When Real Estate Goes …

It’s been said, ‘when real estate goes, everything goes’.

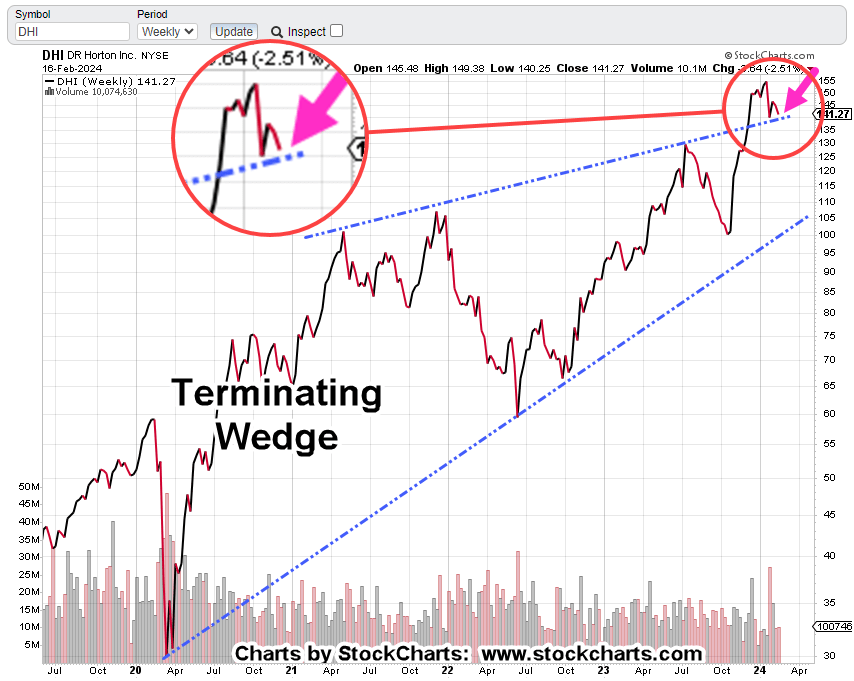

Like a slow-motion train wreck, since late January, this site’s been watching the (potential) topping activity of D.R. Horton, DHI.

Now, DHI is reversing; coincident with the housing starts collapse, link here.

D.R. Horton, DHI Weekly Close

We’re right at the top of the ‘terminating wedge’.

Downside penetration and test will provide confirmation of the reversal (not advice, not a recommendation).

The major market indices appear to be topping out as well.

The SOXX, may have reversed. Trading was ‘outside-down’ during yesterday’s session.

The SPY, and QQQ, also posted outside-down.

The potential Nvidia, NVDA reversal (link here) shows that so far, that high has not been exceeded.

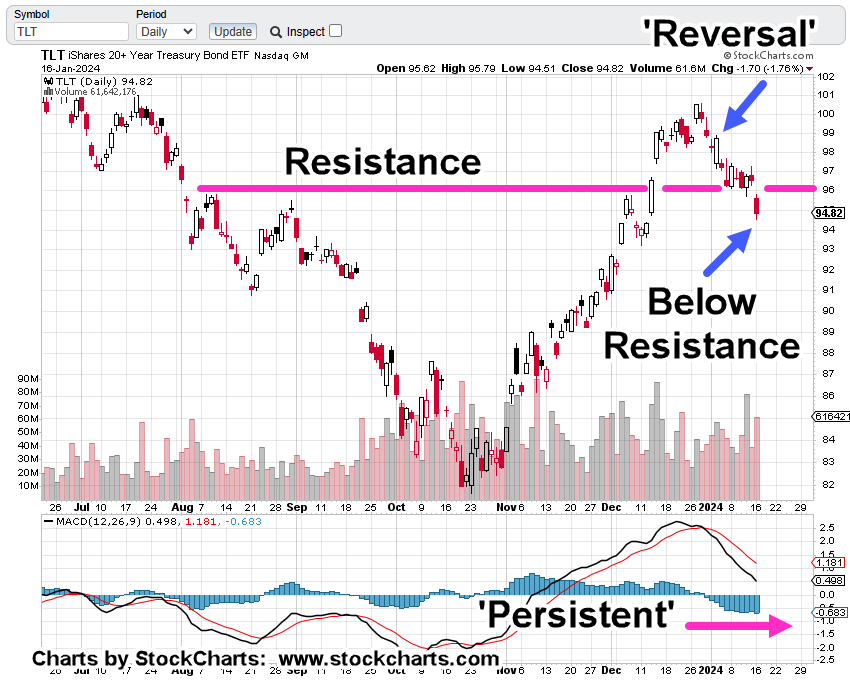

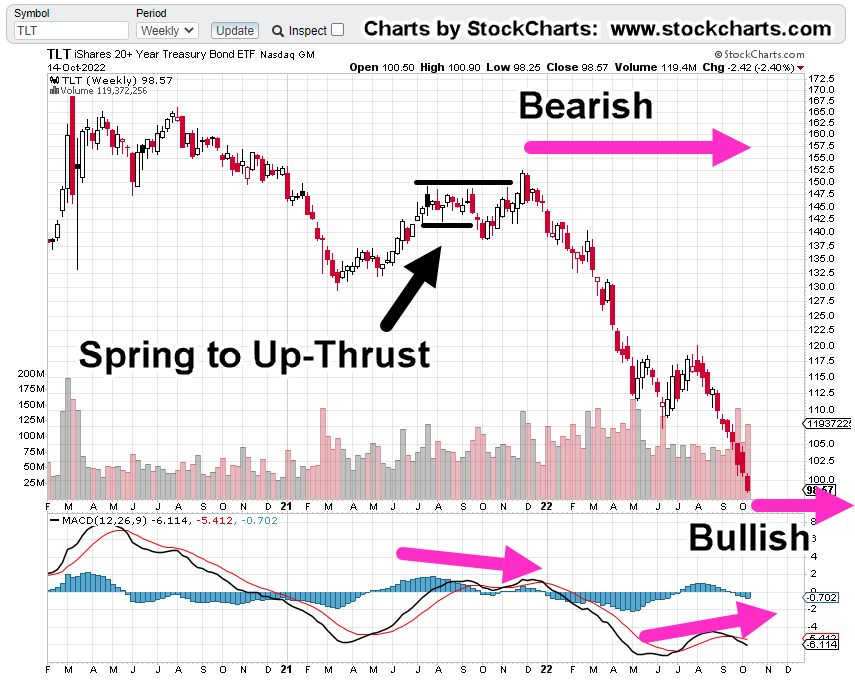

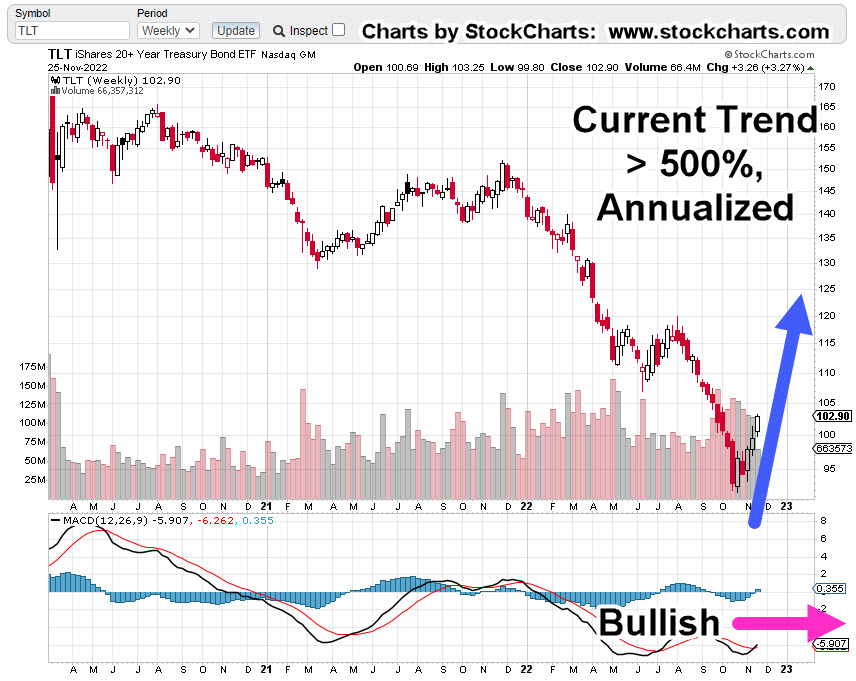

Rates Up, Not Down

Adding gasoline to the fire, part of this site’s strategy is rates are going higher, not lower (not advice, not a recommendation).

So far, we see that’s true with long bonds (TLT) reversing to the downside, yet again.

And Then … Gold

Let’s not leave out the latest bullish report on gold (and silver), link here.

Notice the bias … that silver’s cheap relative to gold.

How about the massive, multi-year, ‘non-confirmation‘ between gold and the other monetary metals.

If it was real 1980s style inflation, everything would be moving up in tandem … which it is not; something else is going on.

Is the mining sector, GDX, GDXJ, anticipating a price decline in gold?

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279