‘Safe And Effective’

Independent sources confirming, Americans are now dying at unprecedented rates.

This article just out from Activist Post, contains two (possibly three) sources, each confirming the numbers.

One of the earliest posts that discussed mass depopulation, is linked here. Line-item No. 1, starts it off.

Murder For Hire

This post from September last year, discussed the ‘Elephant in the room’.

“That elephant is, we’re at the front end of a potential mass genocide event (that’s already underway).”

Now, here is verifiable proof of just one avenue for ‘deflation’; i.e. demand is literally going to die-off.

This on-going tragedy or ‘plan’ depending on the source is not going to end anytime soon. In fact, we’re still at the front end of what will last for decades.

The medical establishments in the ‘proof’ link above, know exactly what they’re doing; their actions affect millions, if not billions, world-wide.

Fundamentals Of The Matter

This time, the fundamentals do matter.

By now, we all know the backdrop for the entire population world-wide, is ‘shortage’.

Shortage of almost everything.

However, one thing’s not short; stupidity.

We seem to be full up on that. Anecdotal evidence from a trip to the local Target had people still getting in line, apparently of their own free will, for injections.

At this juncture the results are starting to pile up.

One local school is so short-staffed from ‘illness’ (i.e. potential adverse effects), it closed this week; planned to re-open this coming Monday.

Dead Paradigm: ‘Money Management’

Schools are a microcosm of the entire population.

If schools are closing, what’s going on in the other industries? Just for argument, we’ll keep our focus on the ‘wealth management’ sector.

A quick check of a randomly selected ‘partnered research firm’ that has $1-Trillion in assets, 19,000 financial professionals, partnered with 800 institutions, shows in their market commentary, it’s nothing but, ‘blue skies ahead’.

With stats like that, one can surmise: This Is The Herd

The herd sees nothing but blue skies. All is well.

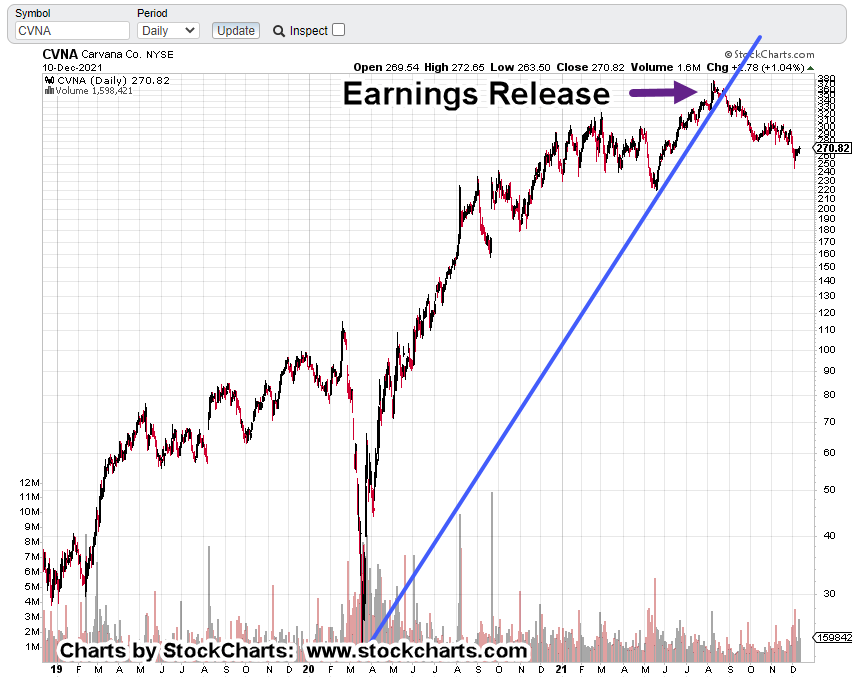

The Netflix implosion could be used to paint market potential as a whole (not advice, not a recommendation): Down over 20%, instantly.

Dan, from i-Allegedly, with his thousands of contacts, has repeatedly stated, the old way of doing business is not coming back: It’s over.

If you’re running a juggernaut of 19,000 ‘professionals’, how fast are you going to be able to change course if/when the market implodes?

New Paradigm: ‘Centralized Management’

You can almost feel it.

That may be the likely outcome of the potential wealth management implosion (not advice, not a recommendation).

That’s if the markets can even survive.

At time stamp 20:49, in this link, Dan may have given us the model for the entire commercial structure, post apocalypse.

After the small and medium businesses have been destroyed, it’s time for a centralized approach.

After it’s all over, if you’re ‘certified’, the centralized method may be all that’s left (not advice, not a recommendation).

Throw in the requirement to be fully ‘injected’ to be part of a centralized firm and voila!, It will become even more centralized as the management population naturally decreases (rapidly).

Taking that to its logical conclusion, as the ranks of certified managers decreases, the only ‘managers’ left will be those who are exempt; the government employees, i.e., the final solution.

There’s more than one way to confiscate an IRA (not advice, not a recommendation).

The War Room

As the ‘About‘ page has stated, we’re in a war; a financial war.

The rules of the game have changed.

The old way of gathering assets, making sure you don’t lose too much money or posting small gains, intentionally keeping clients blissfully ignorant (by spouting garbage like ‘due diligence’), is over.

What’s needed now, at least for starters, is straight talk and the truth; or as much of it that’s currently known.

So far, what is known is this:

Results of mass-injections are starting to show. The largest die-off in recorded (by insurance firm’s) history.

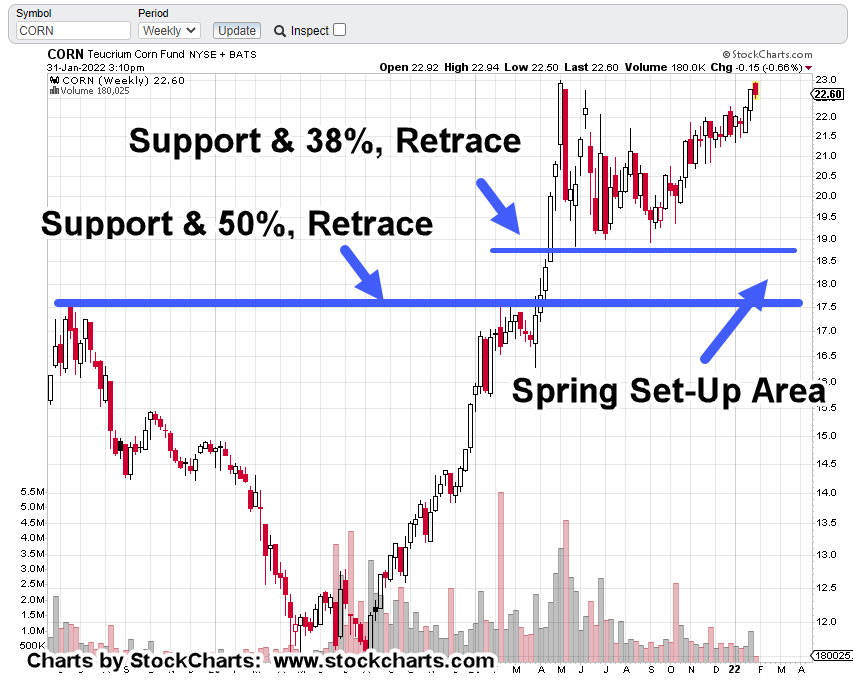

Shortages of everything and especially the food supply (search on this site for keyword, Genesis 41).

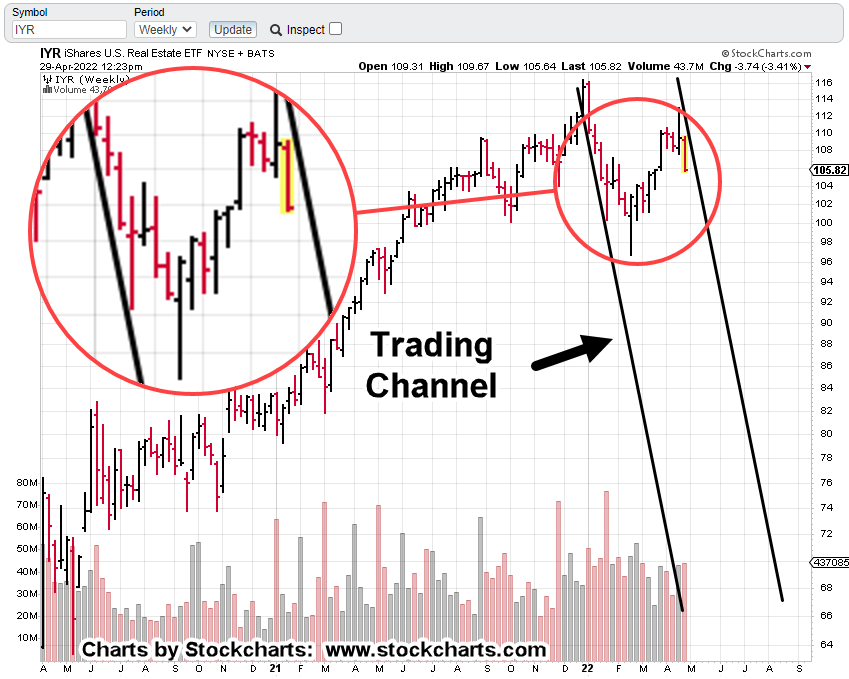

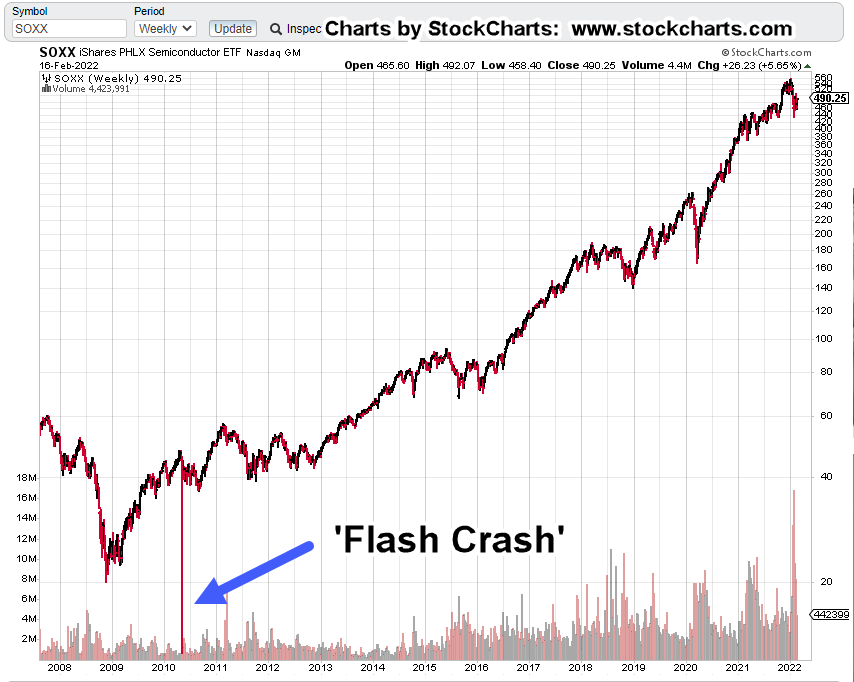

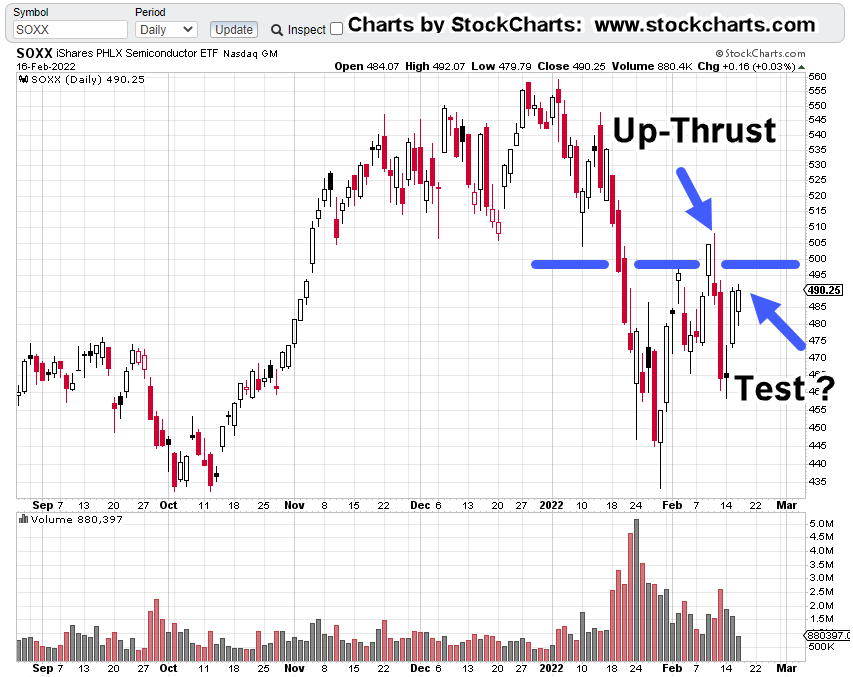

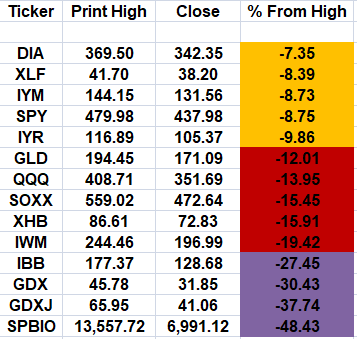

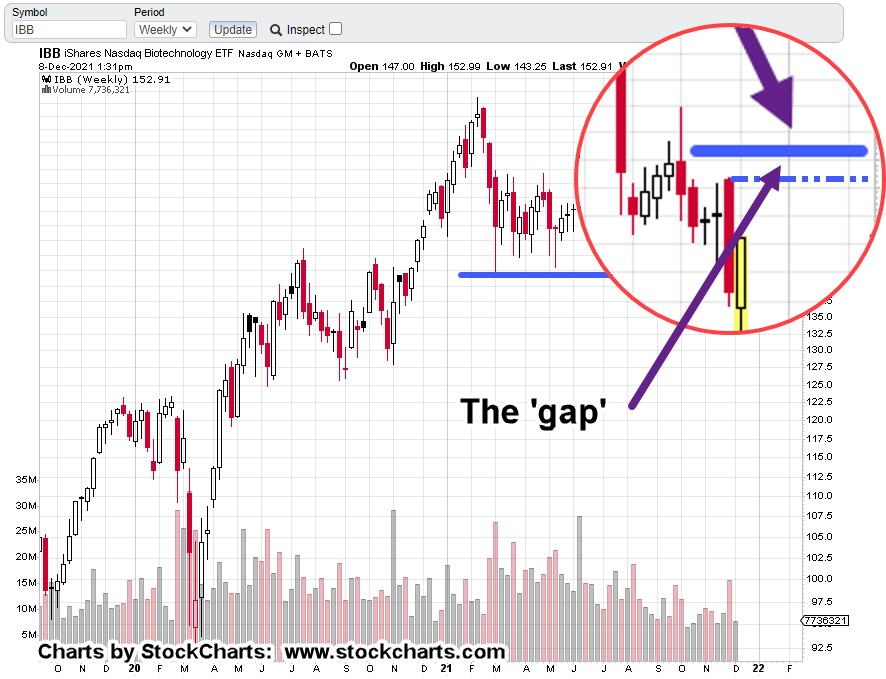

All market bubbles appear to be deflating simultaneously; gold miners and biotech leading the way.

The typical money management firm, if they’re nimble enough will begin to ‘minimize losses on the way down’.

They only know, or can only work in one direction: Up

After meeting with a reputable manager ($100s of millions under management) and asking him if he works the downside, the response was: ‘The clientele can’t handle the volatility’.

So, the answer is no.

The fastest, potentially most profitable direction, the direction that trading professionals prefer, i.e., ‘down’, is not worked by a typical firm. They wait for the upside.

What’s The Market Saying?

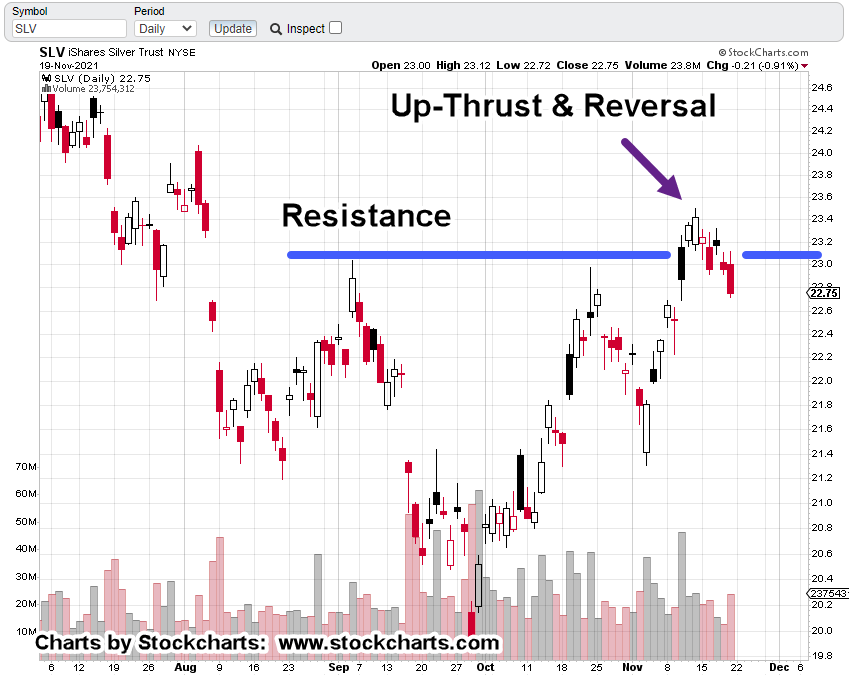

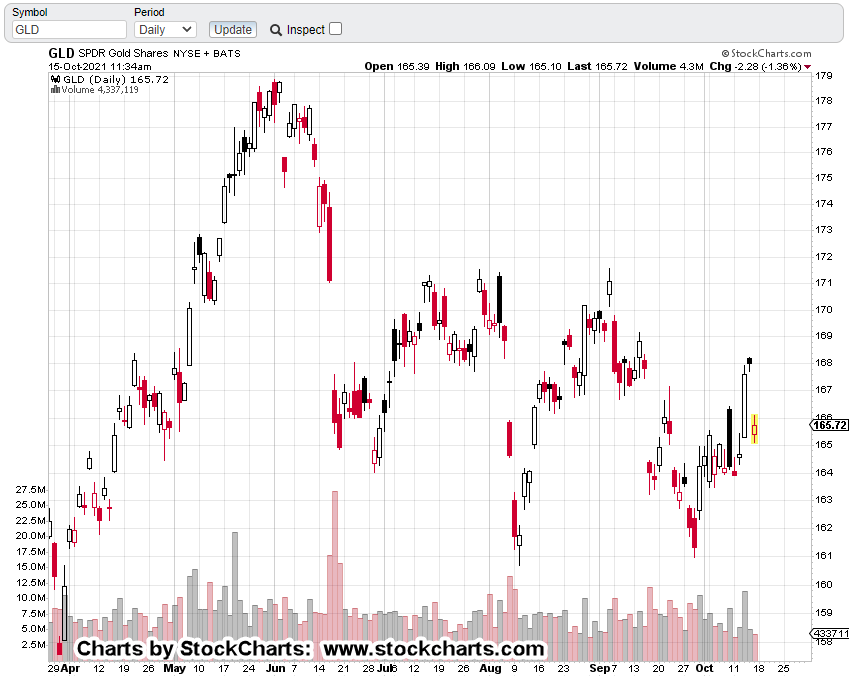

Wyckoff analysis focuses strictly on what the market’s saying about itself.

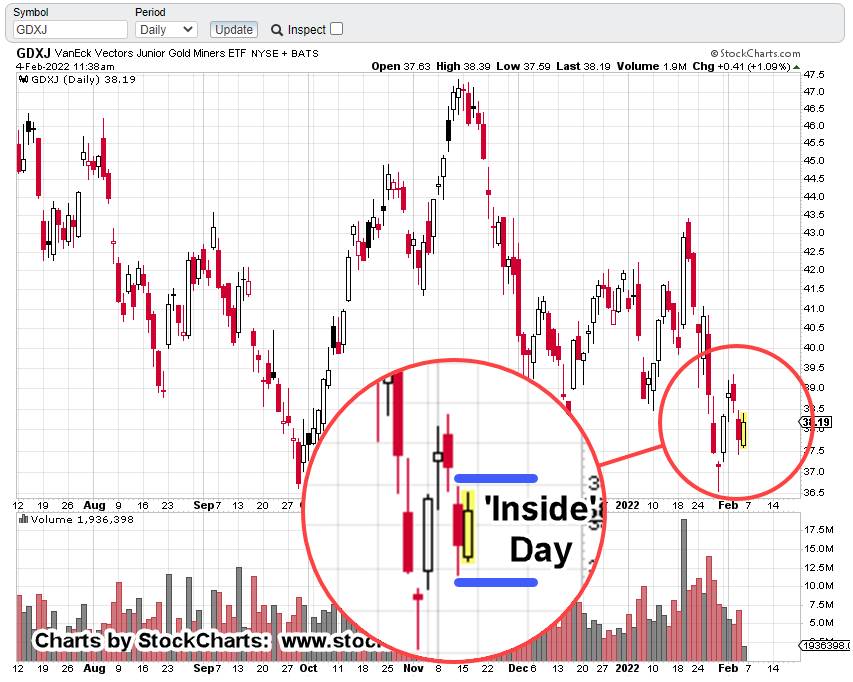

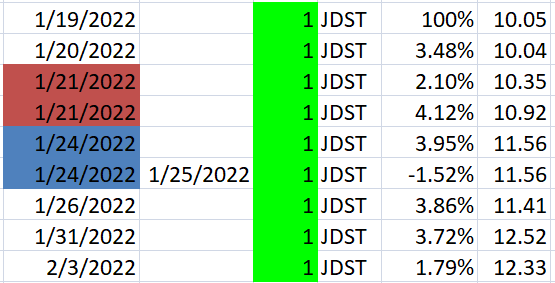

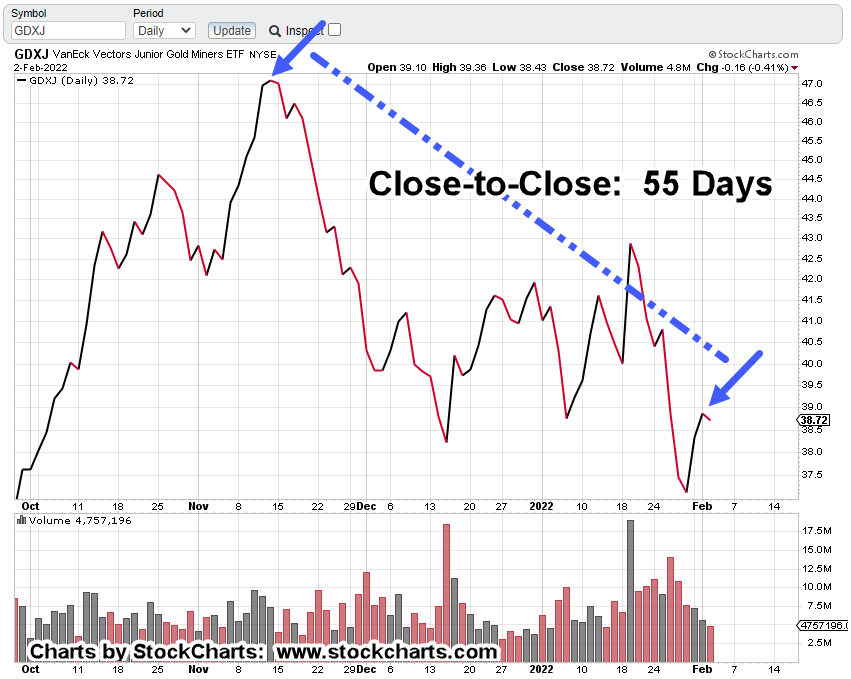

Looking at the table above, that market clearly shows, gold miners and biotech leading the way down; potentially going much lower and each for their own reasons.

On deck for tomorrow, a technical look at gold and the miners; what may be in store for continued downside action.

We’ll discuss Newmont’s apparent reversal; Juniors as the weakest sector, along with P&F and Fibonacci projections.

Stay Tuned

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279