The Press, is Always Last

If the financial press is reporting on a trend, it typically means, that trend is well established and possibly near the end of its move.

So, it could be with Corn and Soybeans as reported by Fortune link here and RawStory, link here.

Ignoring the not-so subliminal messaging (i.e. it’s Trump’s fault), both articles may be contrary indicators of a bottom or bottoming process.

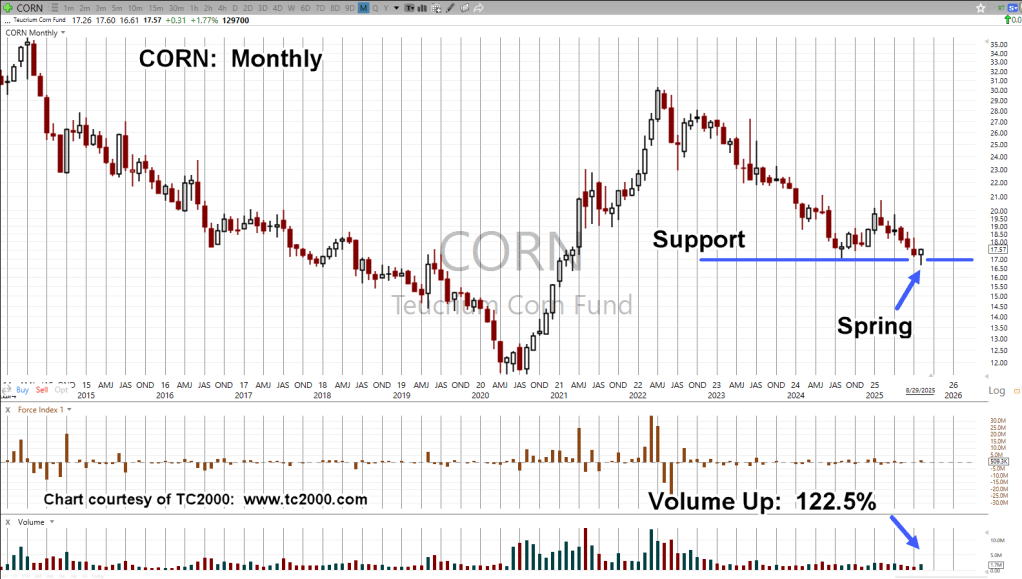

From this site’s perspective, it’s been a long time since the last update on Teucrium tracking fund CORN, link here.

The update said to watch for a reversal and potential ‘test’.

However, it also said this:

“That amount of time below support seems a bit of a stretch for labeling it as a ‘spring’.”

The assessment was correct. The ‘spring’ setup failed, ultimately bringing us to now.

Teucrium Tracking Fund, CORN, Monthly

During August, CORN penetrated support, then reversed.

Volume for the month more than doubled, indicating increased demand at these levels (not advice, not a recommendation).

With commodities like corn, gold, silver, oil and others, literally anything can happen.

We could get negative prices.

With that said, let’s watch to see if there’s a test of what looks to be a nascent reversal; proceed with caution (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279