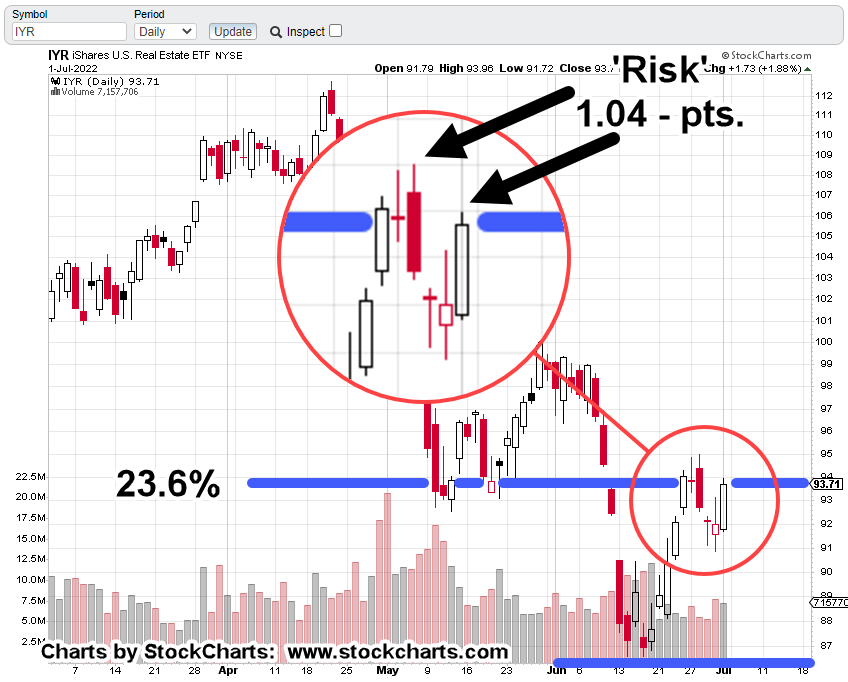

What Comes Next ?

Gold bulls could get cooked.

If gold does not go higher, it’s because of ‘manipulation’, right?

The typical YouTube gold grifter acts like manipulation is a new discovery.

It’s the ‘go-to’ excuse when their forecasts don’t work out.

Way back in the early 1900s, Wyckoff discovered the market has always been manipulated.

His insight was, it’s up to the speculator to figure out the objective of the manipulation and then act accordingly (not advice, not a recommendation).

Livermore knew about manipulation and even engaged in it himself. He looked at things in a slightly different way; meaning, what is, not, what should.

A very key difference.

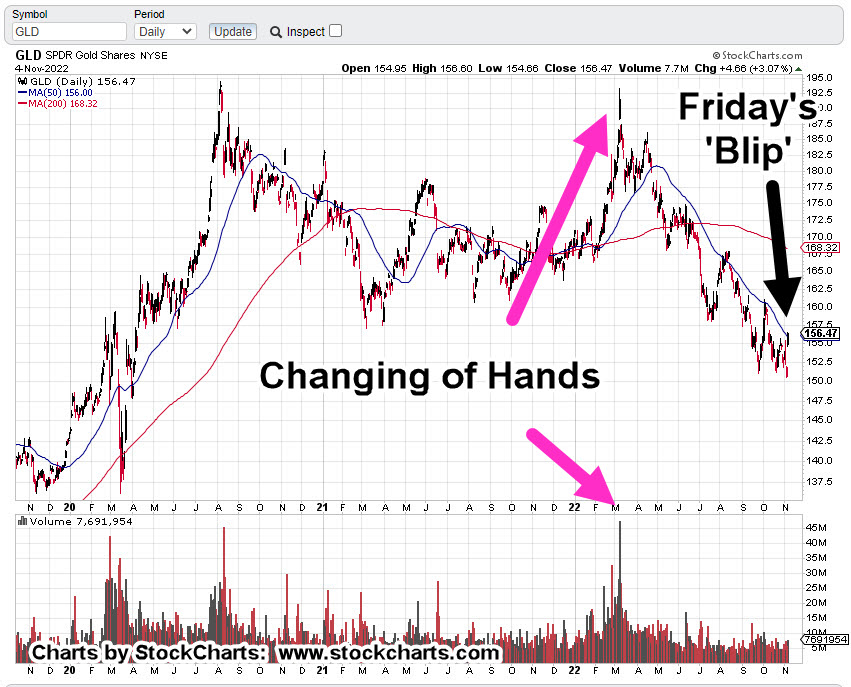

So, let’s look at what is happening with gold (GLD), and where it may head from here.

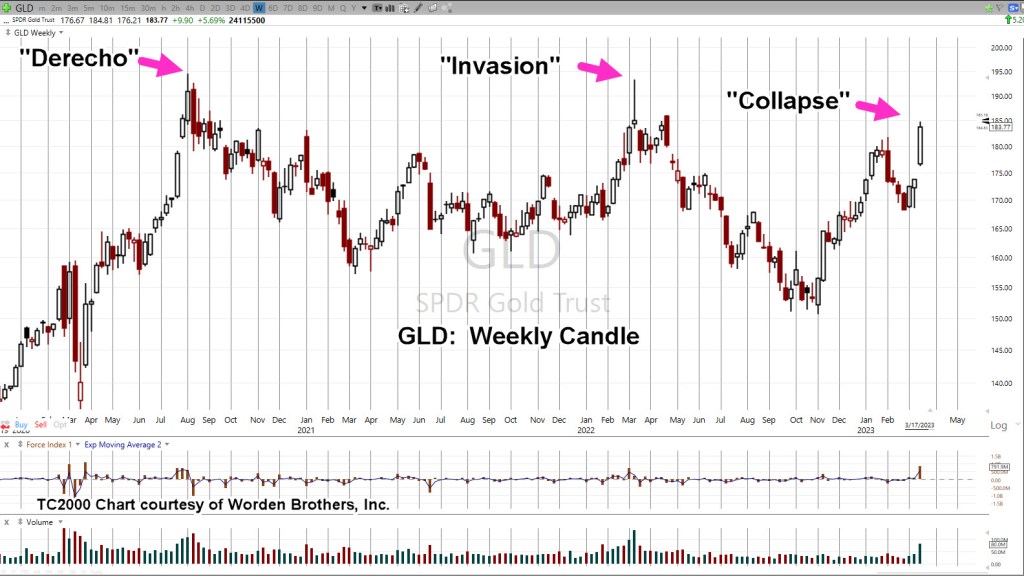

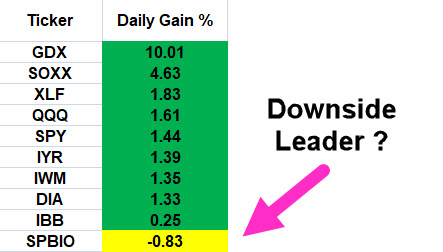

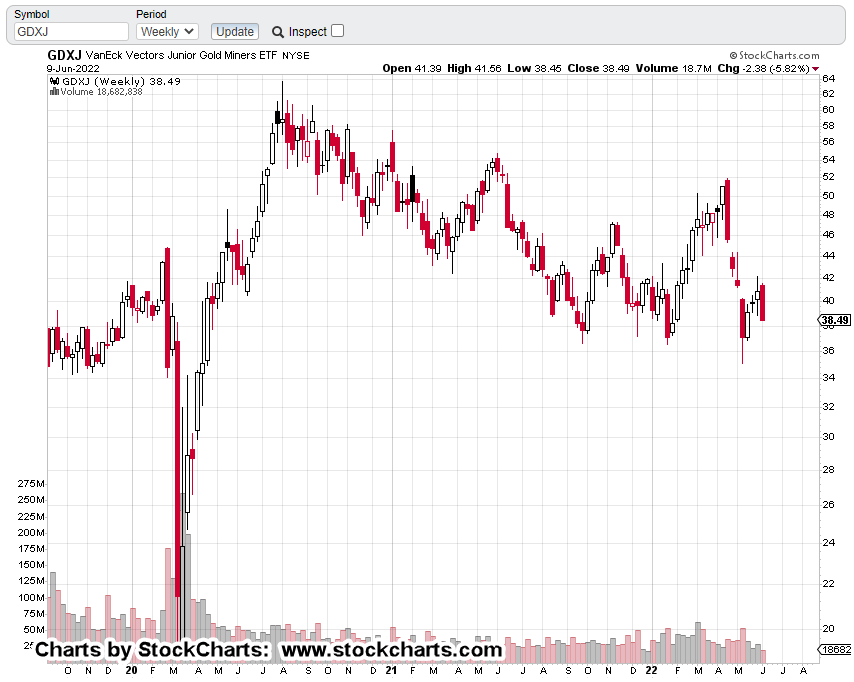

Gold GLD, Weekly

First, the chart from the April 9th, update.

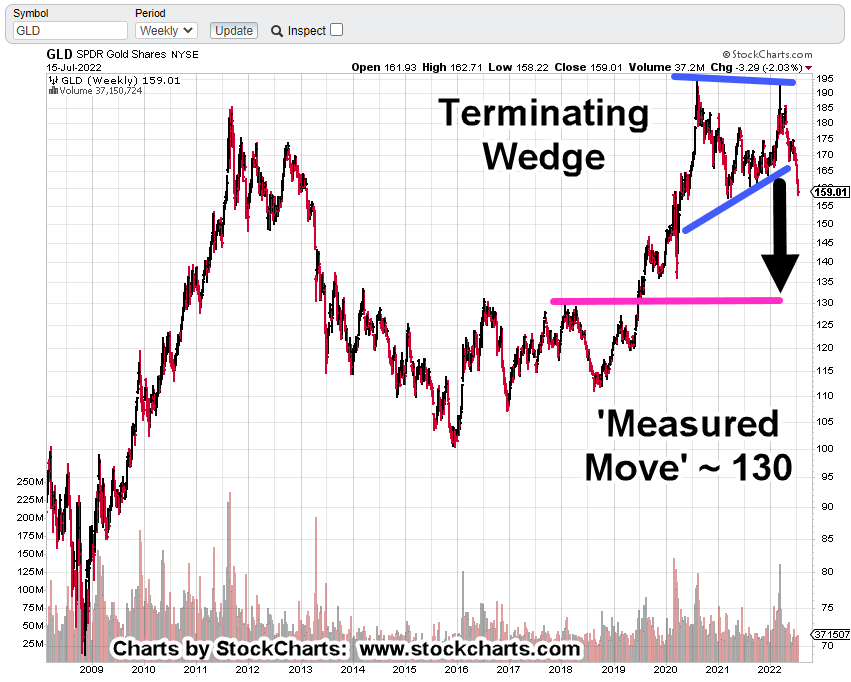

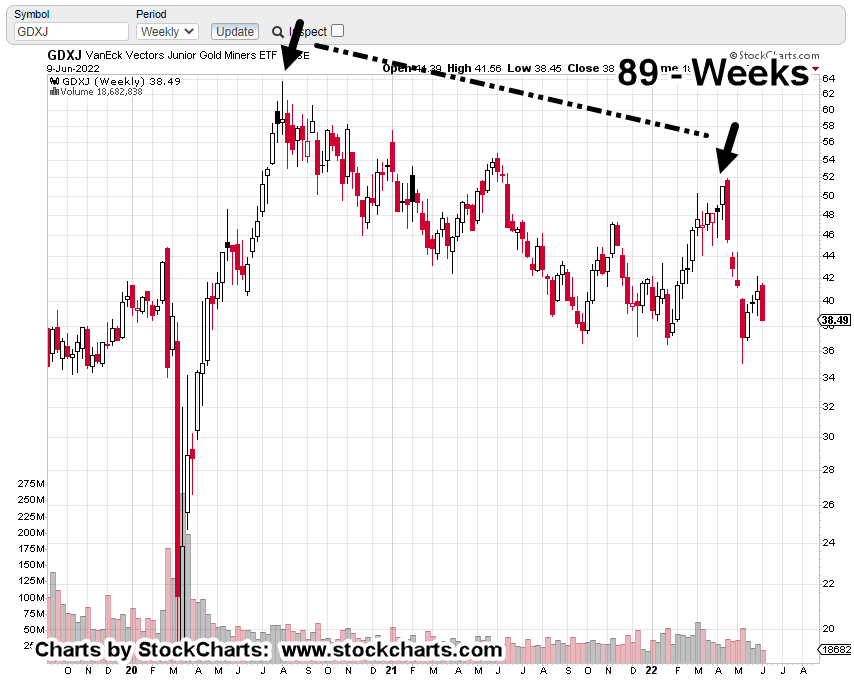

Now, the updated chart.

It took gold (GLD) several weeks to labor higher on ever shortened thrusts before finally exhausting itself and rolling over into a reversal … where we are now.

Is price action hesitating before heading higher or is this a significant downside move in the making?

It probably won’t be long before we have the answer.

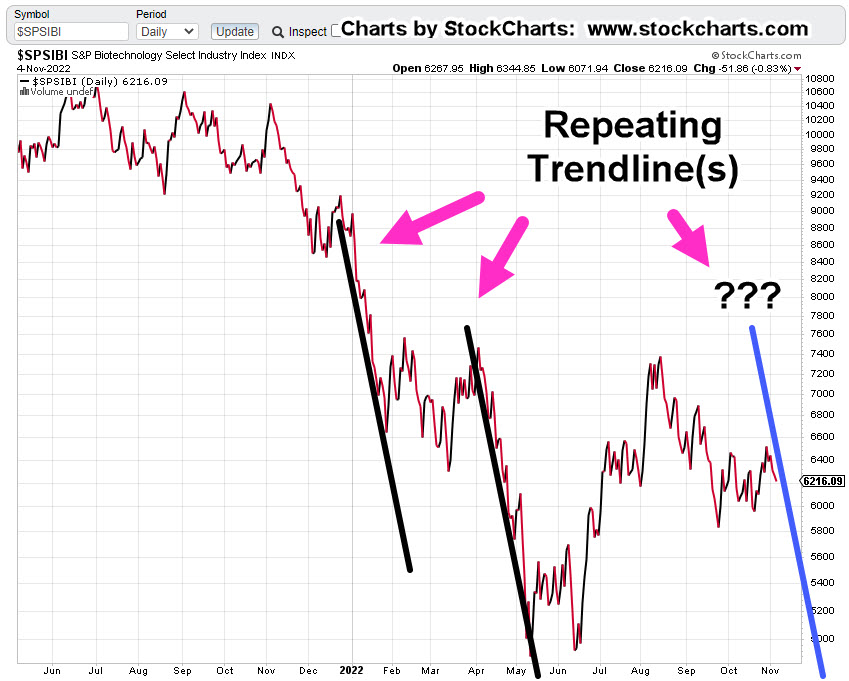

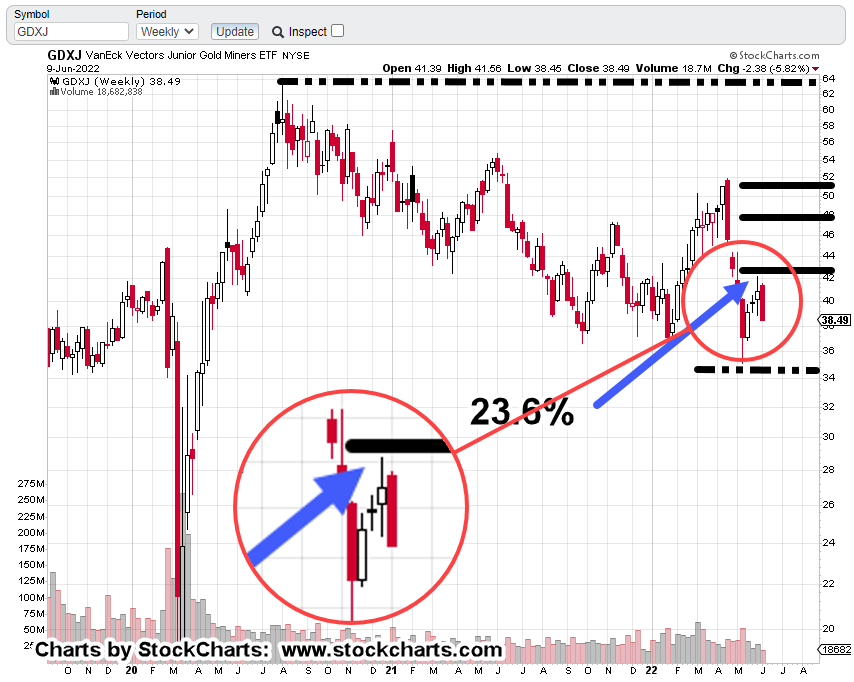

Junior Mining Sector GDXJ, Weekly

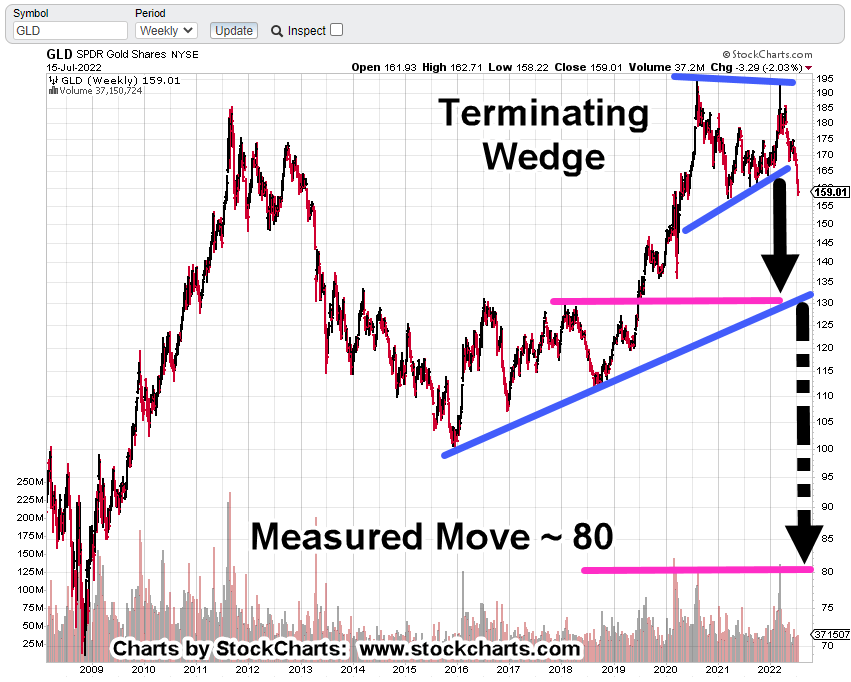

The gold mining indices GDX, and GDXJ, have already made their decision, reversing to the downside.

Note: Each reversal from a gold peak in the Junior Sector GDXJ below, is at significantly lower levels. This is not gold miner ‘bull market‘ behavior (not advice, not a recommendation).

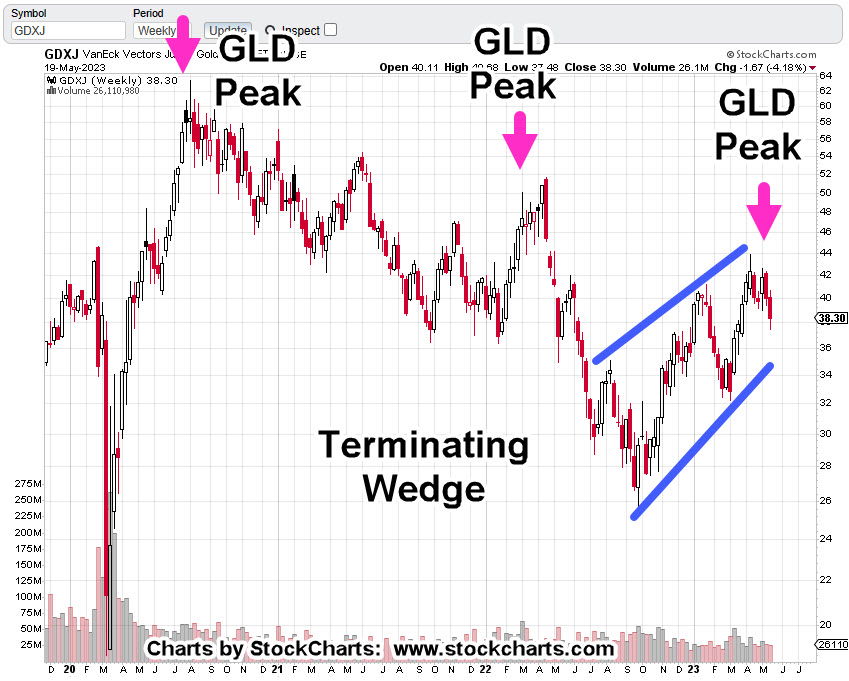

It’s clear, the Junior Miners are in a bear market …

The GDXJ, is completing or has completed what is an obvious bear flag or terminating wedge.

Unless price action shows us differently, this is the current assessment; lower prices ahead (not advice, not a recommendation).

Fundamentals

From a fundamental standpoint, where’s the demand for inedible (possibly fake) metal going to come from? The consumer’s already tapped-out and borrowing money just to buy the weekly groceries.

Maybe something else is going on.

Something else that’s causing precious metals miners to anticipate another huge (economic) move lower.

Possibly completely unrelated (in a way) to the mining sector … maybe yet another ‘Speck’ event, shown at time stamp 3:40, at this link.

At the same link, time stamp 5:25, we’re back to the food supply … yet again.

“And all countries came into Egypt to Joseph for to buy corn; because that the famine was so sore in all lands.”

Stay Tuned

Charts by StockCharts

Note: Posts on this site are for education purposes only. They provide one firm’s insight on the markets. Not investment advice. See additional disclaimer here.

The Danger Point®, trade mark: No. 6,505,279