Slowly, At First

Of all the major indices for today’s (Wednesday) session, biotech’s SPBIO, Leveraged Inverse Fund LABD, had one of, if not the largest gain @ +10.48%.

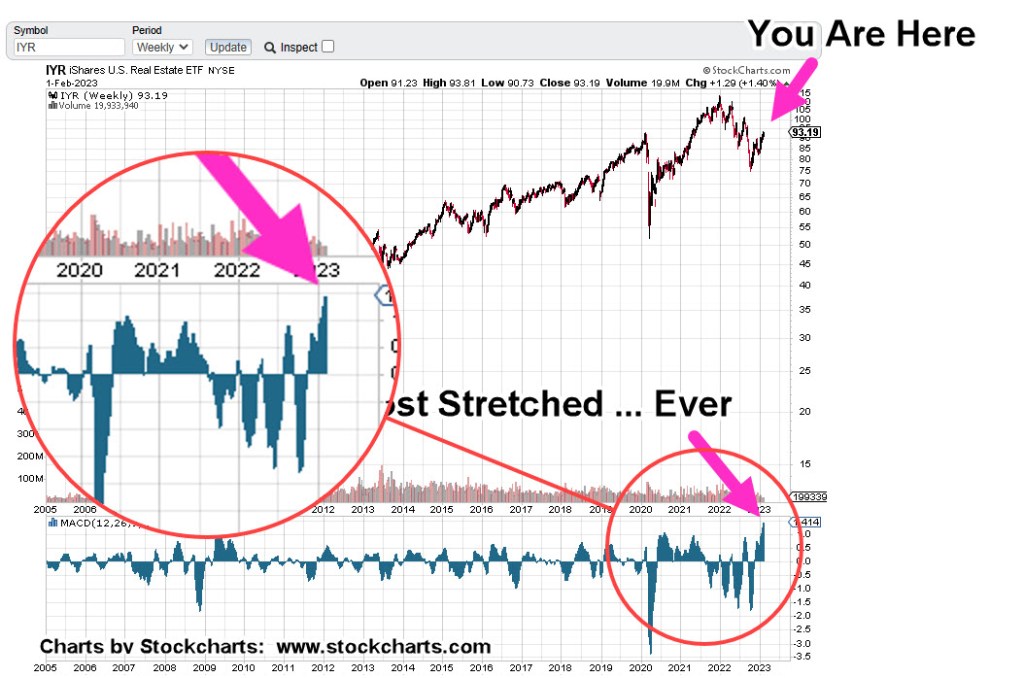

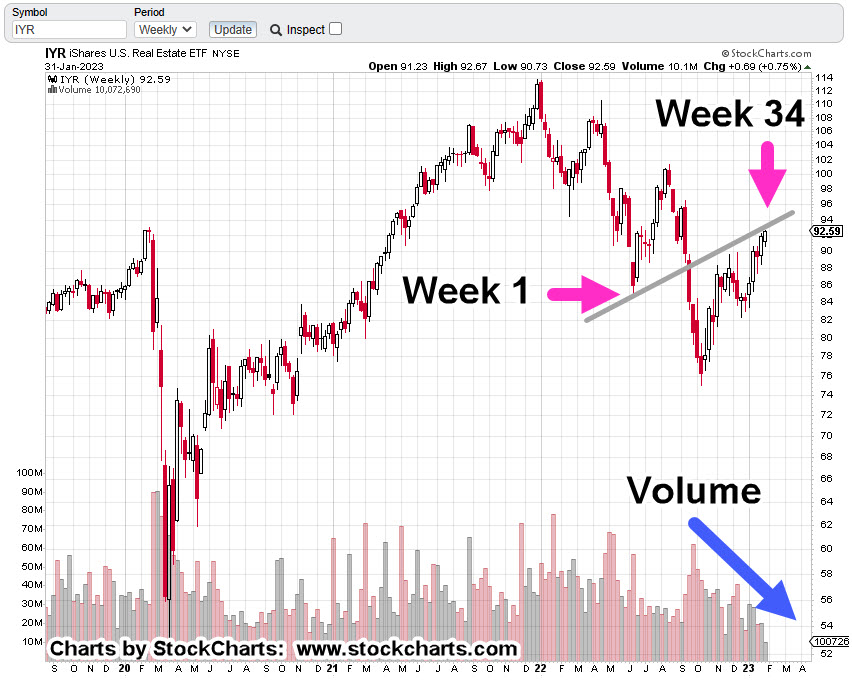

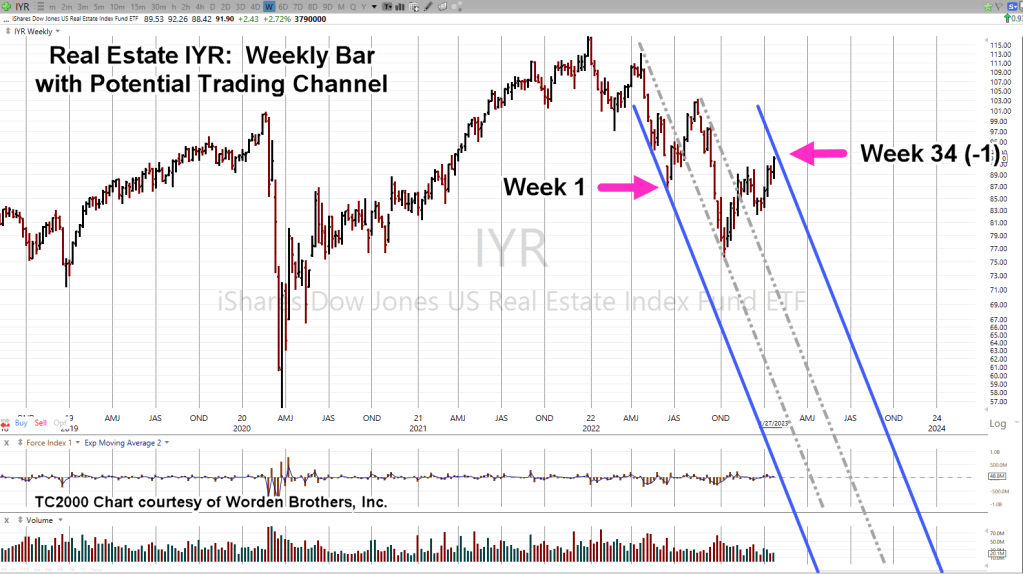

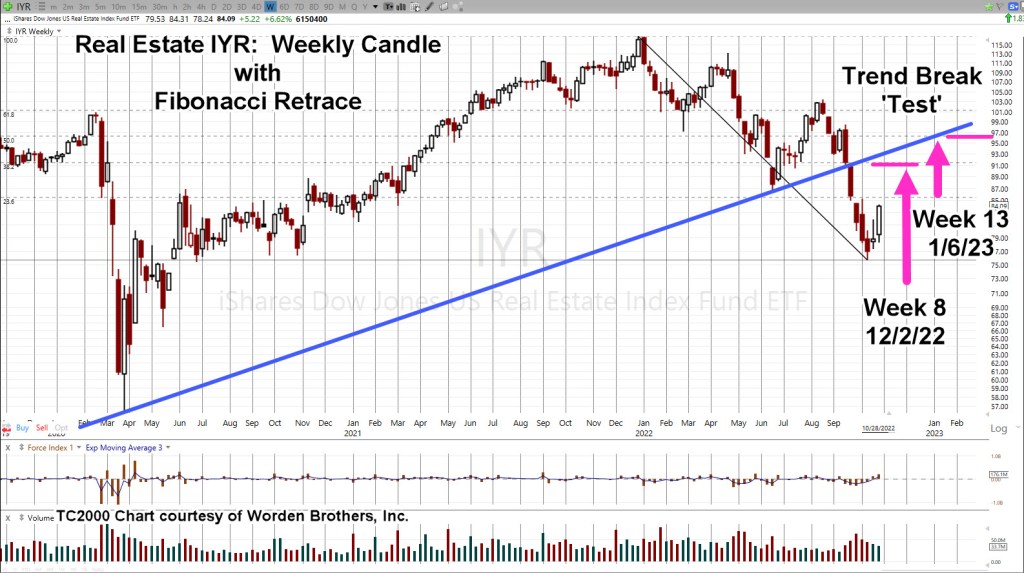

The last update identified two sectors to watch for short positioning: Real Estate IYR, and Biotech SPBIO; Short positioning via leveraged inverse funds DRV, and LABD, respectively (not advice, not a recommendation).

Since that post, DRV is up + 1.74%, and LABD is up + 8.58%, both measured on a close basis.

The ‘Big Reveal’

Remember: When price action turns south, that’s when the bad news comes out.

If this is the big reversal and biotech is the downside leader, unfortunately, that could mean a planned ‘reveal’ by the mainstream media.

Anyone going to alternative sites such as BitChute, ZeroHedge, Rumble, know full well what’s happening.

Maybe we’ll have another distraction like the 100-th (at last estimate) food processing plant fire or even something totally retro, like a balloon flying across … oh, wait. 🙂

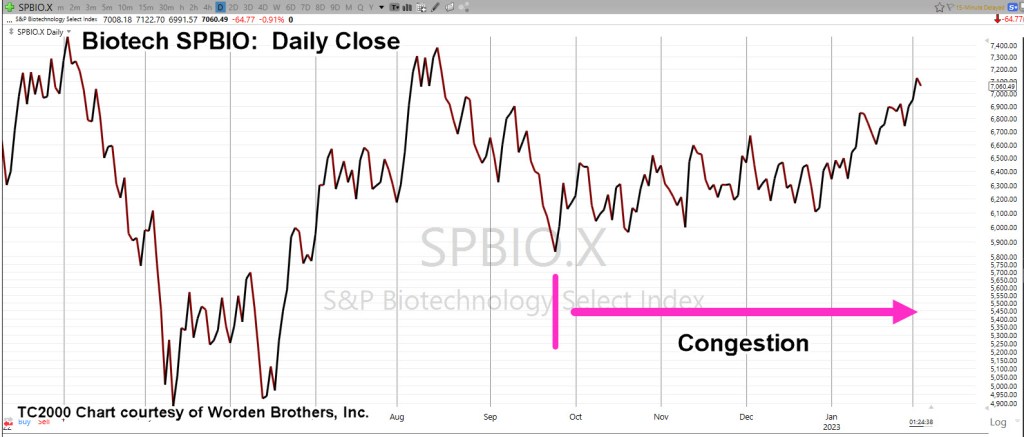

Biotech SPBIO, Leveraged Inverse LABD

We’ll get straight to the point as prior updates have built a substantial case for a long term, significant reversal.

Recall, LABD is the leveraged inverse of SPBIO. The daily chart shows the current set-up.

This site does not provide investment advice.

With that said, one could infer from this prior post (at the bottom), a position in LABD had already been established and included a hard-stop.

That was indeed the case.

Next Steps

There’s no guarantee on how far or how long a directional move will go.

However, for SPBIO, one can observe since the February 2021, reversal from all-time highs, a sustained, directional move typically lasts 4 – 6 weeks.

The next update will show the best chart timeframe (multiple days) that resulted in capturing the majority of the directional moves since the February 2021-high.

Stay Tuned

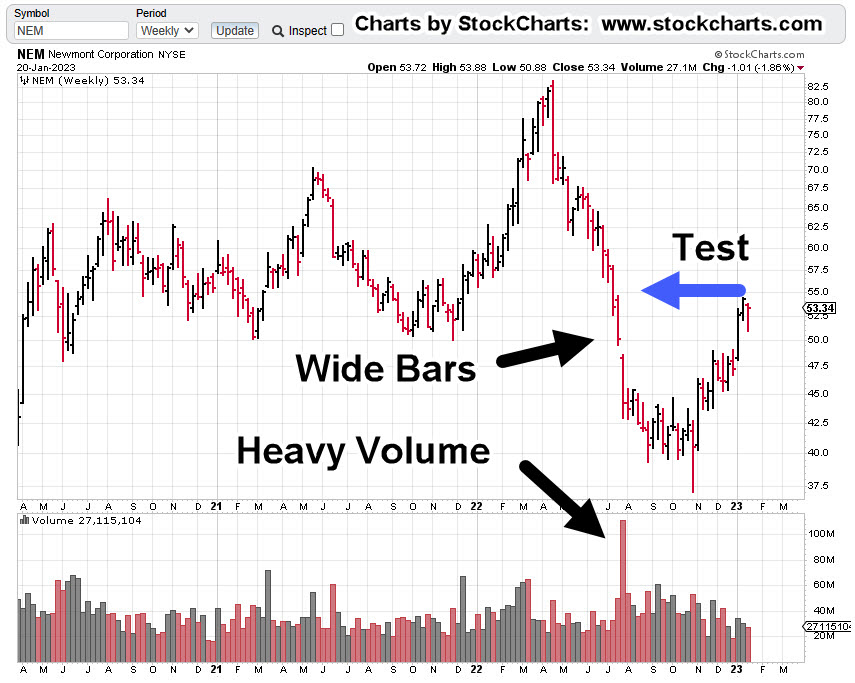

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279