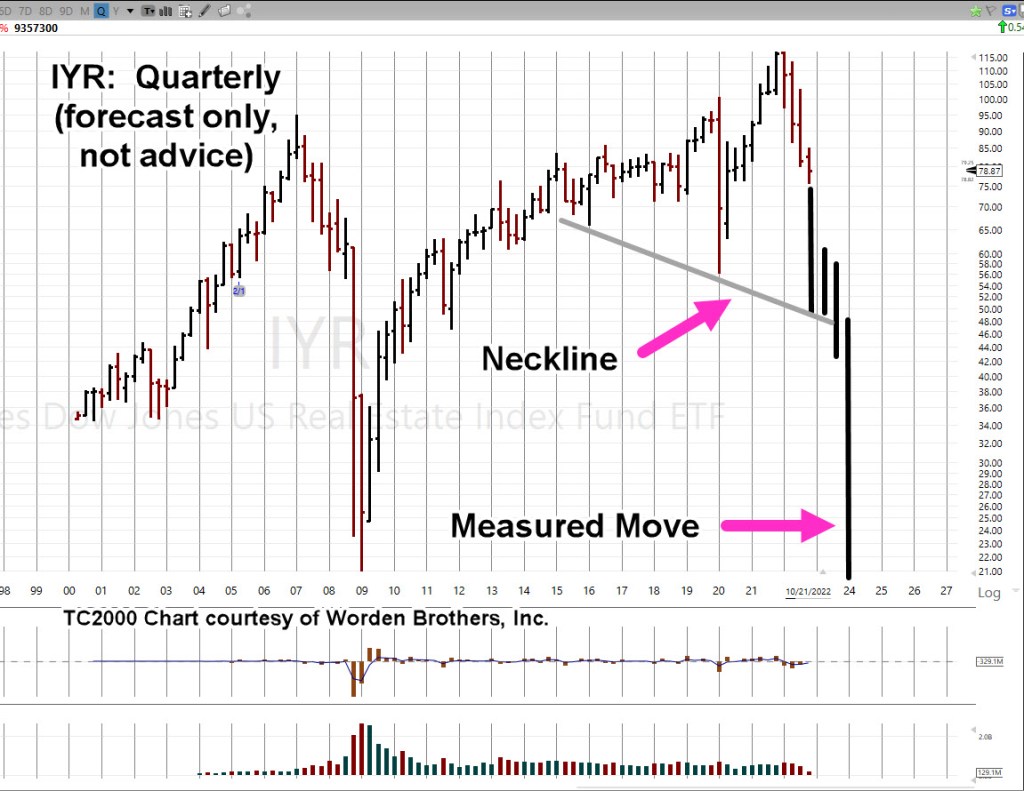

Is The ‘Collapse’ Back In Play?

When the market does not respond as expected, that means something else is happening.

Such may be the case for bonds.

Yesterday, we got this announcement during market hours.

Of course, the already hammered bond market (TLT), got hammed some more.

It’s what happened next, and what’s happening today, that’s important.

That is, the sell-off was quickly reversed (to the upside) with that upside continuing this session.

The bond supply is being absorbed.

So, what does that mean?

It’s possible, the bounce, melt-up, squeeze or whatever one wants to call it could be over. There may already be a ‘flight to safety’ if there’s such a thing these days.

But let’s not hypothesize on what could be happening. The market itself (price action), tells us.

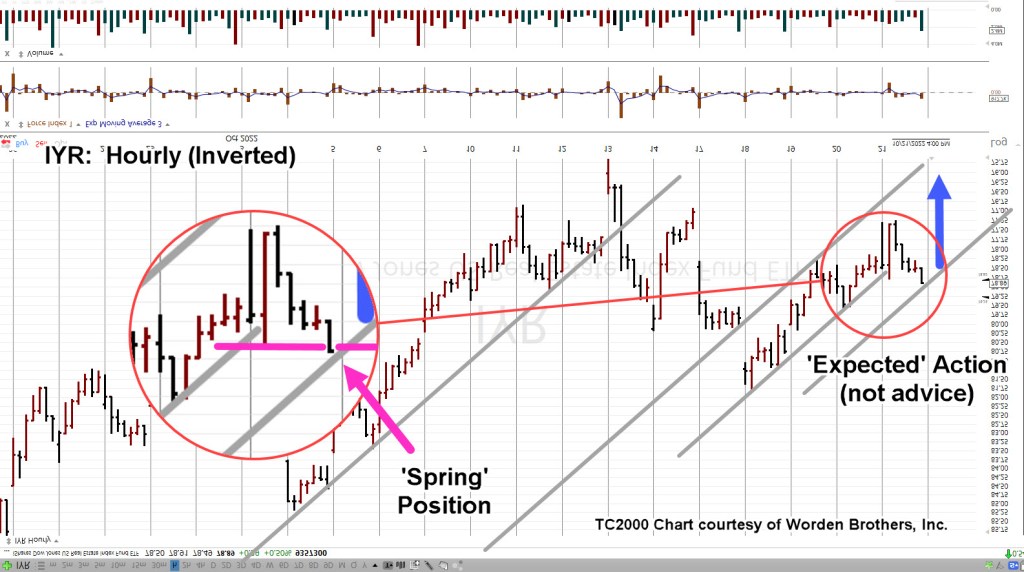

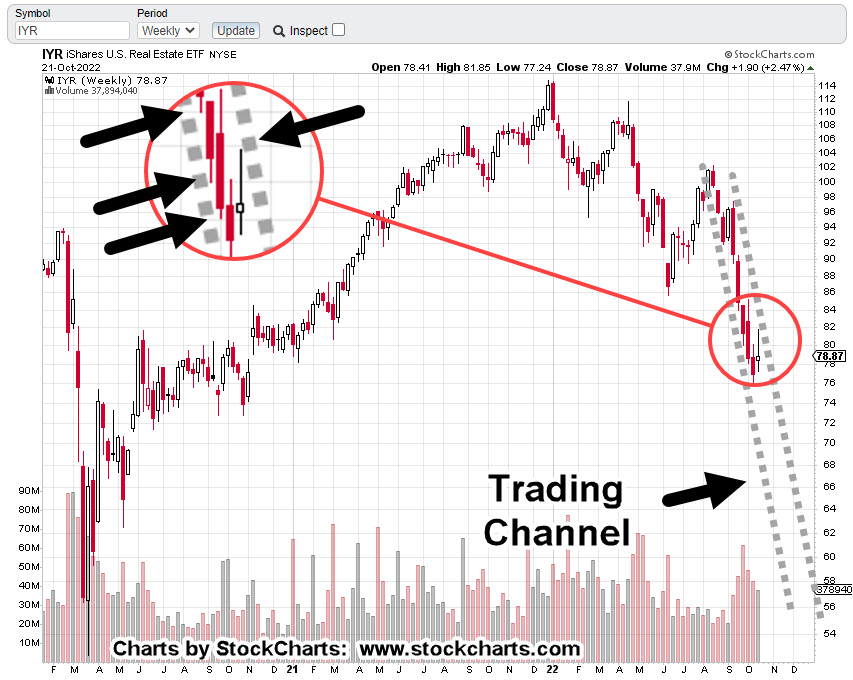

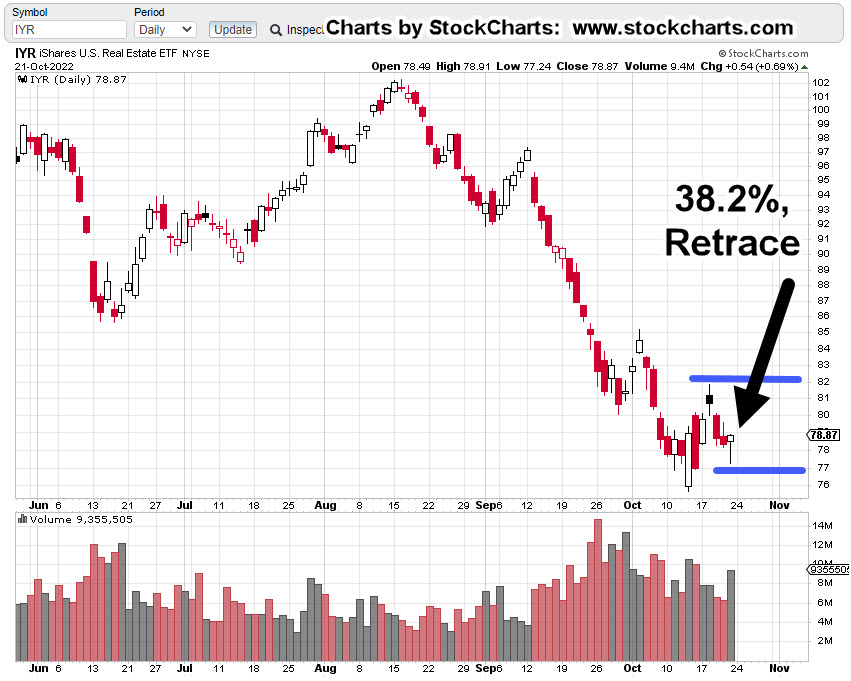

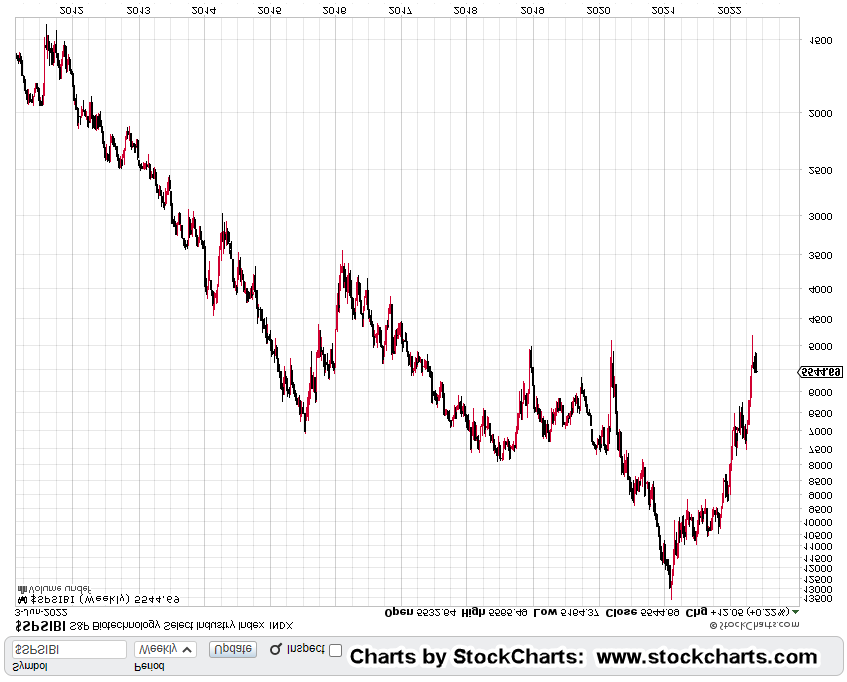

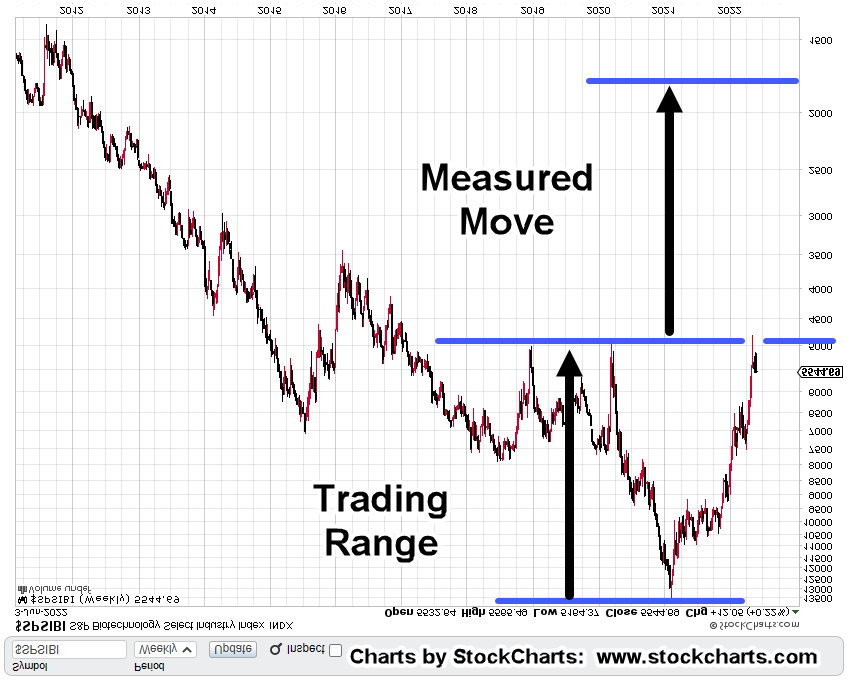

Bonds TLT, Daily

At about mid-session, this is where we are.

We’re right at the downtrend line.

The attempt to mover lower (yesterday), has been rejected.

As a result of today’s new daily high, the stop on position TMF-22-01, has been moved up (not advice, not a recommendation).

So, we’re now between the downtrend and the ‘rejection’; something’s likely to break.

Summary

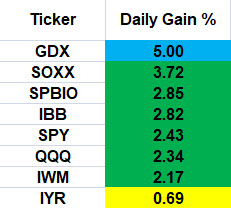

The S&P (SPY) just posted an up-thrust reversal early this session and is still moving lower as of this post.

Keep in mind, all of this is happening before any Fed announcement … as if the market has already decided.

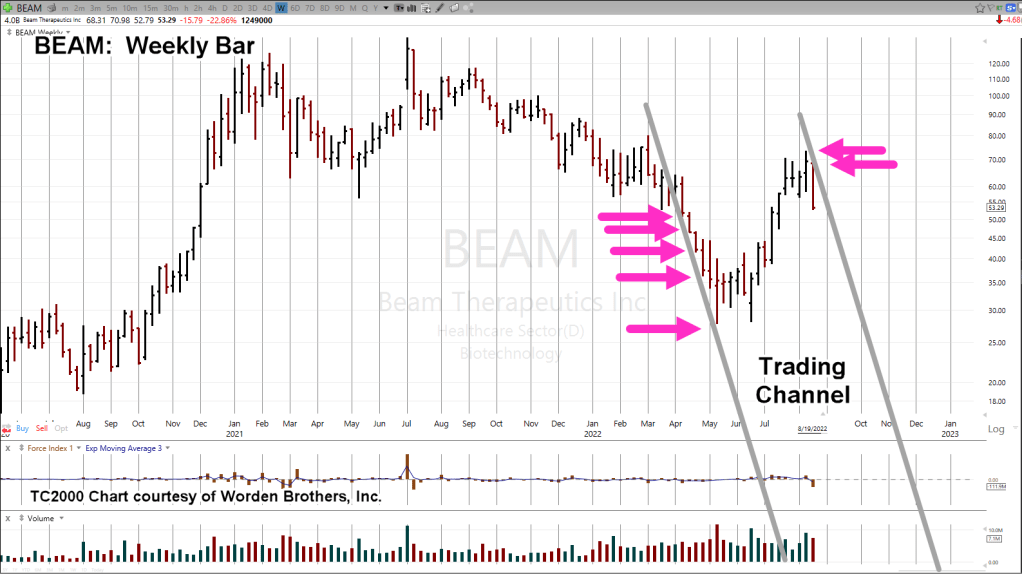

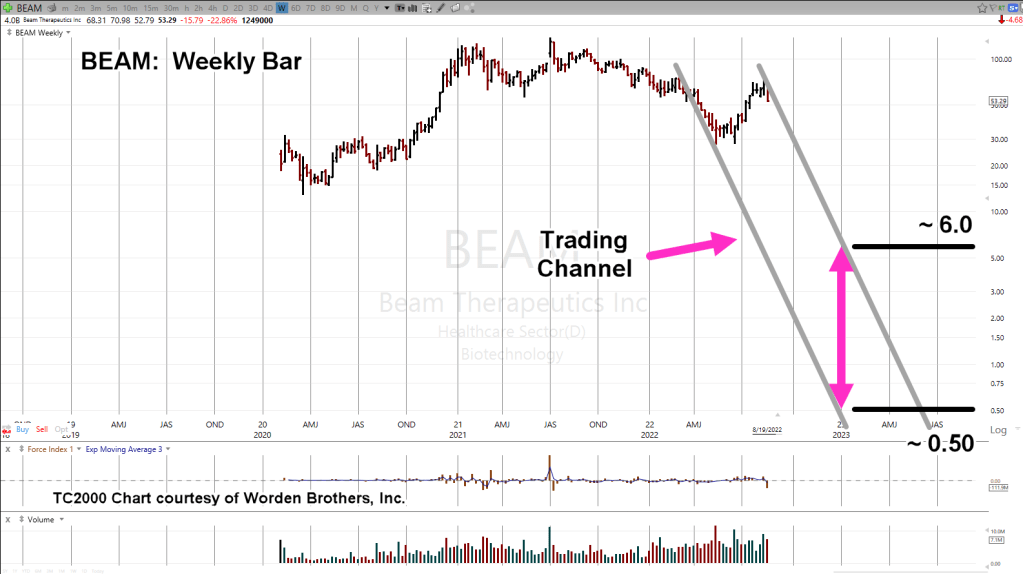

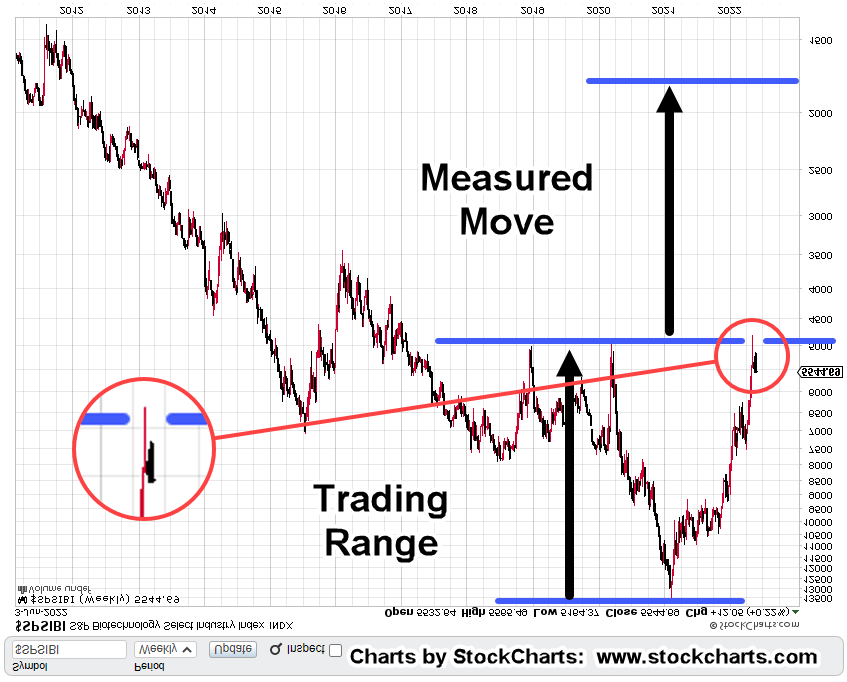

A quick note on biotech, SPBIO.

Position size has been increased in SPBIO, leveraged inverse LABD, as shown below (not advice, not a recommendation).

This sector remains at The Danger Point®

If the bounce really is over, biotech is likely to get hit the hardest.

Positions, Market Stance (courtesy only, not advice).

TMF-22-01:

Entry @ 7.166, Stop @ 6.77***

***, Indicates change

LABD-22-09***

Entry @ 19.88, 19.71***, Stop @ 18.69***

Note: Positions may be increased, decreased, entered, or exited at any time.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279