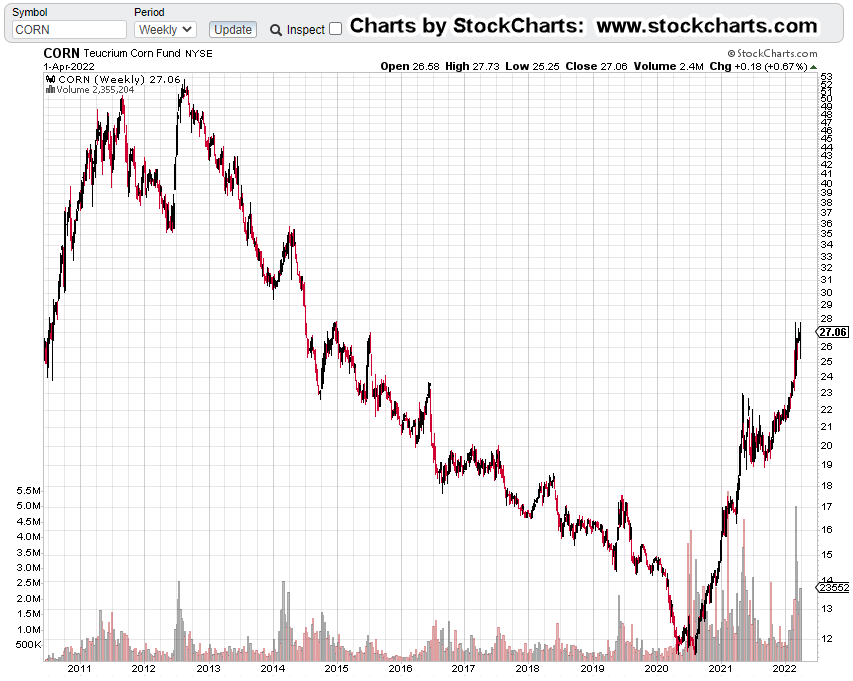

As a result, (i.e., since the Derecho) the commodities, specifically corn, have risen dramatically.

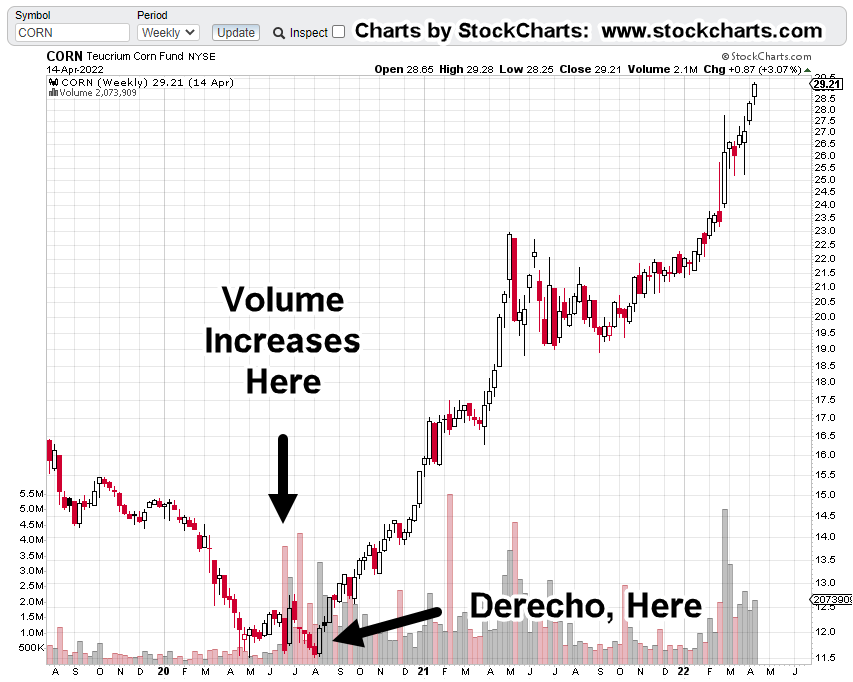

Teucrium tracking fund, CORN, Weekly

Looking and the chart, several items of note.

First: Volume picked up markedly in the fund, before the Derecho of 2020. Almost like someone knew something was about to happen … which it did.

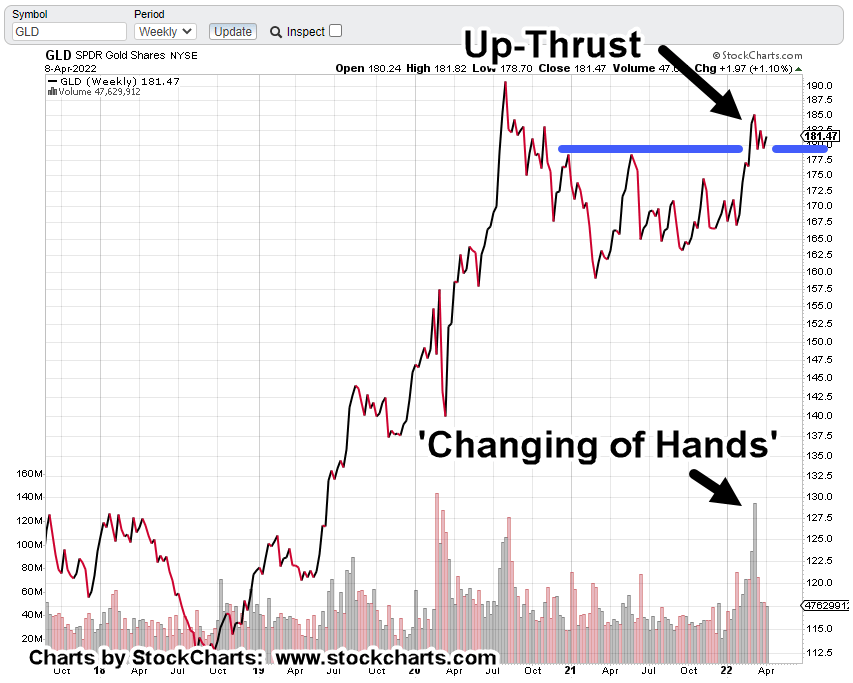

Wyckoff said it best a century ago … those in the know, will have their actions show up on the tape.

Second: We’re currently in Fibonacci Month 21, since the Derecho. Does that mean we’ll have another market event?

Let’s see how the fertilizer news affects the futures market at the next open.

However, more specifically as posted in this update, we’re looking for some type of ‘administration’ announcement that temporally crashes the price of corn.

Third: Getting back to the chart of CORN, the right side is showing signs of potential distribution.

We’ve had the largest weekly volume, ever, during the week of March 4th.

After that, volume has remained elevated … a possible changing of hands and distribution.

Summary

Markets like to test wide high-volume print areas. There’s always a potential for that type of test in any market.

For CORN above, the high-volume area is around 23.00 – 23.50; an approximate drop of -21%, from current levels.

If we get some type of ‘export restriction’ announcement, a (temporary) 20-plus percent drop in CORN, is not unreasonable.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279