Sudden Turn

Watch for failed moves.

When an apparent move fails, it tells you the other side’s exhausted.

That’s when the sharks move in.

It could be happening to IYR, right now; yesterday’s ‘reversal’ bar, has failed (not advice, not a recommendation).

The last update on the sector, link here gave a head’s up, a reversal appeared likely.

Now, we have more confirmation with the failed move shown below.

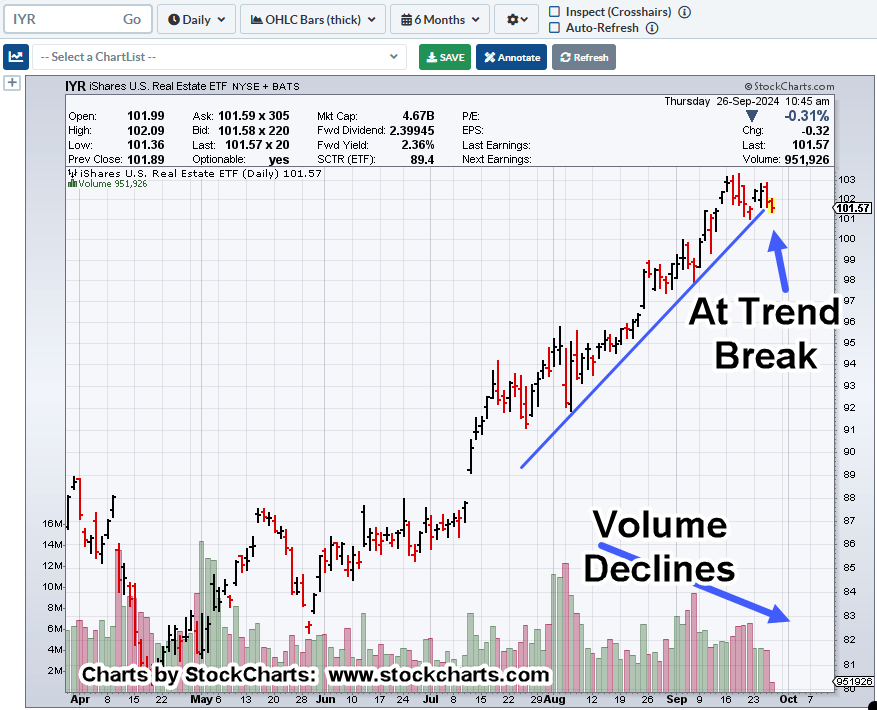

Real Estate IYR, Daily

Yesterday, IYR, had penetrated support (blue line) and was in Wyckoff ‘spring’ position.

That spring (set-up) has failed.

Now, it gets interesting.

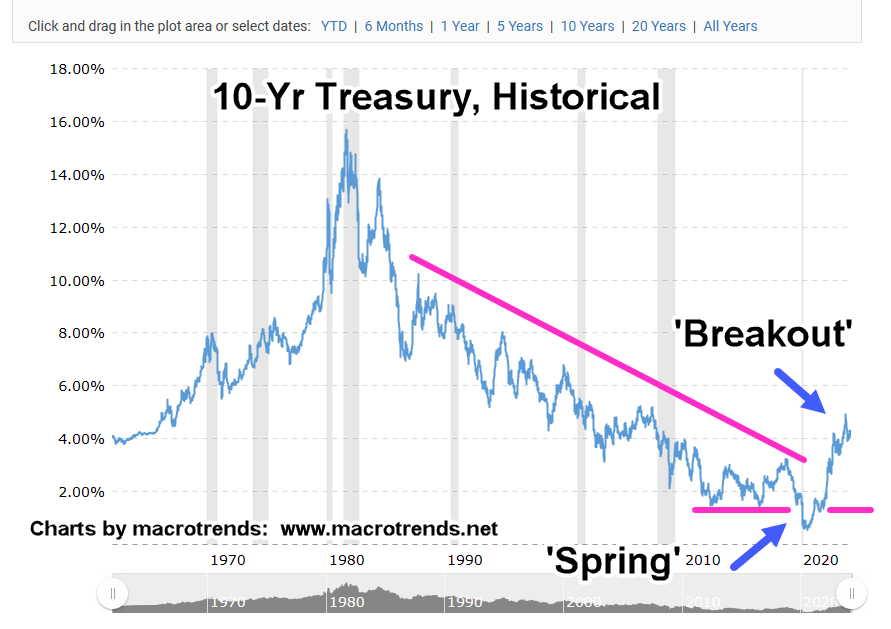

Bonds (TLT) continue lower with rates continuing higher; the exact opposite of what the public thinks is ‘supposed’ to happen.

Positioning

Naturally, with the above conditions a short was opened DRV-24-05, with the stop at DRV’s session low @ 23.89 (not advice, not a recommendation).

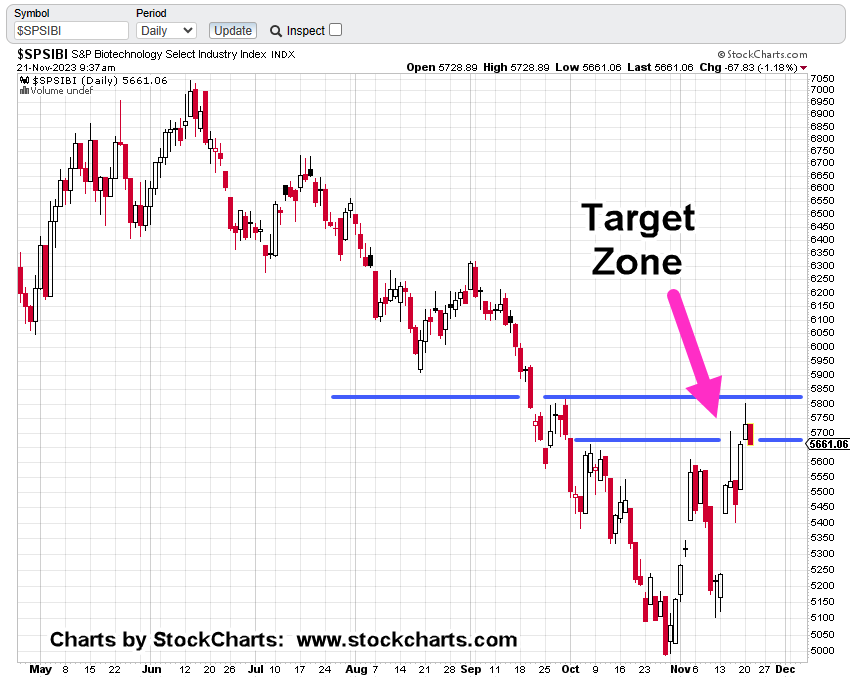

Separately, the short on XBI (LABD-24-19) is not performing as expected. Today is lower but there’s no new daily low (as of 11:55 a.m., EST).

Position was exited with a loss of – 2.48%.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279