We’re About To Find Out

As this post is being created the Credit Suisse battle, rages on.

Recent updates are here and here.

Of course, it’s all planned chaos … but that’s a discussion for another time.

The apparent response from gold (GLD) over the past week, was to move sharply higher.

As expected, the gold bulls are in their brain-stem mania.

Once again. It’s a ‘new paradigm‘.

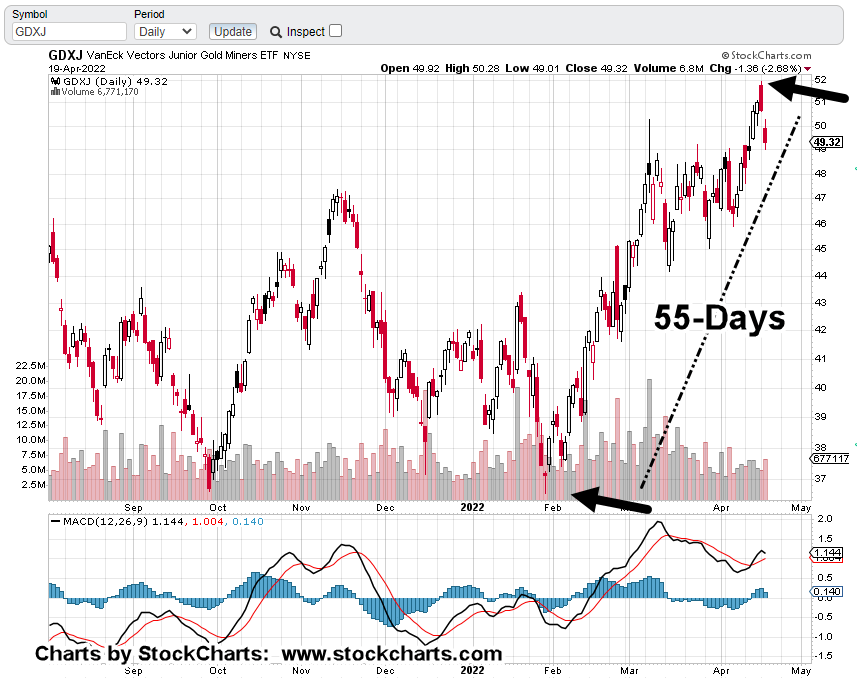

With that, let’s not forget the last time we had a ‘new paradigm’. Gold has not been higher, since.

Trading opportunity? … Maybe.

New ‘Paradigm’? … Probably, not.

Different, This Time?

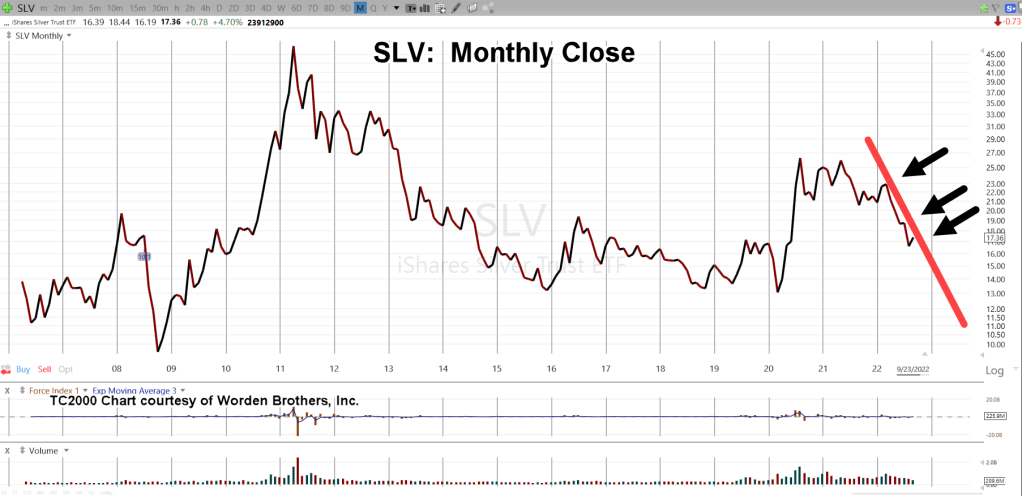

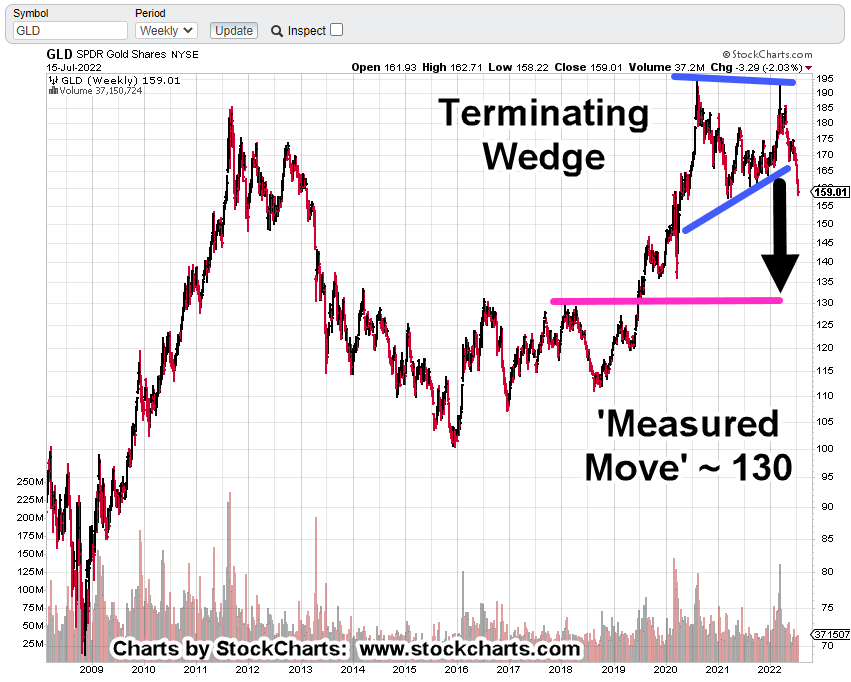

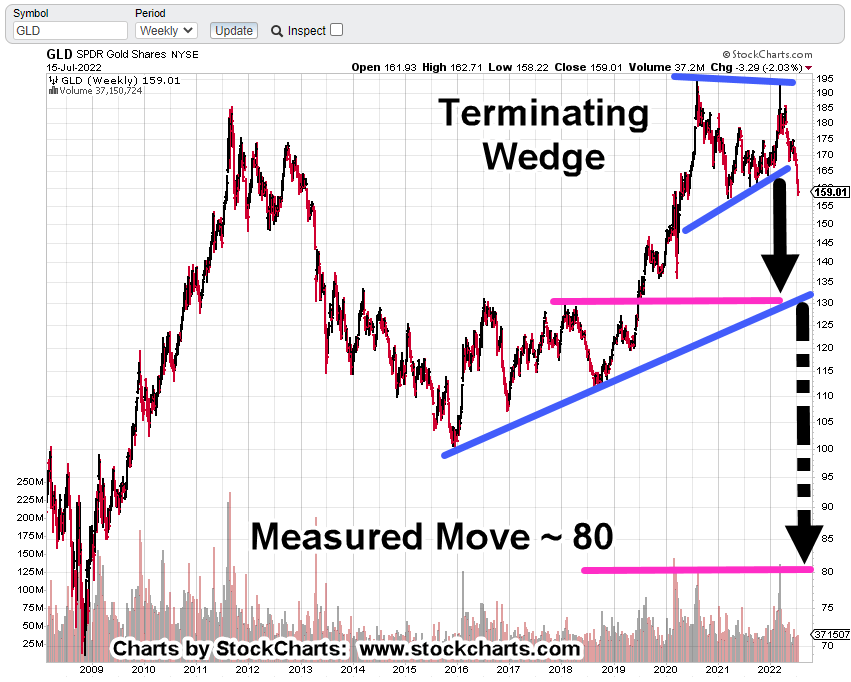

As we’ll see below, there are potentially two outcomes for the price of gold (not advice, not a recommendation).

First: Gold (GLD) either reverses from here or moves slightly higher to the 187.50-area before reversing.

… OR …

Second: GLD, pushes higher, just shy of the 200.00, mark, while getting itself into a Wyckoff up-thrust condition.

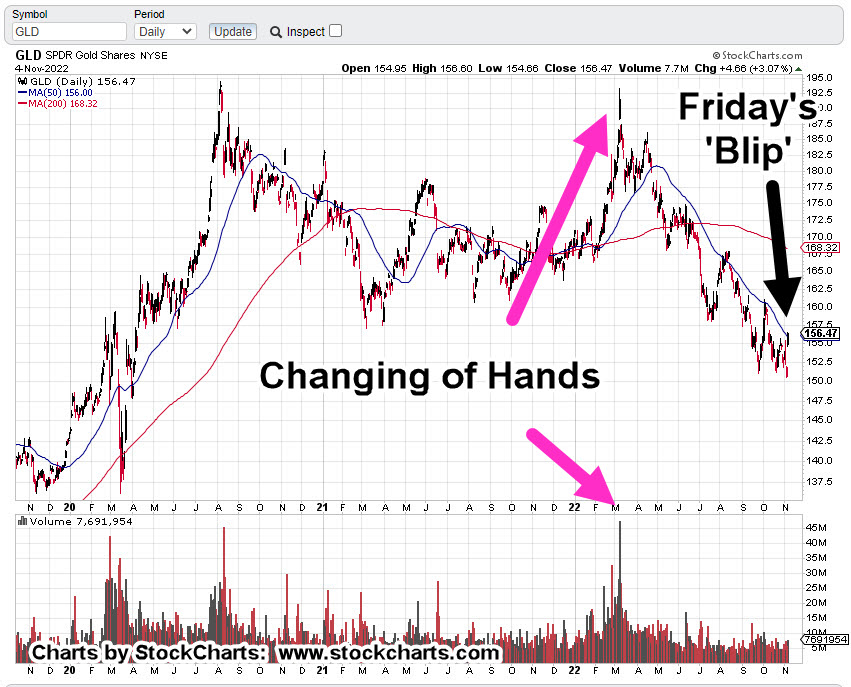

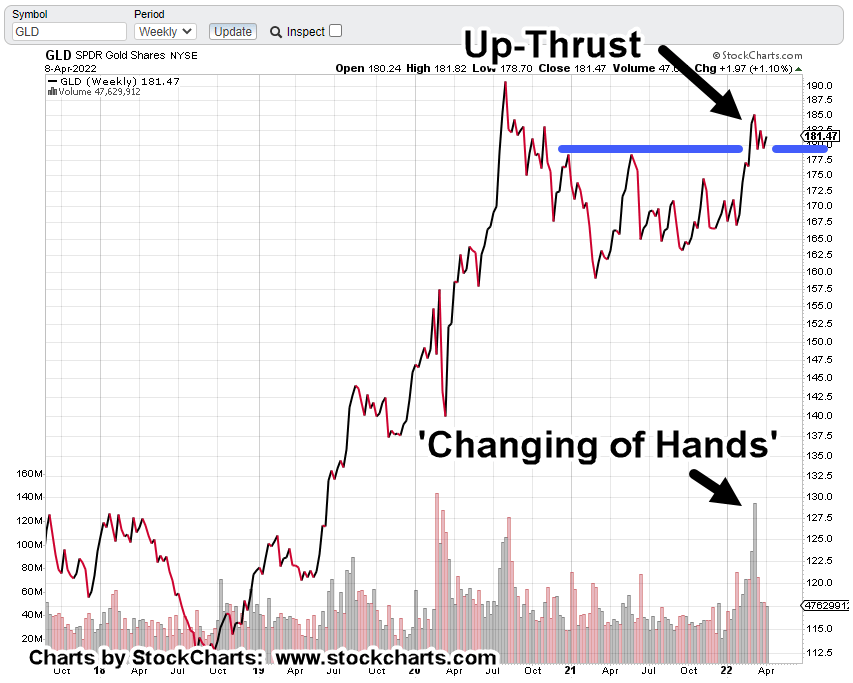

The first chart shows the extremes as of Friday’s close (Sunday futures, yet to open).

Gold GLD, Weekly

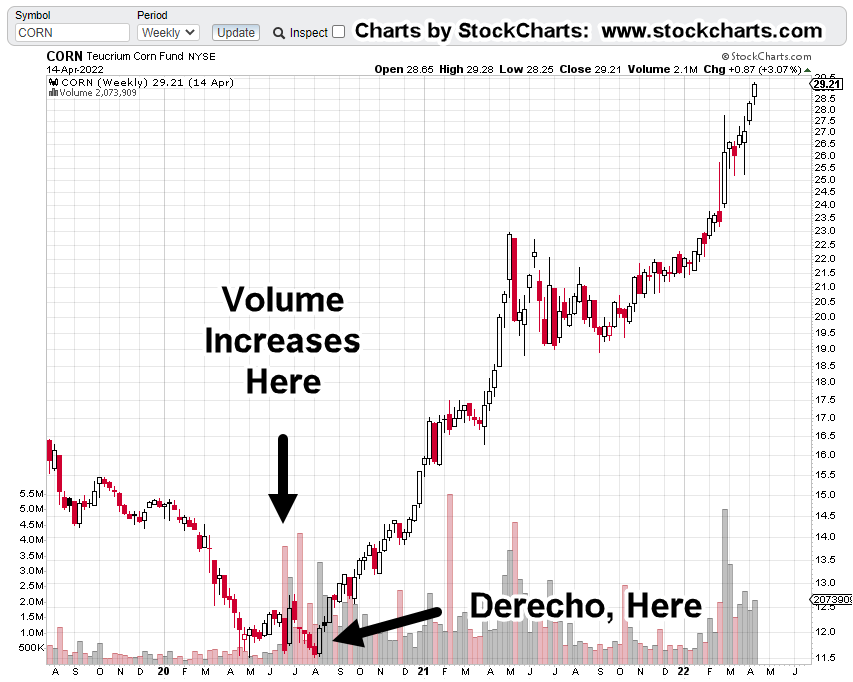

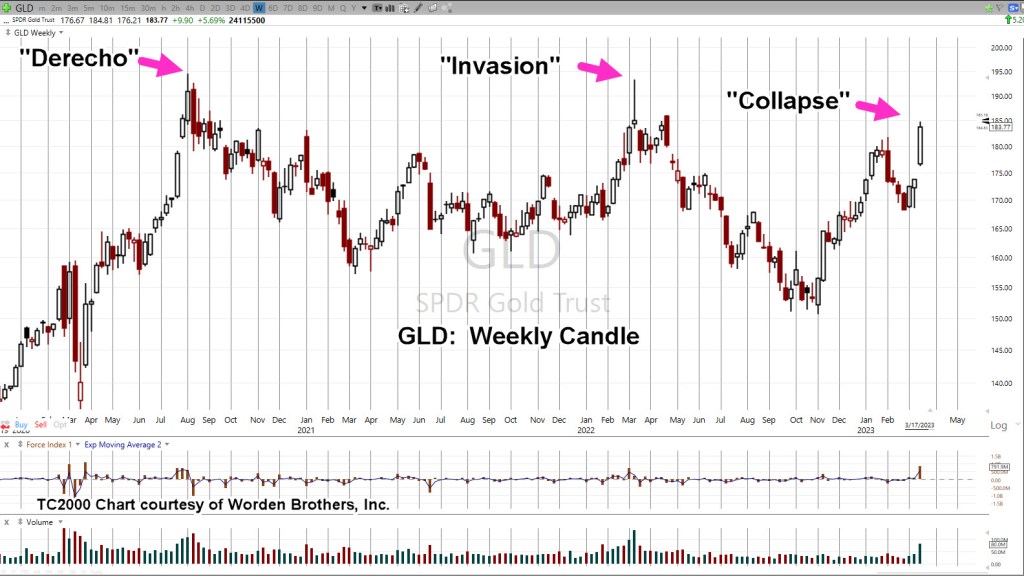

Concerted effort to destroy (or pollute) the food supply began with the Derecho. That effort continues to this day.

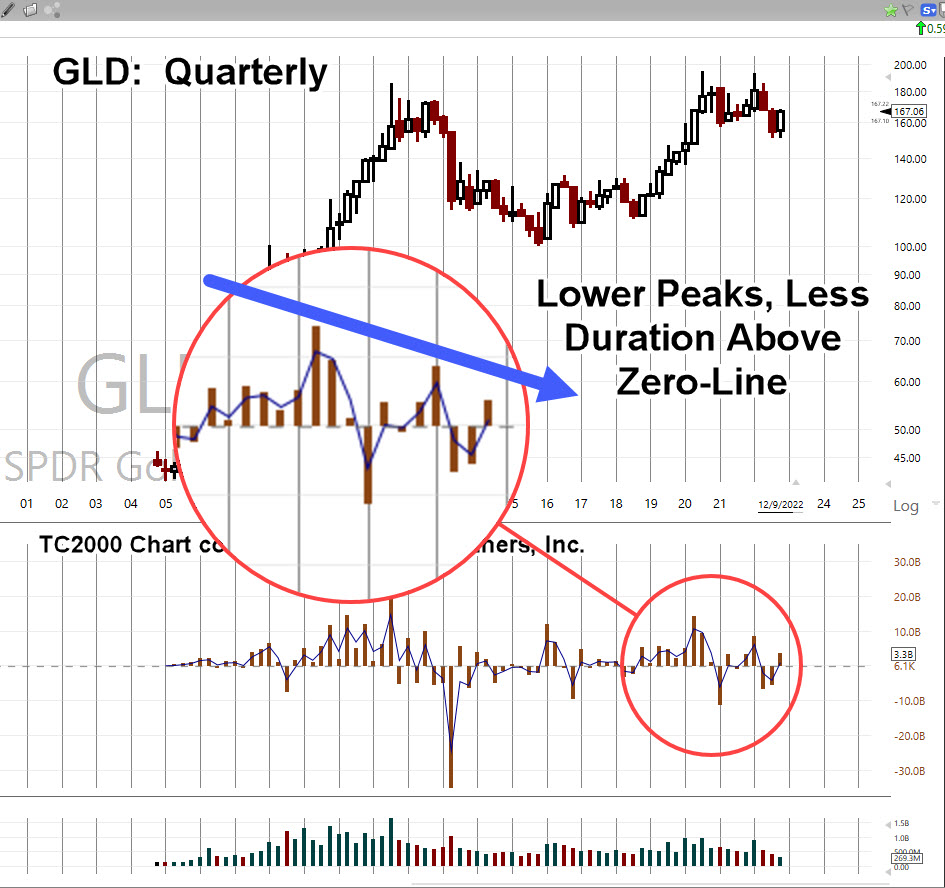

Secondly, we have the ‘invasion’ of Ukraine. Note the GLD spike is lower than the Derecho.

Now, we have the banking ‘collapse’. Once again (so far), the upward spike is lower than previous.

Looking at the second chart, we see a Fibonacci projection to 50%, the GLD 183.77-level; exactly where GLD, closed on Friday.

Empirical observation over many years has revealed, if price action gets to a 50% projected level, it’s typically on its way to higher levels.

A Lower Peak

Even if GLD moves up to the 61.8% projection as shown, the GLD 187.50-area, it’s still below the prior ‘Invasion’ peak set at GLD 193.30.

If GLD, moves significantly past these levels, then it’s likely on to new, all-time-highs and a potential Wyckoff Up-Thrust (reversal) condition.

If it happens, we’ll address it at that time.

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279