One Trade, At A Time

Even if we knew the A.I. bubble has burst, that it’s beginning a multi-year decline (or something worse), even if it was known, trading bubbles like this, is not easy (not advice, not a recommendation).

It might be simple, but it’s not easy.

With the market in chaos, we have the usual suspects out making things complicated; sharpening their pencils, attempting to connect financials with price action.

It always looks good on the surface.

However, as Nissam Talib said in The Black Swan (paraphrasing), he’d rather have a New York street smart, hoodlum reaping a windfall, than a pointy-headed PhD on the sidelines, pontificating about how the strategy’s not consistent with mathematics.

All of which brings us to the truth, price action itself.

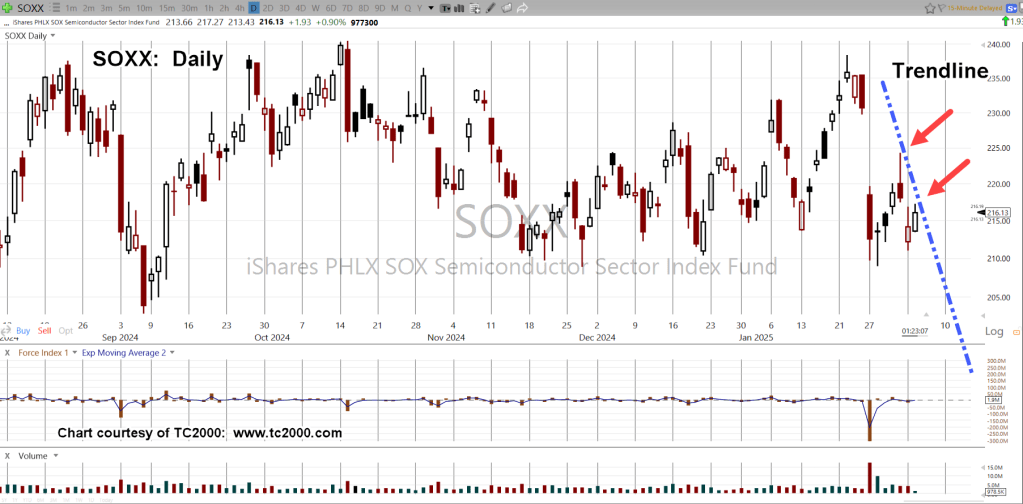

Semiconductors, SOXX, Daily

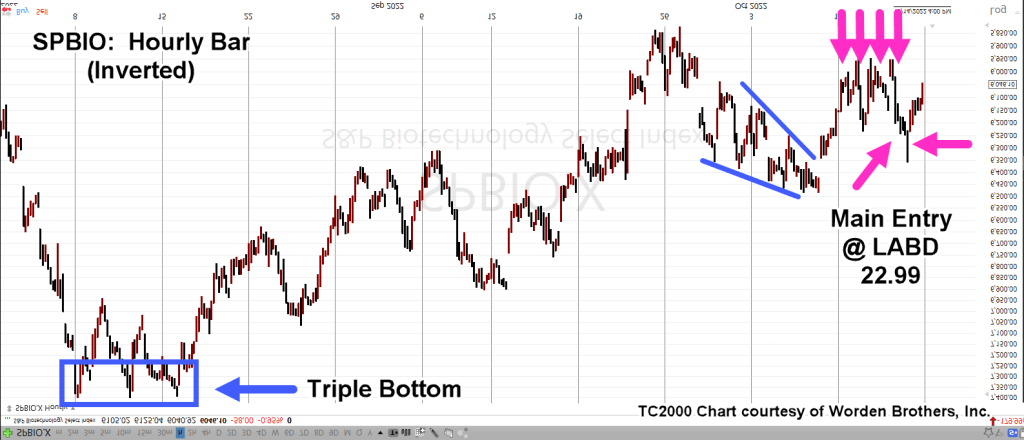

Once again, the trendline has been adjusted based on price action.

The gap lower open from yesterday has been effectively closed during this session (as of 1:50 p.m., EST).

The expectation is for today’s high in the SOXX to hold; meaning, subsequent sessions will not post higher (not advice, not a recommendation).

For a short position, SOXX high of 217.27 (or the high for the day) is a good place for a stop (not advice, not a recommendation).

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279